The report contains forward-looking statements, identified by words like ‘plans’, ‘expects’, ‘will’, ‘anticipates’, ‘believes’, ‘intends’, ‘projects’, ‘estimates’ and so on. All statements that address expectations or projections about the future, but not limited to the Company’s strategy for growth, product development, market position, expenditures and financial results, are forward-looking statements. Since these are based on certain assumptions and expectations of future events, the Company cannot guarantee that these are accurate or will be realised. The Company’s actual results, performance or achievements could thus differ from those projected in any forward-looking statements. The Company assumes no responsibility to publicly amend, modify or revise any such statements on the basis of subsequent developments, information or events. The Company disclaims any obligation to update these forward-looking statements, except as may be required by law.

The global economy grew at 2.4% in CY 2019, slowing from 3% in CY 2018 amid global trade war, tariff related uncertainties, and Brexit. Chinese growth moderated but held up at 6.1% despite escalation of trade tensions with the United States (US). Amidst trade tensions and Brexit related uncertainty, EU growth also weakened to 1.1%. However, with talks of trade resolution in second half of 2019, Europe started to see some recovery in growth. Brexit, which was a key uncertainty for Europe over the last two years, also saw resolution towards end 2019. The US economy remained relatively strong growing at 2.3%.

Global trade environment remained challenging due to heightened trade tensions. However, negotiations between the US and China since mid-October resulted in Phase One agreement. Partial roll-back of some US tariffs in exchange for Chinese commitments to make additional purchases of US products mark a deescalation of trade tensions.

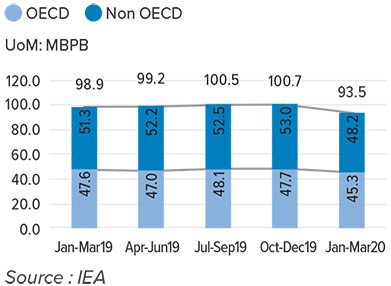

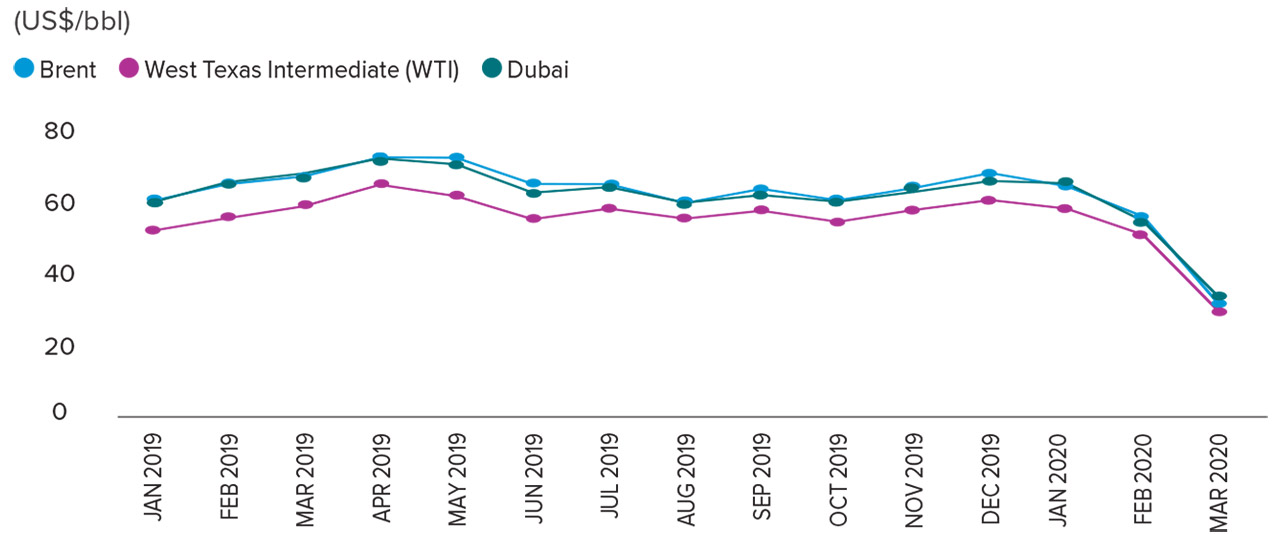

Oil prices averaged US$61 / bbl in 2019 supported by continued production cuts and supply constraints from Iran and Venezuela. Global oil demand growth declined to 0.8mbpd in 2019, from 1.2 mbpd in 2018. Oil demand growth continued to be led by China, India and other Asian economies.

Global demand for ethylene increased by 4% y-o-y to 167 MMT in 2019. However, capacity addition across key petrochemical products significantly outpaced demand growth, pushing down prices and margins to multi-year low for these products.

Global growth outlook has changed since the outbreak of COVID-19. There has been coordinated global monetary policy easing and fiscal support from governments. These policy support measures would act as cushions offsetting weakness in growth to some extent . However, global economic activity is likely to contract in 2020 and global growth environment will remain challenging in the short term.

The Indian economy grew by 4.2% in FY 2019-20 still remaining one of the fastest growing major economies in the world. Industrial activity remained healthy in the beginning of the year, but saw some weakness later. Auto sales suffered due to weak credit conditions, demand softness, and change in regulatory norms. However, services credit averaged at a healthy 10% y-o-y growth even as credit growth deteriorated. Despite weak trade environment amid increasing protectionism, services exports remained resilient at about 8%. On the rural side, with food prices firming up, demand saw some recovery with three-wheeler sales returning to positive growth in December quarter (+8% y-o-y), but reversed the recovery in 4Q.

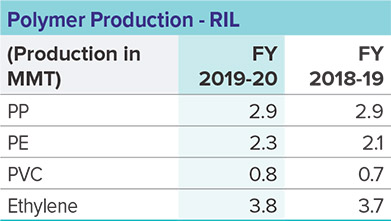

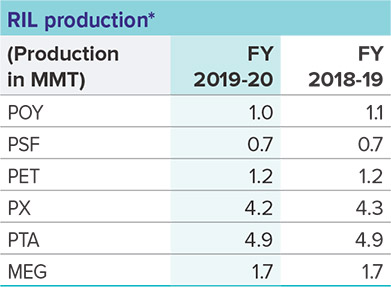

India’s oil demand remained flat in FY 2019-20 as compared to the previous year, with consumption-led demand growth in gasoline (+6.2% y-o-y) and LPG (+6% y-oy). ATF growth (-3.5% y-o-y) was subdued as air traffic growth remained soft, while diesel demand (-1% y-o-y) was impacted by weaker economic growth. Domestic demand growth for petrochemical products was healthy with polymer and polyester demand growing by 4% and 9.0% respectively.

Thrust on policy initiatives continued. FY 2019-20 saw consolidation of Public Sector Banks, which should strengthen the banking sector. Non-performing loans in the banking sector have come down to 9.3% from >10% before FY 2019-20. Resolution under the Insolvency and Bankruptcy Code (IBC) is bringing procedural predictability with higher recovery rates (43% in 2019 vs 14% in 2017). With continued policy initiatives, India further continued its climb in the Ease of Doing Business rankings, climbing up 14 places to reach the 63rd rank. India is the only major country to have moved up by 67 places in just 4 years. FY 2019-20 also saw corporate tax cut being announced, further easing business environment. Government also announced significant rebates for new manufacturing units to attract global supply chains. Outbreak of COVID-19 would make growth environment challenging in first half of FY 2020-21 but liquidity measures announced by the government should help provide support.

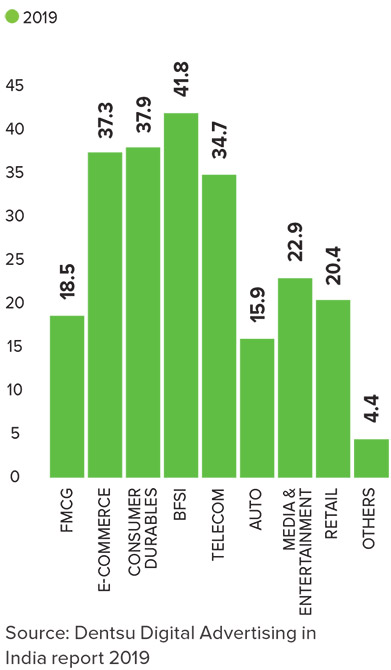

Domestic data usage and use of digital platforms continue to gain traction in India. Reliance Jio has become the second largest single-country operator in the world. The extra-ordinary circumstances unfolding in 2020 has underscored the need for strong data networks. Increasingly, digital platforms have become critical for home, business and school connectivity. Digital transactions also continue to accelerate with UPI payments reaching 10% of GDP from just 0.7% of GDP in FY 2017-18, while credit card growth continued to be strong at 24% y-o-y. Similarly, personal credit remained strong at about 17% y-o-y reflective of the underlying consumption demand. While continuing to grow its organised retail platform, Reliance Retail is working to integrate producers/ manufacturers, supply chain, small merchants and consumers in a seamless digital ecosystem that will benefit all elements of the retail chain.

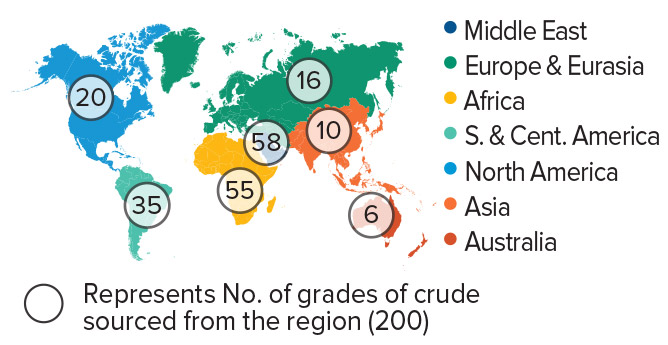

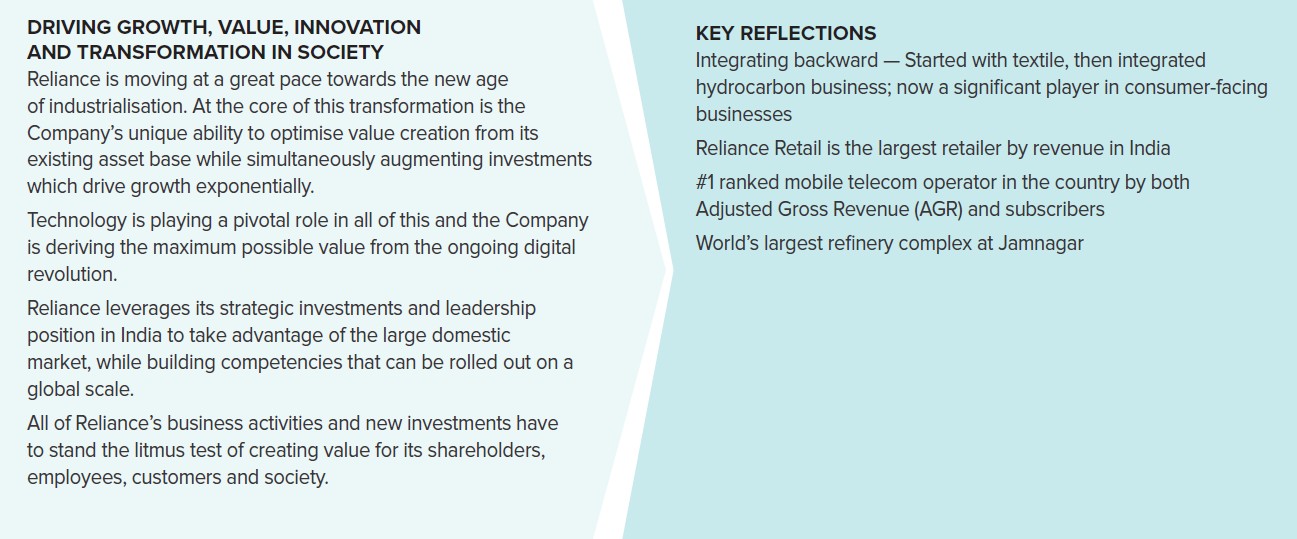

Reliance executed on the next phase of its growth journey in FY 2019-20, forging transformative partnerships across businesses. In the Energy businesses, Reliance is working to complete the contours of a defining strategic partnership with Saudi Aramco (Aramco). Reliance and Aramco share a common outlook and vision on the evolution of the business in the future with emphasis on higher oil-tochemicals conversion. The partnership gives the refineries access to a wide portfolio of value accretive crude grades and enhanced feedstock security. In the fuel retail business, Reliance and British Petroleum (BP) formed a new joint venture to grow the retail service station network and aviation fuels business across India.

In Digital Services, Reliance is working with Microsoft to enhance adoption of leading technologies like data analytics, AI, cognitive services, blockchain, Internet of Things, and edge computing among small and medium enterprises. Microsoft Azure cloud platform and Technology stack along with Jio’s connectivity infrastructure provide Indian enterprises world-class technology solutions to enhance competitiveness.

Recognising the pivotal role of Jio in India’s digital transformation, Facebook has taken an equity stake in Jio Platforms. The strategic focus of the partnership is India’s micro, small and medium businesses, farmers, small merchants and small and medium enterprises in the informal sector. Additionally, the partnership seeks to empower people seeking various digital services.

Concurrent with the investment, Jio Platforms, Reliance Retail and WhatsApp also entered into a commercial partnership agreement to further accelerate Reliance Retail’s Digital Commerce business on the JioMart platform using WhatsApp and to support small businesses on WhatsApp.

In the current financial year, Reliance completed its first Rights Issue in 3 decades. It was the largest Rights Offering by a non-financial company globally in the last 10-years and enabled participation of all shareholders in growth businesses of Reliance. The Rights offering received an overwhelming response, despite the challenges presented by the lockdown. Overall subscription for the issue was at 1.6x, representing a capital commitment of $11.2bn and public subscription was 1.22x

Through the Covid-19 crisis, Reliance operated its O2C facilities at near 100% by shifting products to export markets to sustain operating rates. Scale economics along with strong competitive cost positions across the chain helped Reliance sustain positive contribution through this unprecedented phase.

The partnership between Jio and Facebook will empower farmers and small & medium businesses/enterprises/ merchants with various digital services.

Apart from ensuring safety and well-being of employees through the pandemic, Reliance significantly stepped up support to the Community. The Covid-19 response included use of facilities for production of grades and equipment used in medical applications, steps to support state medical infrastructure and contributions to social efforts in helping marginalized communities and migrant workers.

Reliance is geared to provide products and services needed by Indian consumers as the economy emerges from the lock-down.

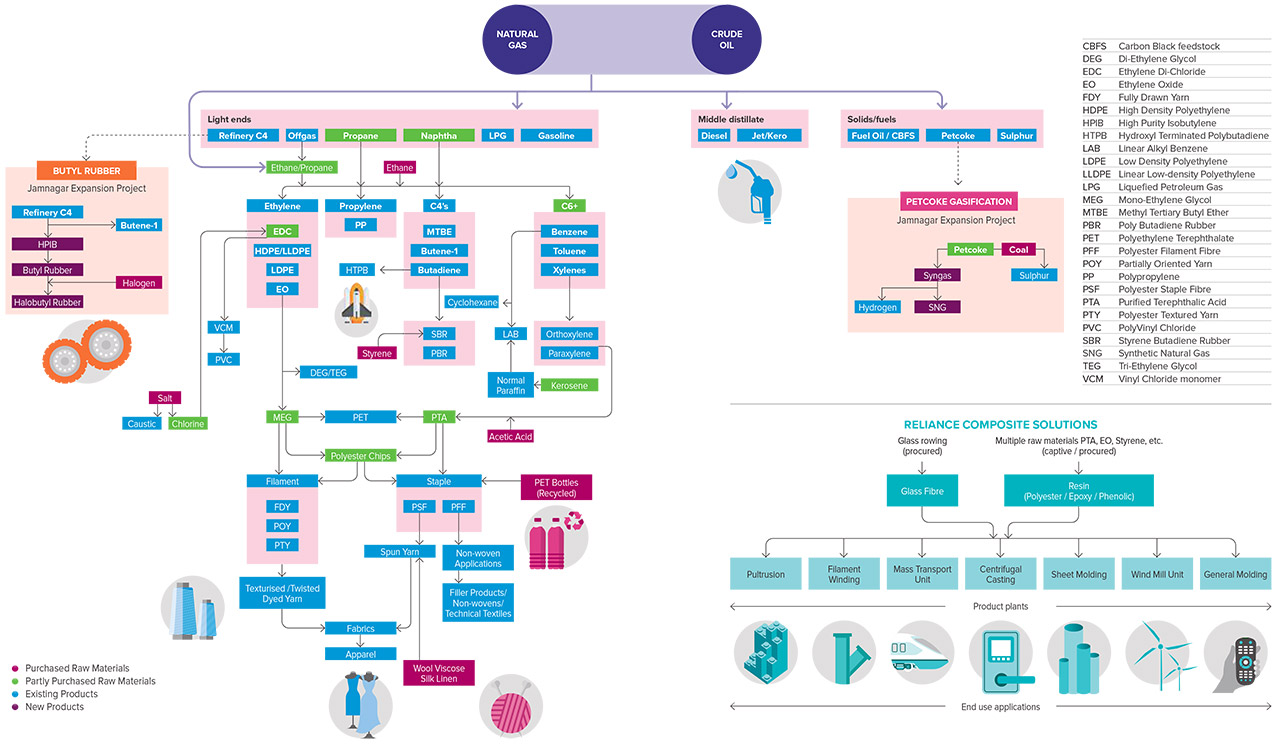

Robust performance for the year reflects benefits of our integrated Oil to Chemicals (O2C) value chain and the rapid scale-up of our consumer businesses. For the year, our O2C businesses reported resilient performance despite unprecedented macro challenges. Our O2C business has inherent strengths due to feedstock flexibility and cost competitive positions across products. The cost economics also benefitted from the high operating rates we were able to maintain by leveraging our robust product placement capabilities. Our O2C business, with new partnerships, is well poised to pursue growth and sustainable value creation in the coming years.

Our consumer and technology led businesses continue to be guided by our obsession to provide the best value to our customers. Reliance Retail delivered robust performance with record revenues and EBITDA for the year. Our digital services business is recognised for having the nation’s widest 4G wireless network. Jio has continued on its unprecedented growth journey receiving overwhelming customer response for best-in-class mobile connectivity services. On combined basis, retail and digital services business EBITDA has increased by 49% compared to previous year.

We are steadfast in our commitment to capital discipline and financial strength. We remain focused on operating excellence, executing our growth projects, improving returns on assets and shareholder value enhancement.

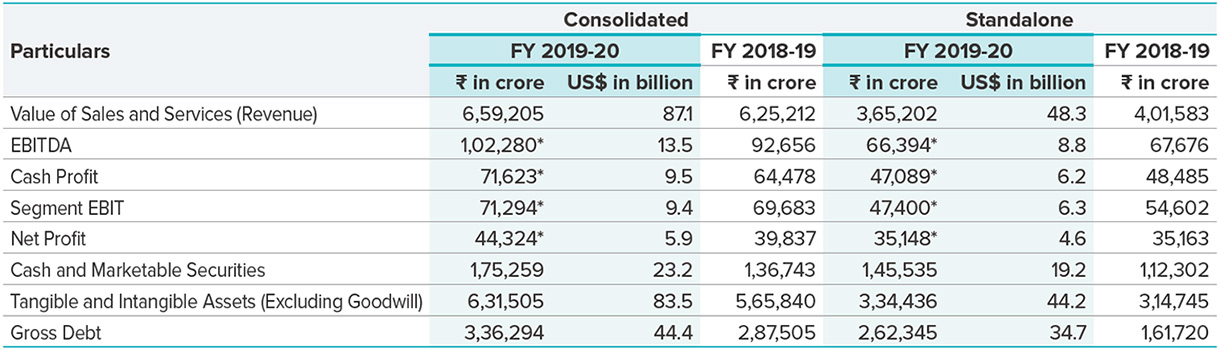

US$1 = `75.665 (Exchange rate as on 31.03.2020)

*Excluding Exceptional Item

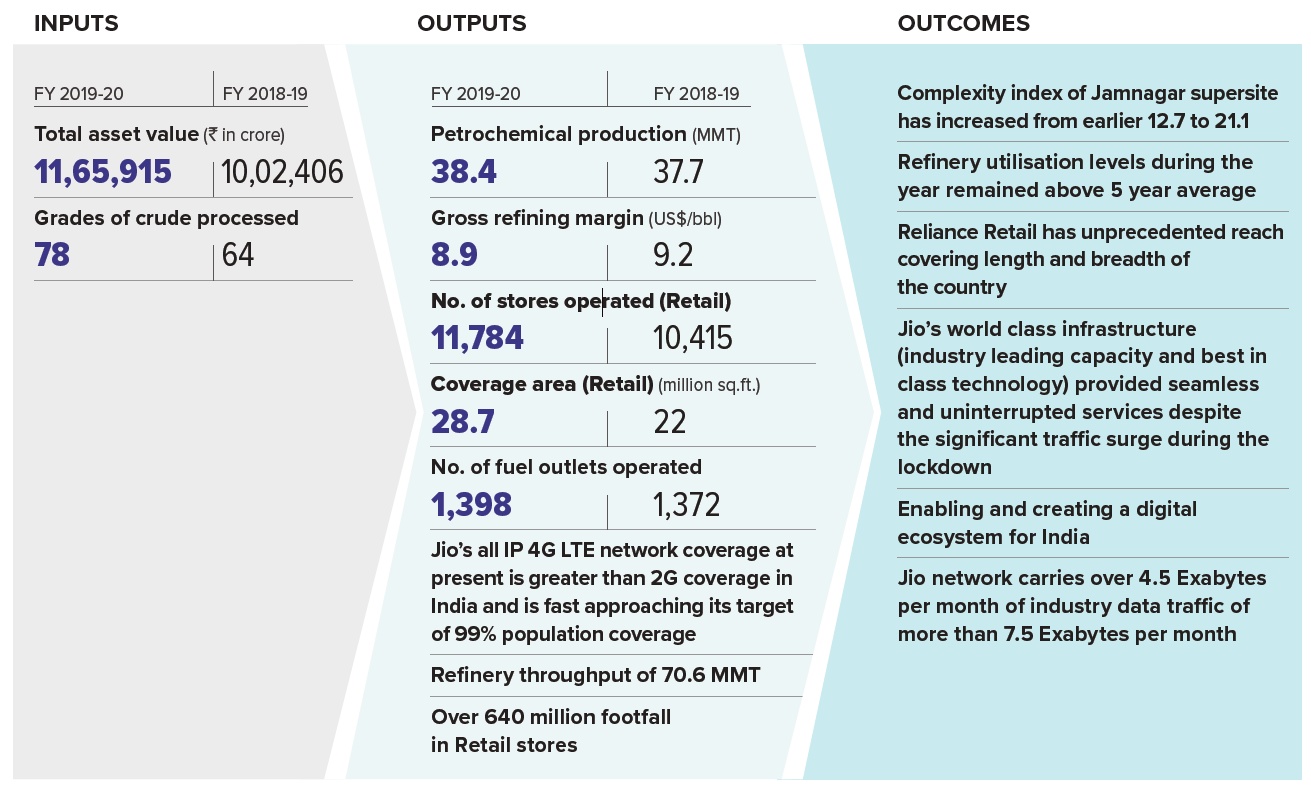

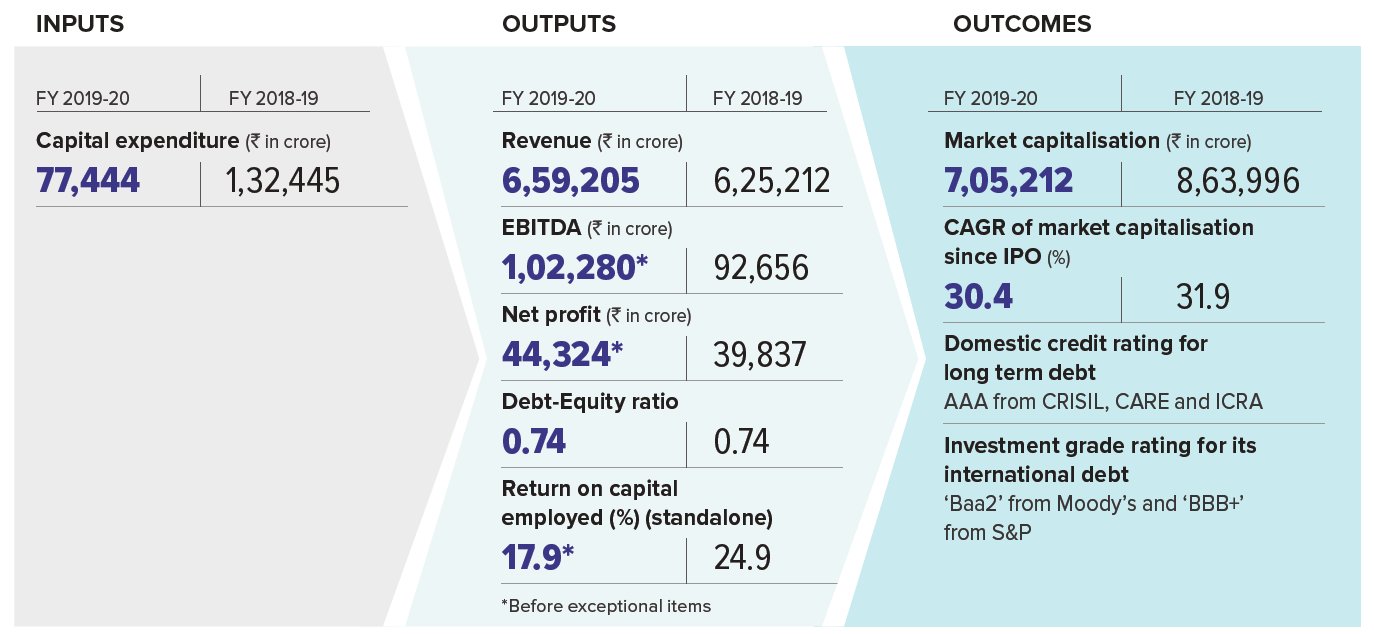

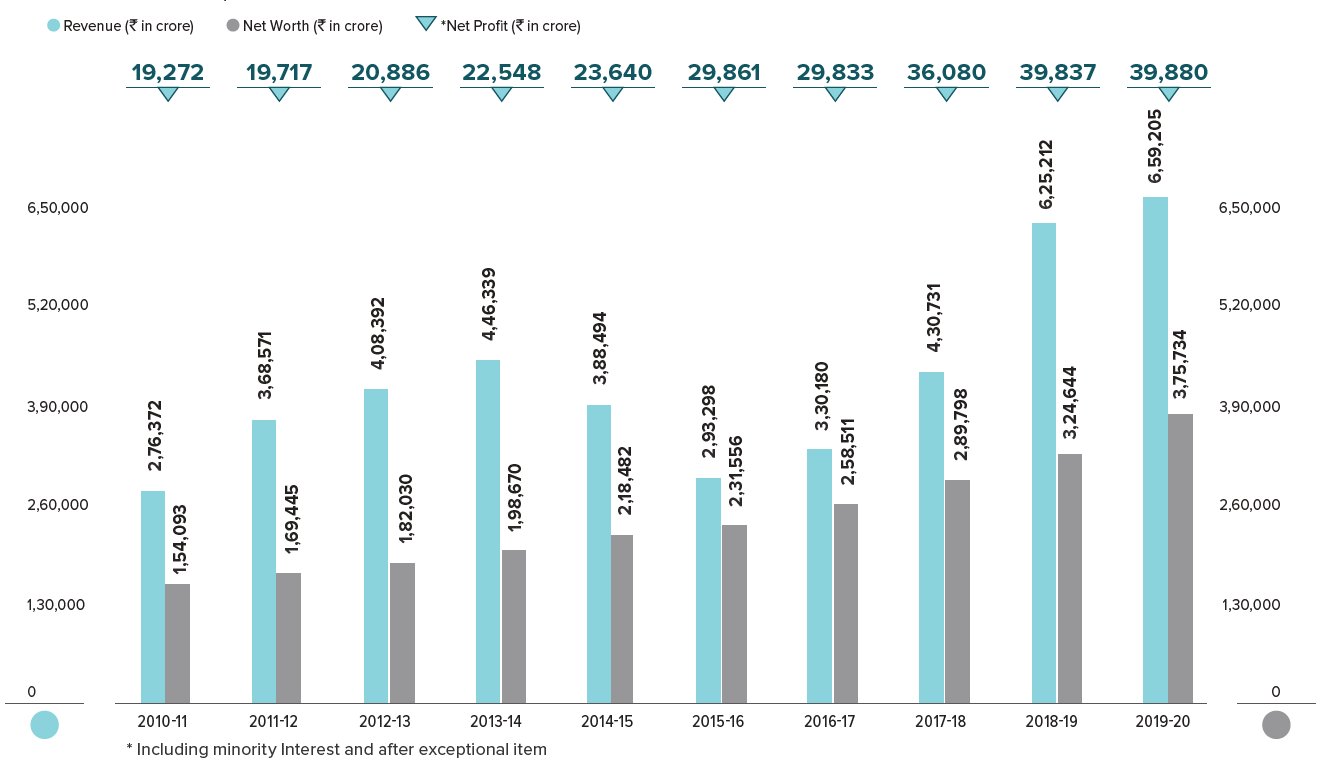

Reliance achieved consolidated revenue of `6,59,205 crore (US$87.1 billion), an increase of 5.4%, as compared to `6,25,212 crore in the previous year. Increase in revenue was primarily on account of higher revenue from Consumer Business. Reliance’s consolidated revenue was boosted by robust growth in retail and digital services business, which recorded an increase of 24.8% and 40.7% in revenue, respectively as compared to the previous year. Revenues for the Refining and Petrochemical business declined in line with fall in average oil and product prices for the year.

Consolidated EBITDA for the year increased by 10.4% on a y-o-y basis to `102,280 crore as compared to `92,656 crore in the previous year. Consolidated EBITDA nearly doubled in the last five years. Profit After Tax (excluding exceptional items) was higher by 11.3% at `44,324 crore (US$5.9 Billion) as against `39,837 crore in the previous year.

Retail - Reliance Retail continues to grow in scale, driven by new store expansion across the geography, improving store throughput and favourable product mix. Operating leverage is resulting in release of strong operating cash flows to continue making requisite investments for securing future readiness and delivering profitable growth. The business continues to improve customer experience across all store concepts and focuses on providing unmatched value proposition, which has resulted in robust growth in footfalls and operating metrics. Roll-out of the Digital Commerce initiative will open up further growth opportunities for the organised retail business, leveraging the best of our consumer and digital platforms.

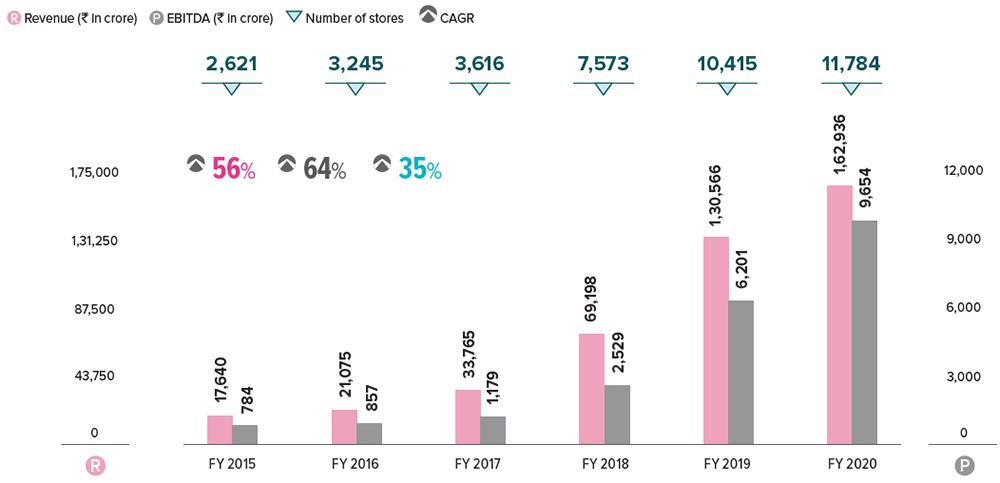

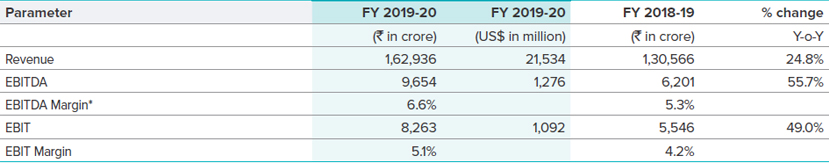

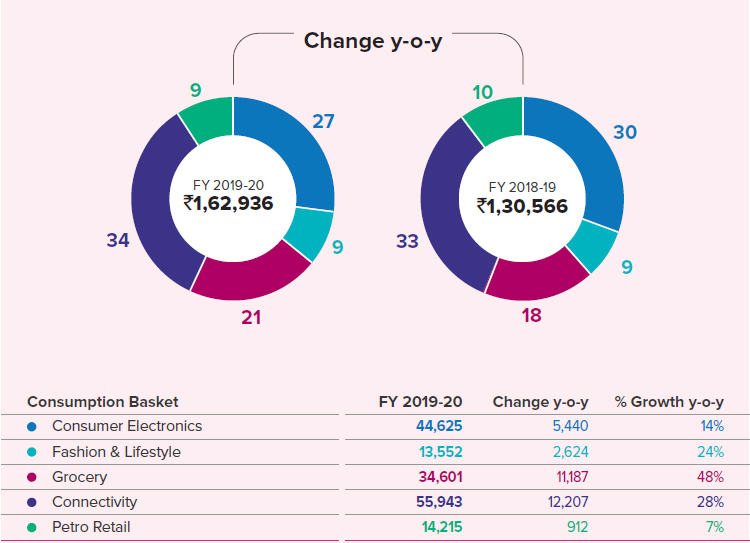

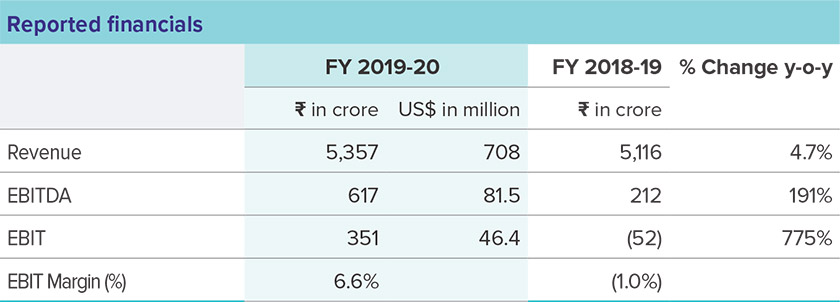

Organised Retail revenues grew by 24.8% y-o-y to ` 1,62,936 crore. Segment EBITDA for FY 2019-20 grew by 55.7% y-o-y to ` 9,654 crore. EBITDA margins improved 130 bps to 6.6% boosting operating profitability. Reliance Retail further consolidated its leadership position and is India’s largest, most profitable and fastest growing retailer.

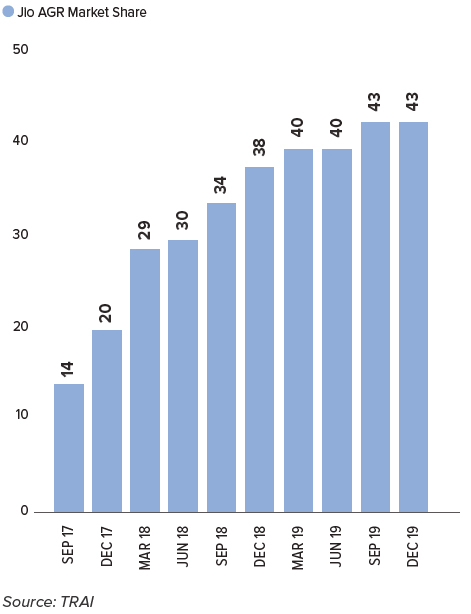

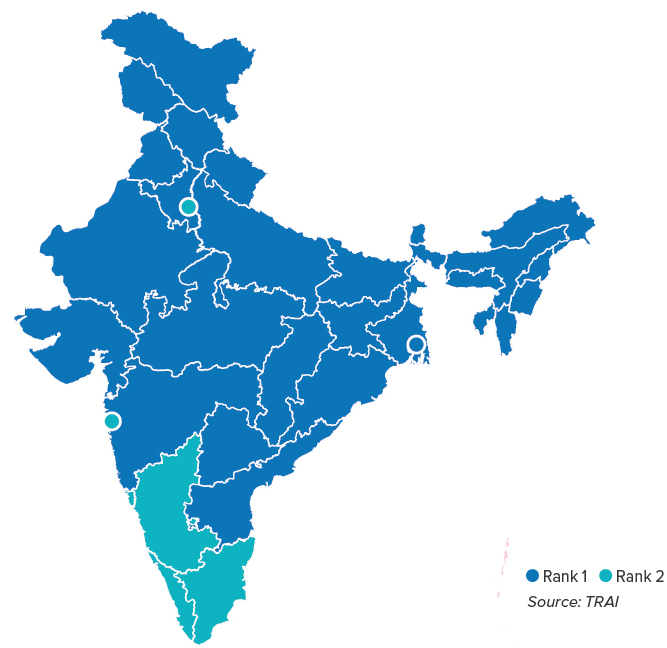

Digital Services - Reliance Jio has been the key catalyst in creating the broadband data market in India. It is now the #1 ranked mobile telecom operator in the country by both Adjusted Gross Revenue (AGR) and subscribers. Building on this success, Jio is rolling out its state-of-the-art wireline services across Homes and Enterprises. All this will help lay a strong foundation for offering platform based digital services. To further facilitate this from the perspective of business organisation, Jio has consolidated all its technology capabilities, investments and connectivity business into a single holding company called Jio Platforms Limited.

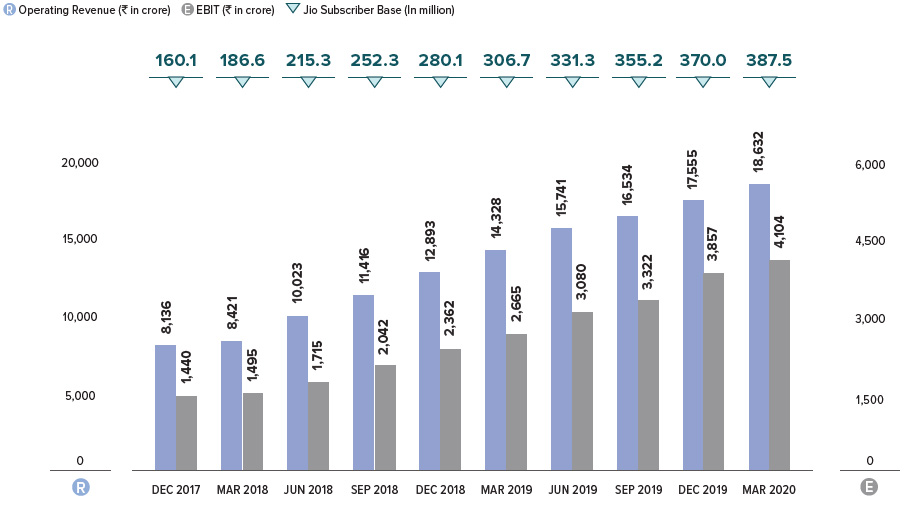

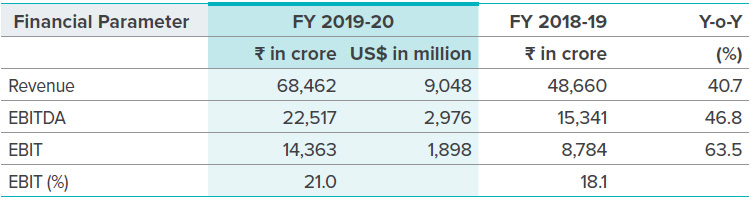

The business recorded revenues of ` 68,462 crore, as against ` 48,660 crore in previous year, with year-end subscribers base at 387.5 million. Reliance Jio reported strong financial performance for the year. Segment EBITDA was at `22,517 crore for the year, as against `15,341 crore in previous year

The fallout of the global pandemic impacted commodity markets and prices in the last quarter of FY 2019-20. Despite the challenging industry conditions, Oil to Chemicals (O2C) business delivered a resilient performance.

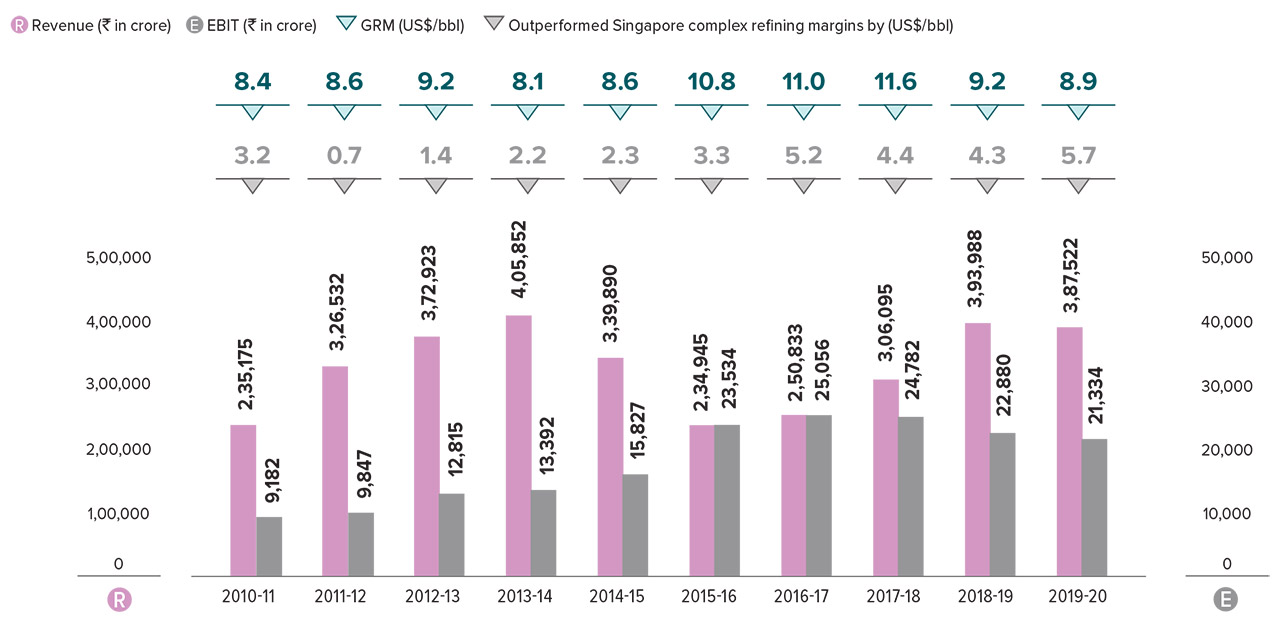

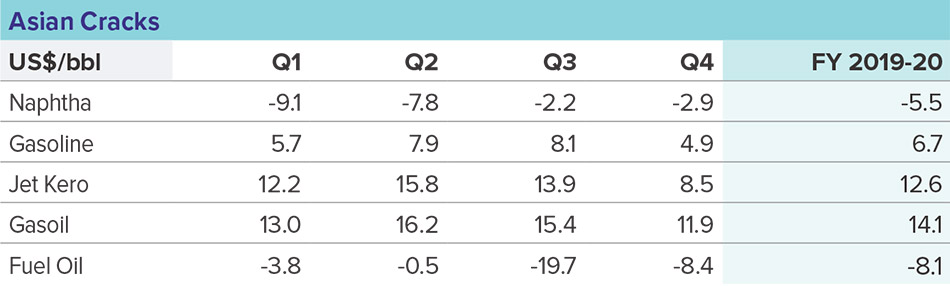

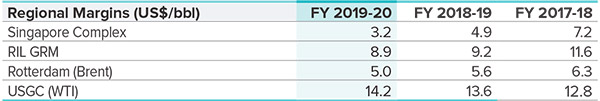

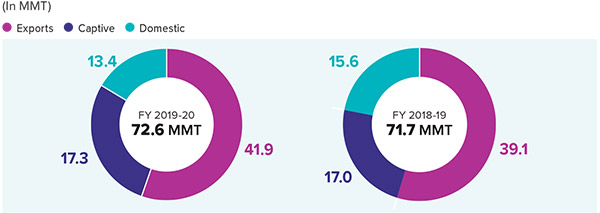

Refining and Marketing – Revenue (including inter segment transfers) decreased by 1.6% y-o-y to ` 3,87,522 crore (US$51.2 billion). Segment EBITDA decreased by 6.1% to `24,461 crore (US$3.2 billion). The impact in revenue was because of lower price realisation in domestic and export markets due to fall in crude prices. GRM for FY 2019-20 stood at US$8.9/ bbl, outperforming Singapore complex margins by US$5.7/bbl.

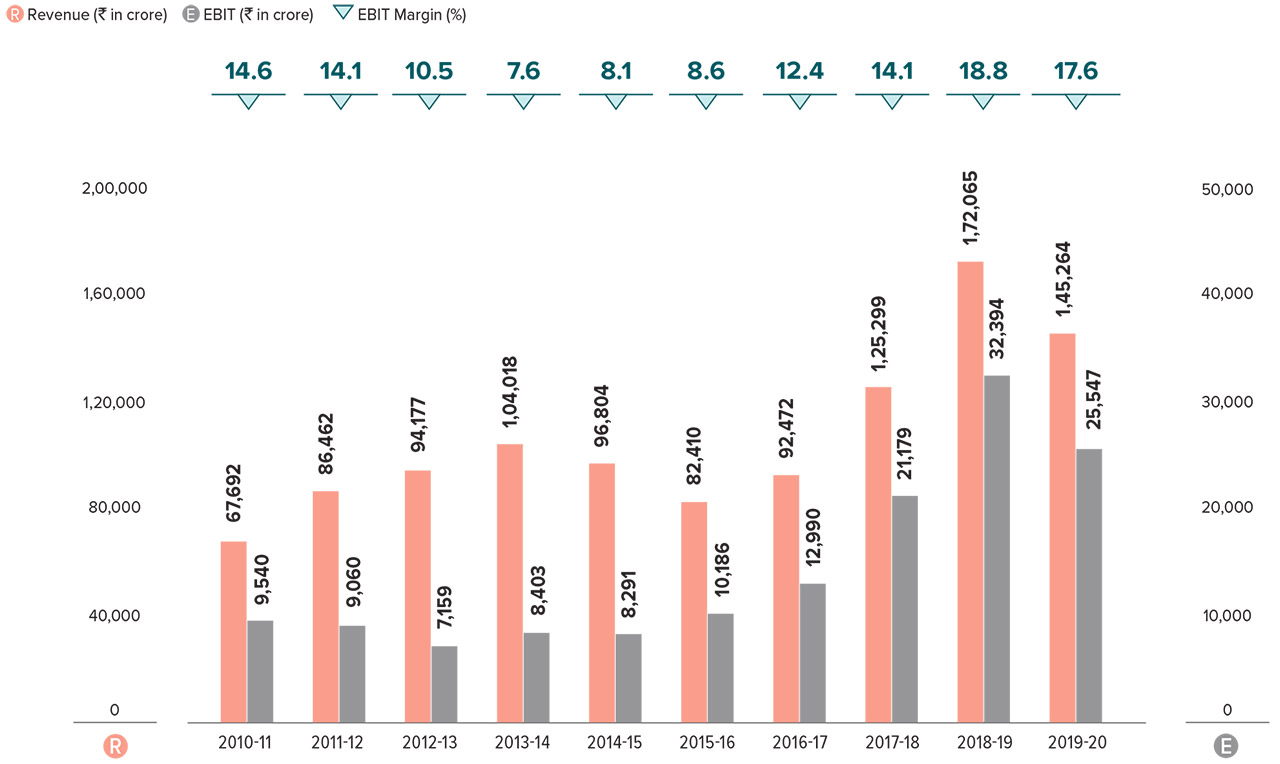

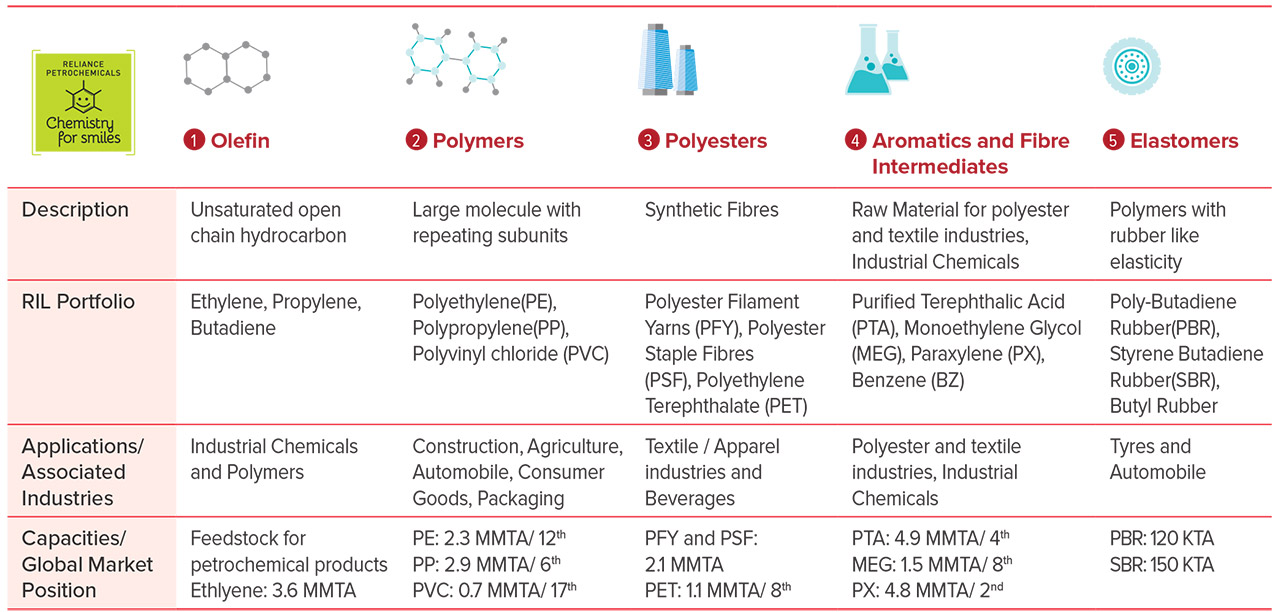

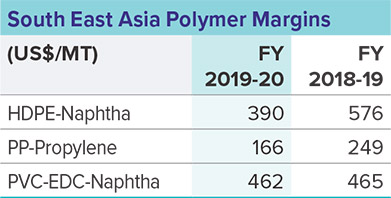

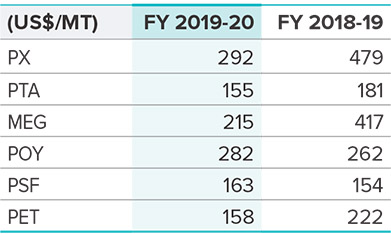

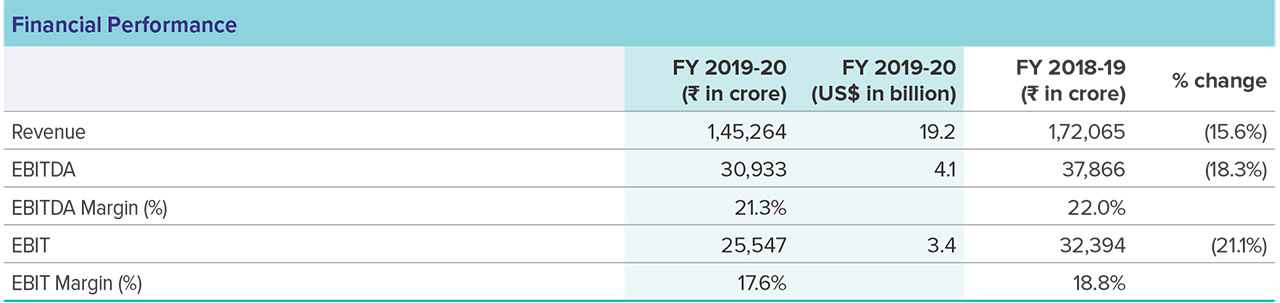

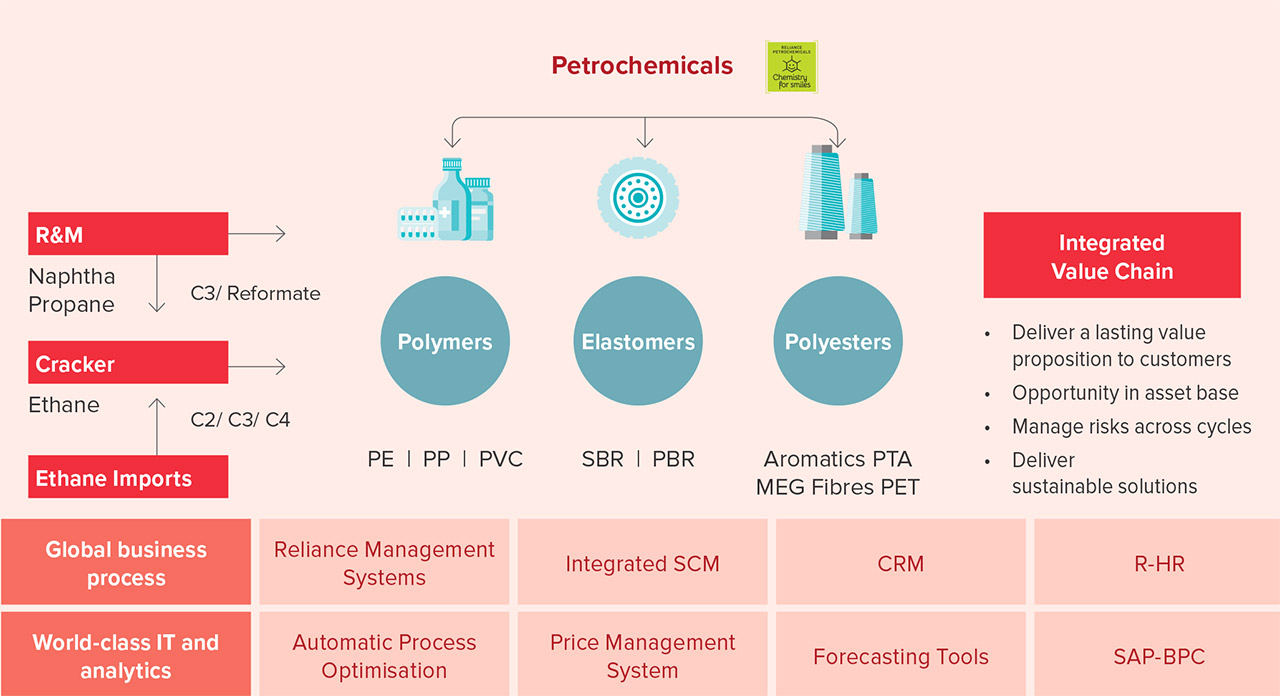

Petrochemicals – Revenue (including inter segment transfers) decreased by 15.6% y-o-y to ` 1,45,264 crore (US$19.2 billion), primarily due to lower price realisations with weaker demand in well-supplied market. Segment EBITDA decreased by 18.3% to `30,933 crore (US$4.1 billion) due to lower margins in key products - Paraxylene, MEG, PET, Polypropylene and Polyethylene.

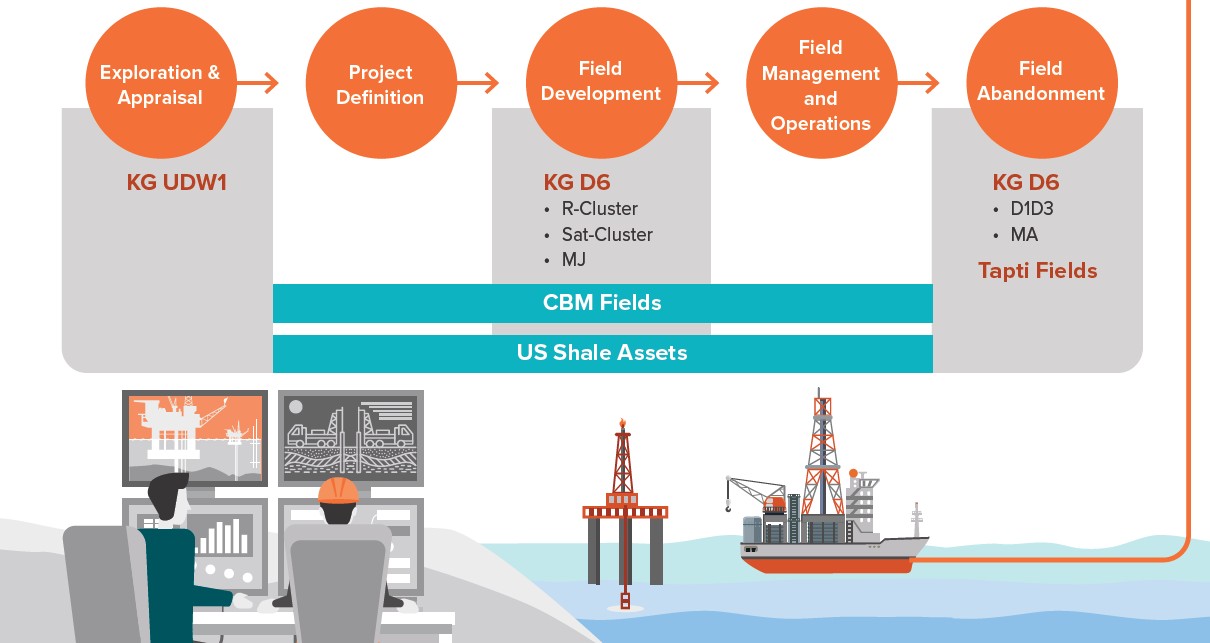

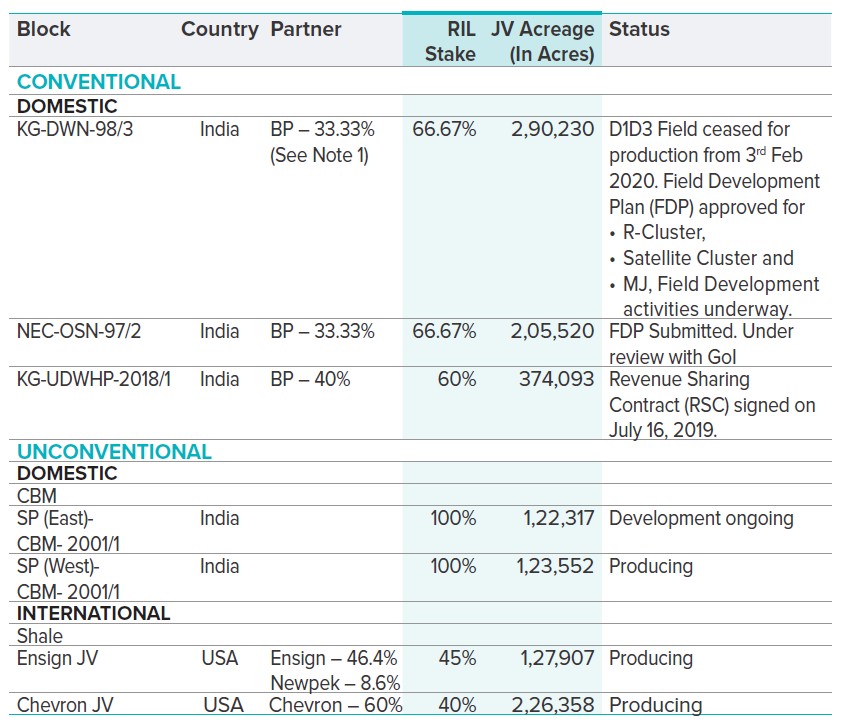

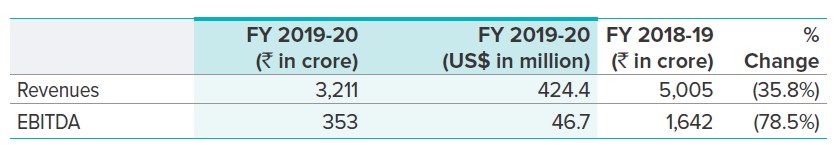

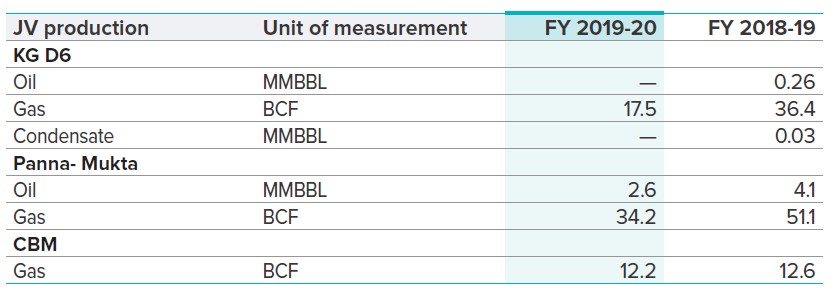

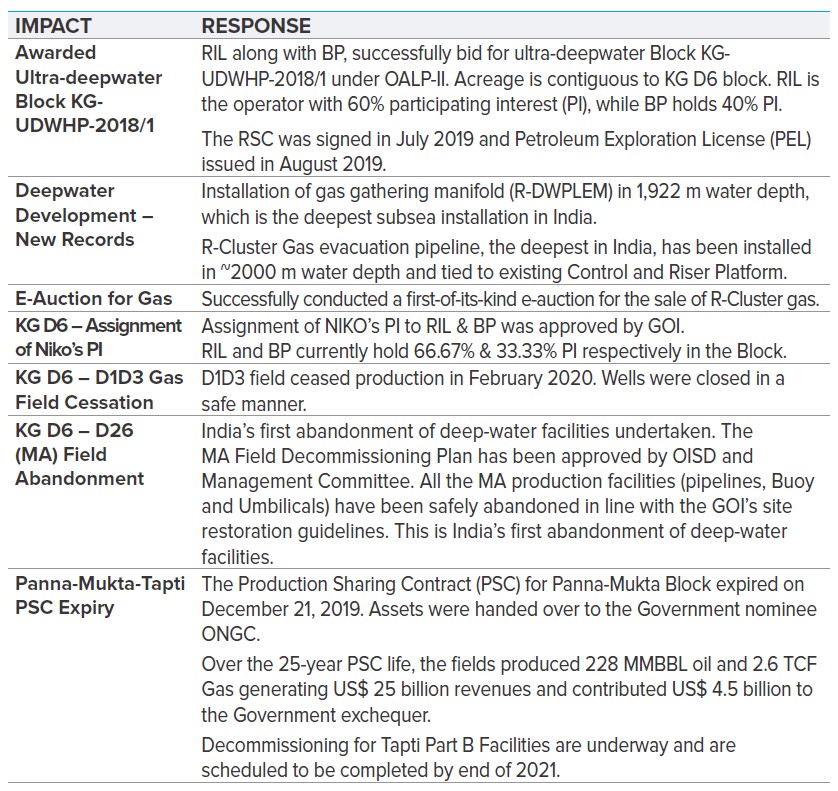

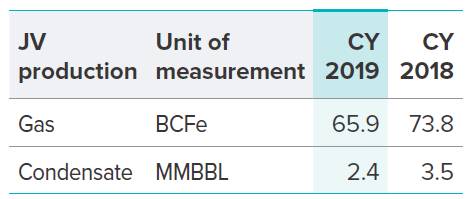

Oil and Gas – Revenues decreased by 35.8% y-o-y to ` 3,211 crore. Volumes from domestic upstream fields and US shale were lower on account of natural decline and slowdown in development activity. Segment EBITDA was at `353 crore as against `1,642 crore in the previous year. For the year, domestic production (RIL share) was at 38.8 BCFe, down 34.1% y-o-y and US Shale production (RIL Share) was 80.4 BCFe, down 14.9% y-o-y basis.

Other Income was at ` 13,956 crore (US$1.8 billion) as against ` 8,386 crore in the previous year, primarily on account of interest income.

Finance Cost was at ` 22,027 crore (US$2.9 billion) as against ` 16,495 crore in the previous year. The increase was primarily on account of higher loan balances, currency depreciation and lower interest capitalisation on account of commissioning of digital projects.

Depreciation (including depletion and amortisation) was higher by 6.1% to ` 22,203 crore (US$2.9 billion) as compared to ` 20,934 crore in the previous year. Increase in depreciation was primarily on account of capitalisation of Gasification and digital services projects.

Basic Earnings Per Share (EPS) for the year ended March 31, 2020 (before exceptional items) was at ` 70.66 as against ` 66.82 in previous year. Basic Earning Per Share for the year ended March 31, 2020 (after exceptional item) was at ` 63.49 as against ` 66.82 in previous year.

The Board of Directors of the Company has recommended dividend of ` 6.5/- per fully paid up equity share of ` 10/- each.

Reliance’s fixed assets (excluding goodwill) stood at ` 6,31,505 crore (US$83.5 billion) as on March 31, 2020. This includes RIL Standalone’s fixed assets of ` 3,34,436 crore and balance of ` 2,97,069 crore in its subsidiaries mainly Reliance Jio, Reliance Holding USA and Reliance Retail.

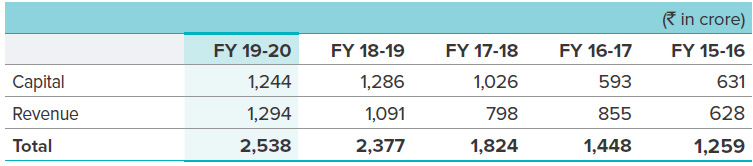

Capital Expenditure for the year ended March 31, 2020 was ` 77,444 crore (US$10.2 billion), including exchange rate difference. Capital expenditure was principally on account of the digital services business, projects in the petrochemicals and refining business and in the organised retail business.

Reliance’s Gross Debt was at ` 3,36,294 crore (US$44.4 billion). This includes standalone gross debt of ` 2,62,345 crore and balance in key subsidiaries, including Reliance Holding USA (` 36,254 crore), Reliance Jio (` 23,242 crore), Reliance Retail Group (` 4,618 crore), Independent Media Trust Group (` 3,265 crore), Reliance Sibur Elastomers Pvt Ltd (` 2,478 crore) and Hathway Cable and Datacom Limited (` 1,975 crore).

Cash and Marketable Securities were at ` 1,75,259 crore (US$23.2 billion) resulting in net debt at ` 1,61,035 crore (US$21.2 billion).

RIL’s standalone Revenue for FY 2019-20 was ` 3,65,202 crore (US$48.3 billion), a decrease of 9.06% on y-o-y basis. Profit after tax was at ` 30,903 crore (US$4.1 billion) a decrease of 13.2% against ` 35,163 crore in the previous year. Basic EPS on standalone basis (before exceptional item) for the year was ` 55.45 as against ` 55.48 in the previous year. Basic EPS on standalone basis (after exceptional item) for the year was ` 48.75 as against ` 55.48 in the previous year.

To be the most admired and successful organised retail company in India that enhances the quality of life of every Indian

Consumer Electronics

Consumer Electronics

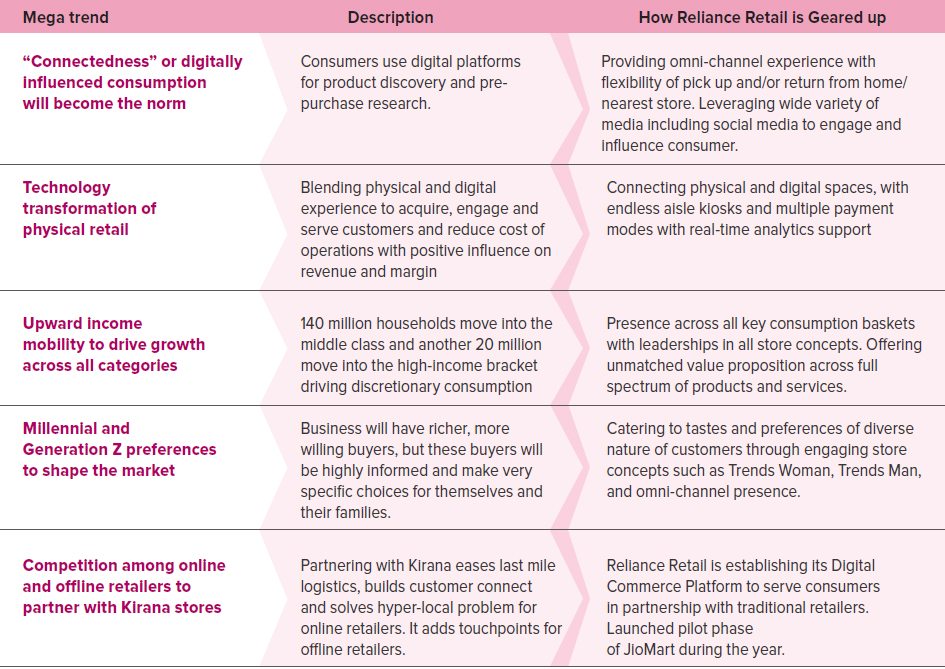

FY 2019-20 has been a growth year for Reliance Retail with all consumption baskets consistently delivering on business strategy. Current positioning of the business and the business momentum is highlighted in the following points:

Reliance Retail’s meticulous planning, frugal approach, large scale and rapid execution has been the major driver of robust growth with capital efficiency y-o-y. The year has seen launch of over 1,500 stores across concepts demonstrating Reliance Retail’s superior execution skills. SMART Point, a neighborhood store concept took less than 45 days from design conceptualisation to launch during which 18 stores were opened across Thane, Navi Mumbai and Kalyan in Maharashtra.

Reliance Retail has the largest customer franchise of over 125 million registered customers who patronise all its diverse store concepts. Reliance Retail serves millions of customers every week who visit the stores and make them an important part of their shopping mission.

Reliance Retail’s store concepts span across all major consumption baskets which accounts for over 80% of consumption needs of Indian households. This enables Reliance Retail to touch and improve the lives of its consumers across diverse needs.

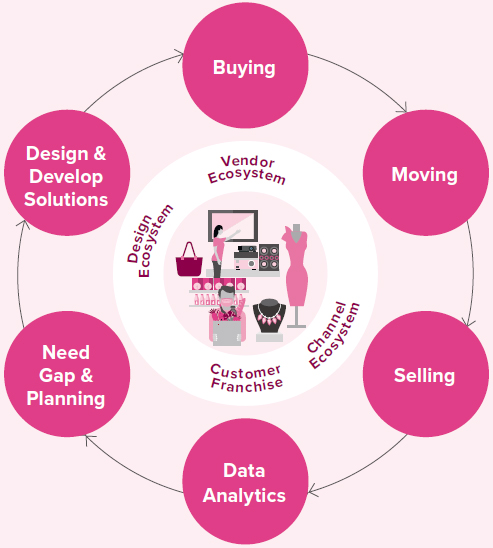

Reliance Retail’s integrated value chain ensures seamless distribution across demand markets through supply chain efficiencies. Reliance Retail’s farm to fork model with interventions at the farm level to procure fresh fruits and vegetables every day from farmers; fiber to wardrobe model for fashion & lifestyle, design to install and after sales service model in consumer electronics are fully integrated value chains which ensures direct control over product quality with sourcing benefits and stronger consumer value proposition.

Reliance Retail continues to penetrate further into smaller towns through new store expansion across all store concepts. Reliance Retail stores enjoy first mover advantage in a large number of markets which remain underserved by organised retail.

Reliance Retail operates the largest portfolio of esteemed international partner brands.

Buying

Vendor Ecosystem

Comprehensive network

of vendors from farmers to

large enterprises

Channel Ecosystem

Comprehensive network

of vendors from farmers to

large enterprises

Moving

Efficient and seamless supply:

Selling

Providing anytime, anywhere,

shopping experience through

stores, e-com, connected kiosks

and catalogue sales; after

sales service through resQ and

dedicated customer care

Data Analytics

Serving individuals, kiranas,

hotels, restaurants, caterers and

B2B customers; engagement

through loyalty programme,

enriching shopping experience

through consumer insights

Design & Develop

Solutions

Combination of inhouse and

external design support for

product development

Leveraging technology backbone across entire value chain and integrated IT systems

Inhouse engineering, procurement and construction team supporting rapid expansion

People - microservices organisation with defined roles and responsibilities

India’s retail market is estimated at US$822 billion in FY 2019-20 and is expected to grow at a CAGR of 10% over next 5 years to reach US$1,315 billion by FY 2024-25. The penetration of organised retail market is estimated at 11% in FY 2018-19 and is expected to grow to 17% by FY 2024-25E. The organised retail market is estimated at US$89 billion in FY 2018-19 and is expected to grow at a CAGR of 21% over next 5 years to reach US$230 billion by FY 2024-25E.

Reliance Retail is India’s largest and most successful retailer. In just 14 years of launch, Reliance Retail has accomplished a feat which no other retailer has achieved. Reliance Retail touches every aspect of its consumers’ life from morning to evening, food to fashion, items of necessities to luxuries of life, cities to towns, online to offline and much more, enabling the ease of living for every Indian. Reliance Retail is not only India’s foremost retailer, but it has emerged as the fastest growing retailer in the world and features among the top 100 retailers globally1.

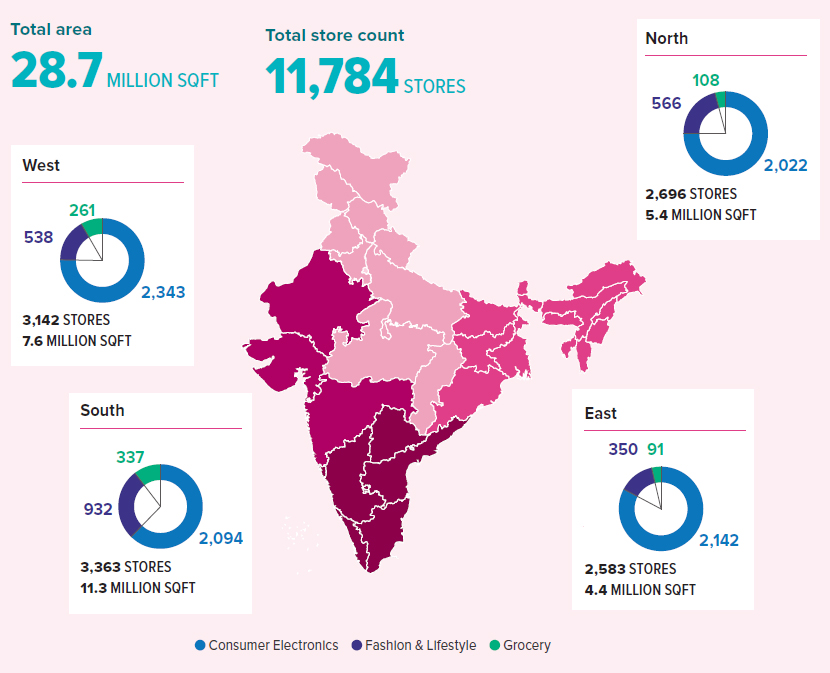

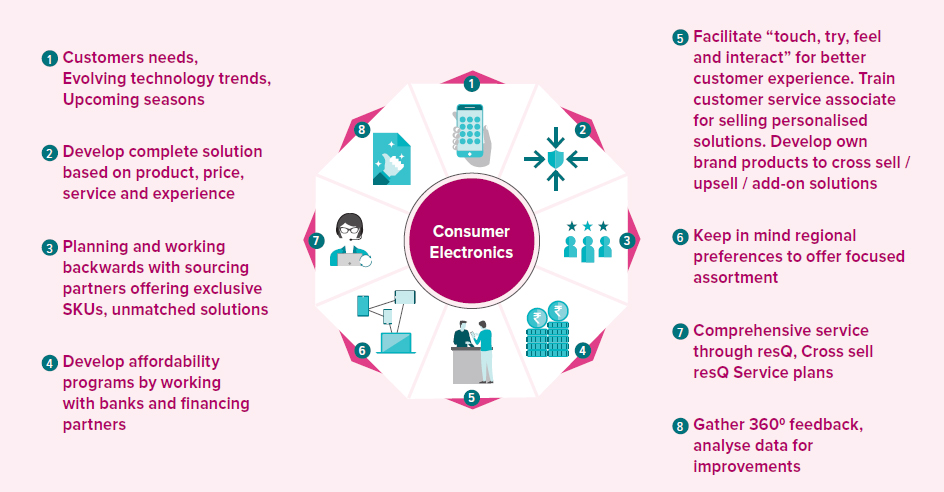

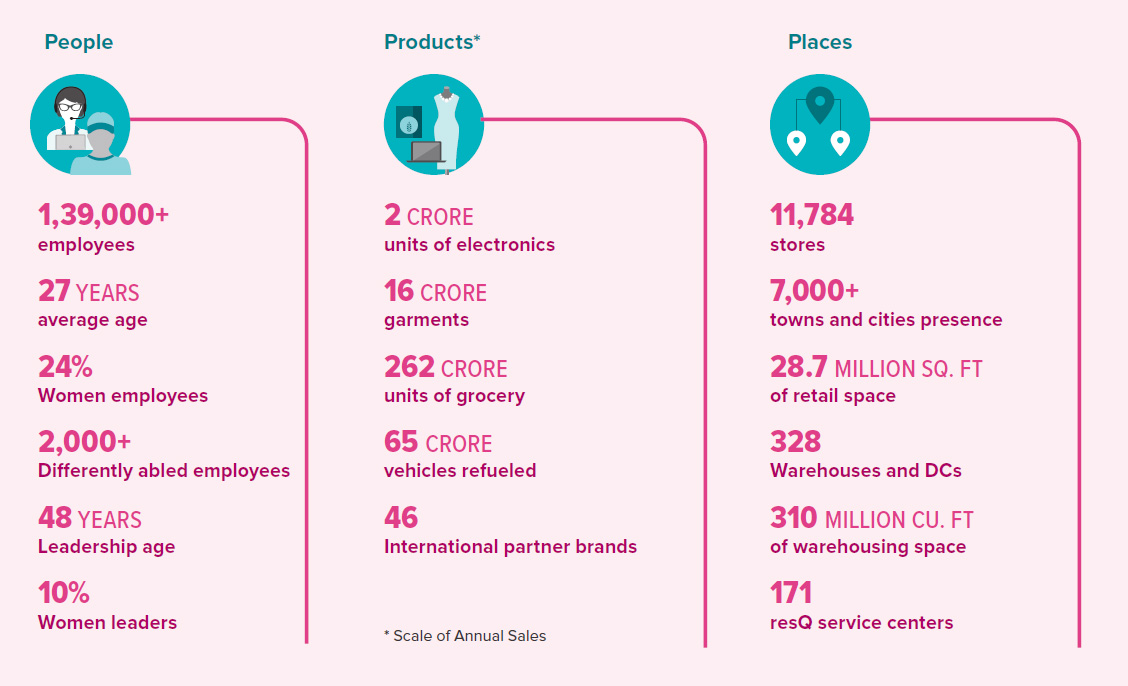

Reliance Retail has established its business across five key consumption baskets of: a) Consumer Electronics, b) Fashion & Lifestyle, c) Grocery, d) Petro Retail and e) Connectivity with deep business moats. The dimensions of the business span across 11,784 physical retail stores across 7,000+ towns and cities, direct to consumer, Digital commerce channels and B2B channels serving millions of Indian consumers across underserved markets. The adjacent table sets out the spread of Reliance Retail’s business.

1Deloitte Global Powers of Retailing 2020

* includes stores of partner brands under joint ventures

CONSUMER ELECTRONICS

The Consumer Electronics market is

estimated at US$53 billion in

FY 2019-20 and is expected to grow at a

CAGR of 11% over next 5 years to reach

US$91 billion by FY 2024-25. The organised

Consumer Electronics market is estimated

at US$18.2 billion in FY 2019-20 with a

penetration of 34%.

Reliance Retail is India’s largest Consumer Electronics retailer with an extensive physical store network. The key proposition of Reliance Retail’s store concepts is centered around ‘Service’, ‘Solution’ and ‘Consumer Experience’. Reliance Digital is an experiential store concept where consumers can touch, feel, use and experience the products. Reliance Digital takes care of entire lifecycle needs of a consumer right from identifying the need gap, narrowing down the solution, suggesting product choices, to pre and post installation support to the customers through its service arm resQ.

Reliance Digital is India’s largest big box retail chain offering wide range of products across all key categories of mobiles, computing, household appliances such as televisions, washing machines, air conditioners, coolers, refrigerators, cameras, speakers, and many more.

Reliance Digital offers exclusive value for money products under its own brands ‘Reconnect’, ‘Jio Phone’ and ‘LYF’, exclusive brands ‘BPL’, ‘Sharp’ and ‘Kelvinator’ under long term collaboration arrangements and SKUs from all the leading Consumer Electronics brands. The core business model of Reliance Digital is to offer latest, exclusive and sophisticated products to consumers, in an all under one roof experiential store environment, at attractive price points and leverage its supply chain, partnerships with leading Consumer Electronics brand partners and financing partners to offer a win-win proposition for all.

resQ is India’s only ISO 9001 certified electronics service brand. With 171 service centers, resQ provides multi-brand, multiproduct service including installation, repairs, maintenance and comprehensive resQ care plans to consumers thereby providing a one stop solution to consumers.

Jio Stores offers connectivity and mobility solutions to consumers with over 8,100 stores across 7,000+ towns and cities. Jio Stores act as an interface offering Reliance Digital’s catalogue of offerings, through a ‘phygital’ experience to consumers. Close to 10% of Jio store’s revenues come through catalogue sales.

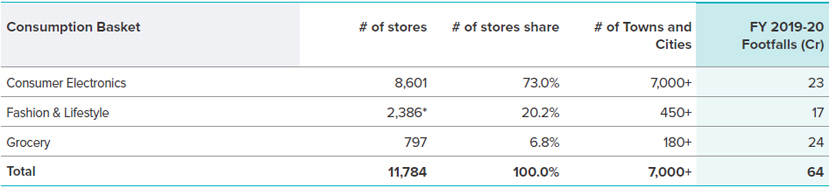

A glimpse of how Reliance Retail approaches consumer electronics consumption baskets is outlined in the below infographic:

FASHION & LIFESTYLE

The Fashion & Lifestyle market is estimated at US$139 billion in FY 2019-20 and is expected to grow at a CAGR of 11% over next 5 years

to reach US$233 billion by FY 2024-25. The organised Fashion & Lifestyle market is estimated at US$40 billion in FY 2019-20 with a

penetration of 29%.

Reliance Retail is the largest fashion & lifestyle retailer in India with offerings across all income segments covering value, mainstream, premium, affordable luxury and luxury. Reliance Retail manages end to end value chain across apparel, footwear, accessories, toys and much more through bouquet of store concepts. A glimpse of how Reliance Retail approaches fashion & lifestyle business is outlined in the below infographic

Trends is the flagship store concept of Reliance Retail democratising fashion for millions of Indian consumers. Acceptance of Trends concept by its consumers has further helped it to nurture engaging store concepts of Trends Woman, Trends Man, Trends Junior and Trends Footwear. Together, Trends is India’s largest fashion retail chain operating over 1,400 stores.

Trends predominantly sells own brand products, which constitute over 70% of its sales. The core business model of Trends is dogged upon providing best and latest of fashion trends to consumers at compelling price points backed by an integrated value chain that ensures high quality products with optimisation from sourcing till delivery of products to consumers. This approach ensures early break-even for most Trends stores and contribute to the overall profitability of the business. At the same time, a curated blend of select third-party brand offerings add to the choices and comparison for the consumers.

Trends has developed a robust portfolio of over 20 own brands such as Avaasa, DNMX, Netplay, Performax, Teamspirit, etc. to cater to diverse tastes and preferences of customers. Today, many of these brands have an annual turnover of over ` 500 crore making them comparable to many national and international brands operating in the market.

Under the Trends umbrella, Reliance Retail operates Trends Small Town, which is a smaller sized store measuring about 5,000 sq. ft. on an average, offering focused range of products for dressing needs of entire family. The store concept is addressed to Tier III and Tier IV towns, where larger sized quality real estate may be either difficult to find or may be inefficient to operate. Trends Small Town concept has been well received by its customers and has scaled up to 240 stores across 200+ towns in a short time.

Trends Footwear is a family footwear store concept offering affordable and fashionable footwear for everyday needs. The stores offer a range of value for money merchandise under own brands and a wide variety of footwear and accessories across all leading footwear brands.

In addition, Trends operates three apparel store concepts: Trends Woman, Trends Man and Trends Junior. These are destination stores for women, men and kids (aged 0-14 years) respectively and offers apparel, footwear & accessories in differentiated store environment.

Project Eve is an experiential women’s only store concept positioned in the mid to premium segment. The store offers apparel, beauty & cosmetics, accessories, footwear, in-store salon and a café, all under one roof to address entire wardrobe needs of a woman.

The Jewellery market is estimated at US$65 billion in FY 2019-20 and is expected to grow at a CAGR of 11% over next 5 years to reach US$111 billion by FY 2024-25. The organised Jewellery market is estimated at US$20 billion in FY 2019-20 with a penetration of 31%. Crafted on the pillars of purity, trust, transparency and quality, Reliance Jewels is a chain of premium jewellery stores present across 60+ towns and cities offering wide variety of fine jewellery collections.

To cater to the needs of India’s millennials to Generation-Z, Reliance Retail has created a curated fashion platform AJIO. It offers over 2,50,000 styles of curated collections across own brand and 1,400+ national and international brands. AJIO provides seamless shopping experience to customers through e-com website, mobile app, physical outlets inside Trends, and endless aisle kiosks.

Reliance Retail operates over 650 stores across a portfolio of 46 revered exclusive international partner brands. It has set up, built and ‘glocalised’ international brands such as Armani, Diesel, Brooks Brothers, Marks & Spencer, Muji, Mothercare and many more.

GROCERY

The Food & Grocery market is estimated

at US$545 billion in FY 2019-20 and is

expected to grow at a CAGR of 9% over

next 5 years to reach US$850 billion by

FY 2024-25. The organised food and

grocery market is estimated at US$21 billion

in FY 2019-20 with a penetration of 3.7%.

Reliance Retail is the largest grocery retailer in India with a presence of 797 stores across 180+ towns and cities. Reliance Retail endeavors to bring extensive selection of fresh produce, items of daily use and general merchandise in a modern setting and at an attractive value proposition. In order to achieve this, Reliance Retail operates four engaging store concepts viz. Reliance Fresh, Reliance SMART, SMART Point and Reliance Market, delivering benefits of modern shopping experience to consumers.

Reliance Fresh is the neighbourhood store offering daily needs and essential items across fresh foods, staples, FMCG, home and personal care and much more with a focus on offering convenience, quality produce and ensuring availability.

Reliance SMART is a destination store concept offering wide variety of products across fresh foods, staples, FMCG, home and personal care, beauty & cosmetics, value apparel & footwear, general merchandise and much more in an all under one roof setting.

SMART Point, a smaller avatar of SMART store, is a one stop multi-purpose store concept housed in residential neighborhoods offering SMART’s price promise across all grocery needs, pharmacy and assisted Digital commerce.

Reliance Market is the wholesale cash and carry store concept serving households, kiranas, hotel, restaurants and catering (HORECA), institutions and B2B member partners. Reliance Market is the largest cash and carry chain operating over 52 stores across 46 cities.

Reliance Retail has developed wide range of own brand products across various categories such as staples, food FMCG, home & personal care and general merchandise. Best Farms, Good Life, Masti Oye, Kaffe, Enzo, Mopz, Expelz, Home One, Graphite, RelGlow, among others are some of the brands that have been well received by consumers.

The inherent strength of Reliance Retail’s grocery business model arises from its farm-to-fork grocery value chain. Reliance Retail has directly partnered with tens of thousands of farmers and small vendors which ensures that quality produce is made available at its stores through ground level interventions, supply chain efficiencies, lower wastages compared with traditional trade channels, and an agile movement of produce to consumers, thereby ensuring shared prosperity.

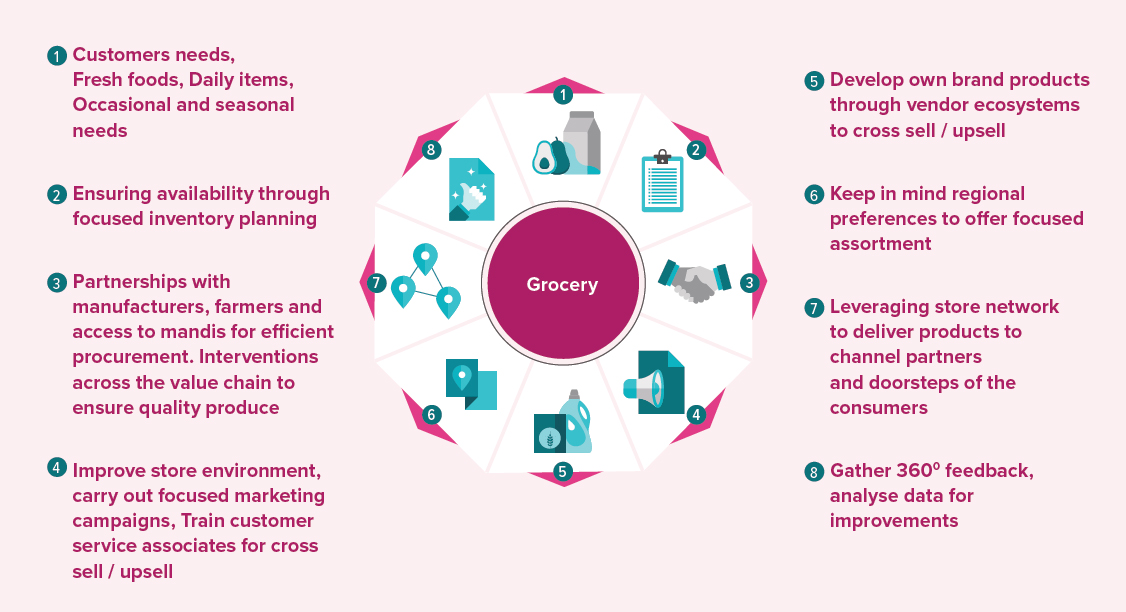

A glimpse of how Reliance Retail approaches grocery business is outlined in the below infographic:

PETRO RETAIL

Reliance Retail is a leading private sector

petro retail operator with 519 owned Petro

Retail outlets. These outlets are spread

across India with a focus on serving

highway corridors between major cities.

Reliance Petro Retail outlets yield significantly higher volumes than industry average led by efficient processes, technology backbone and well-trained employees. The petro outlets offers diesel, petrol and LPG to its customers with a focus to serve high quality fuels.

CONNECTIVITY

Reliance Retail works as the Master

Distributor for Jio connectivity services. The

distribution network comprises over 8,100

Jio stores and vast network of retailers

across the country for new customer

acquisition and recharges.

* EBITDA margin is on net revenue

Reliance Retail achieved a turnover of ` 1,62,936 crore in FY 2019-20, registering a growth of 24.8% y-o-y. EBITDA margin improves to 6.6% vs 5.3% last year. The business delivered an EBIT of ` 8,263 crore in FY 2019-20, registering a growth of 49% y-o-y.

Reliance Retail operated 11,784 retail stores in over 7,000 towns and cities covering an area of 28.7 million sq. ft. as on 31st March 2020. Reliance Retail operated 519 petro retail outlets as on 31st March 2020.

Reliance Retail demonstrated yet another year of highest ever revenue, EBITDA and margin expansion despite challenging market environment, slowing consumer demand, and COVID-19 disruption towards the end of the year. This robust business performance is backed by consistent strategy, sharp operational execution and a customer centric approach.

REVENUE

Business performance has been broad

based with growth delivered across all

categories. The revenue growth continues

to be built around a balanced mix of healthy

like for like sales from existing stores,

bolstered by new customers acquired

from a rapid expansion of stores across

consumption baskets and geographies.

The gains of modern retail are being

brought to the real ‘Bharat’ as more than

2/3rd of stores are operated in Tier II, Tier III

and Tier IV towns.

Business model is witnessing the benefits of operational efficiencies with margin growth outpacing the exponential revenue growth. The margins continue to improve across all consumption baskets backed by improving store productivity, favorable product portfolio mix, sourcing benefits and operational efficiencies. Further, initiatives centered around process improvements, use of technology and training are helping optimise costs and enhance store throughput resulting in margin improvement.

(` in crore)

Reliance Digital

As the business is scaling up further, benefits of operating leverage are providing significant headroom for the business to continue making requisite investments to secure its future readiness, whilst delivering profitable growth alongside. Expansion of the business in Tier 3 / Tier 4 markets and early break even witnessed in these markets reflect this feat.

In Consumer Electronics, the business continued to pursue physical store expansion and opened 605 stores during FY 2019-20. Reliance Digital continues to march ahead of its competition and crossed a milestone of 400 stores. Business registered robust growth which was driven by focused strategy, marketing campaigns, superior customer experience, exclusive product SKUs, partnerships with leading financial institutions for consumer financing, strong festive season footfalls and big days performance.

Reliance Retail entered into a long-term exclusive brand licensing arrangement with Kelvinator and BPL. The arrangement grants Reliance Retail an exclusive manufacturing, marketing and distribution right in India for a range of products covering consumer electronics, durables and accessories.

SMART Superstore

In Fashion and Lifestyle, Trends continues to carry out fastest store expansion among fashion retailers in India and opened over 500 stores during FY 2019-20. Overall, the Fashion & Lifestyle business crossed 2,000 store mark.

AJIO continues to witness superlative growth across all operating parameters viz. web visits, assortment listing, browsing time, number orders, among others. The business continues to strengthen its O2O (offline-to-online) capabilities through in-store couponing, endless aisle kiosks across 841 Trends and extension stores, direct deliveries from 350 Trends and 70 Trends Footwear stores.

Reliance Brands acquired the iconic British Toy retailer Hamleys. With over 250 years’ history, Hamleys is oldest toy retailer in the world, bringing smiles and laughter to children all over the world. During the year, Reliance Brands announced a JV with Tiffany & Co, American luxury jeweller and specialty retailer, JV with WOMO | Bullfrog, the premium Italian men’s cosmetics brand and exclusive partnerships with British Footwear and Handbags brand Kurt Geiger.

The market for traditional jewellery retailers faced headwinds during the year, whereas customer centric modern trade retailers witnessed growing demand. Business believes this movement to be a secular trend. To capitalise on this market opportunity, Reliance Jewels nearly doubled its reach from 143 stores to 241 stores.

In Grocery, the business accelerated the pace of expansion with 98 SMART stores launches during the year, taking total SMART store count to over 250 stores. Almost half of the SMART stores are in Tier II and smaller towns and have shown equally robust customer traction and sales throughput as the stores in metro cities.

A new store concept SMART Point was executed in a record 45 days’ time from concept ideation to launch. The business continues to strengthen merchandising capabilities through stronger ties with vendor partners – exclusive product launches, exclusive pack sizes and consistency in supplies. Reliance Retail has also been a growth catalyst for many regional brands in developing innovative products, packaging designs and in expanding their markets.

Reliance Retail is now embarking on a journey to transform traditional retail through its JioMart Digital Commerce Platform. The roadmap to this journey requires Reliance Retail to establish a complex yet robust physical and digital pan-India infrastructure and neatly weave this network to a smooth, sound and responsive operating system, which will enable Reliance Retail to serve consumers in partnership with traditional retailers.

Reliance Retail has commenced taking strides towards this with the launch of pilot phase of JioMart in select cities. It provides omni-channel experience to consumers who can place orders through alternative ways including Whatsapp which will be served by merchant partners. It is aimed at changing the entire customer journey in ways that even consumers who are not comfortable with digital channels become comfortable with JioMart. JioMart acts as a centralised procurement and delivery platform between manufacturers and merchant partners. JioMart enables digitisation of merchants through Jio PoS at the backend and JioMart app at the frontend. As for the pilot, Reliance Retail has commenced onboarding merchant partners in a limited geography.

Reliance Retail will continue to invest in expanding the existing store network and enhance core capabilities including omni-channel solutions, innovative store concepts, enhancing store environment for providing immersive customer experience, leveraging customer insights through use of sophisticated technology and much more to consolidate its market leadership across all consumption baskets and store concepts.

Reliance Retail promptly addressed many of the challenges posed by COVID-19 disruptions through numerous initiatives and actions. It ensured security of its employees through daily monitoring of diagnostic symptoms, assistance to employees in case of medical emergencies, early disbursement of salaries, protective gear for on-ground staff, recognition of heroes for their exceptional service through newsletters and much more. Business ensured that more than 98% of the grocery stores were operational, sufficiently stocked with essentials and re-aligned store layouts for quick service. It increased capacity for home delivery, enabled “buy online pick up in store” to prevent crowding at stores, introduced “combos” to reduce shopping time and launched bulk ordering for residential societies. Business ensured supplies across the entire ecosystem and delivered essentials to various state governments, and NGOs for welfare initiatives in partnership with Reliance Foundation.

As much as COVID-19 was a disruption, the business also viewed it as an opportunity to strengthen its partnership with kirana ecosystem. During the lockdown JioMart provided uninterrupted services to kiranas across Navi Mumbai, Thane and Kalyan and witnessed order flow increase of 4x times of pre-lockdown period. JioMart also commenced WhatsApp ordering for consumers through its partnership with Facebook.

Reliance Retail is rewiring parts of its business and future readying it for a post COVID-19 world through various measures. It is enhancing safety and hygiene standards and workplace practices for offices, stores and operations. Business is re-imagining the store in a post COVID-19 world and reworking its interactions with customers when they come back, how they come back, their shopping journey, checkout and so on. Taking a 3600 view of the customers, business is strengthening digital commerce and omni-channel capabilities, bolstering its supply chain / fulfillment capacity to handle 10x home delivery. The lockdown has provided valuable learnings for JioMart’s business model and yielded encouraging progress. This will enable accelerated roll-out of JioMart Digital Commerce. Business is further building a strong own brand portfolio in apparel and grocery in keeping with emerging consumer trends.

Reliance SMART connects the customers with the under-privileged by collecting donations from customers and donating the same to NGOs. The platform aids busy customers who want to help the under-privileged by connecting them with the under-privileged.

These NGOs cater to senior citizens, orphans, destitute and differently-abled. The store staff have established cordial relationship with these institutions by visiting these NGOs on a monthly basis to donate and also inviting them for the store visits.

The Store Operations team identify and connect with NGOs to carry out donation activities in their premises.

A monthly budget has been set for each SMART store to conduct the donation activity for the NGOs.

A collection bin has been installed in SMART stores in which customers donate items and it also has a money Donation box where customers can voluntarily contribute Re.1 or more. Stores also buy items from their community budget and add to the customers’ donations.

Stores then segregate and pack the donation items before visiting the NGO.

Stores share donation details and pictures of the activity during NGO visit on monthly basis.

More than 100 NGOs have collaborated with Reliance SMART Stores covering all major cities of India. Every month Reliance SMART touches lives of over 1 lakh underprivileged people. On an average, 15,000 kg. worth of non-perishable food items, clothes, personal and homecare items, sweets and stationary items are donated on monthly basis.

Serving and caring the society as a responsible corporate citizen by contributing to improve the living conditions of the less fortunate. Establishing Reliance Retail Stores as community Stores, a focal point, where people can feel their connection with the underprivileged. Spreading happiness and love among orphans, differently abled and senior citizens.

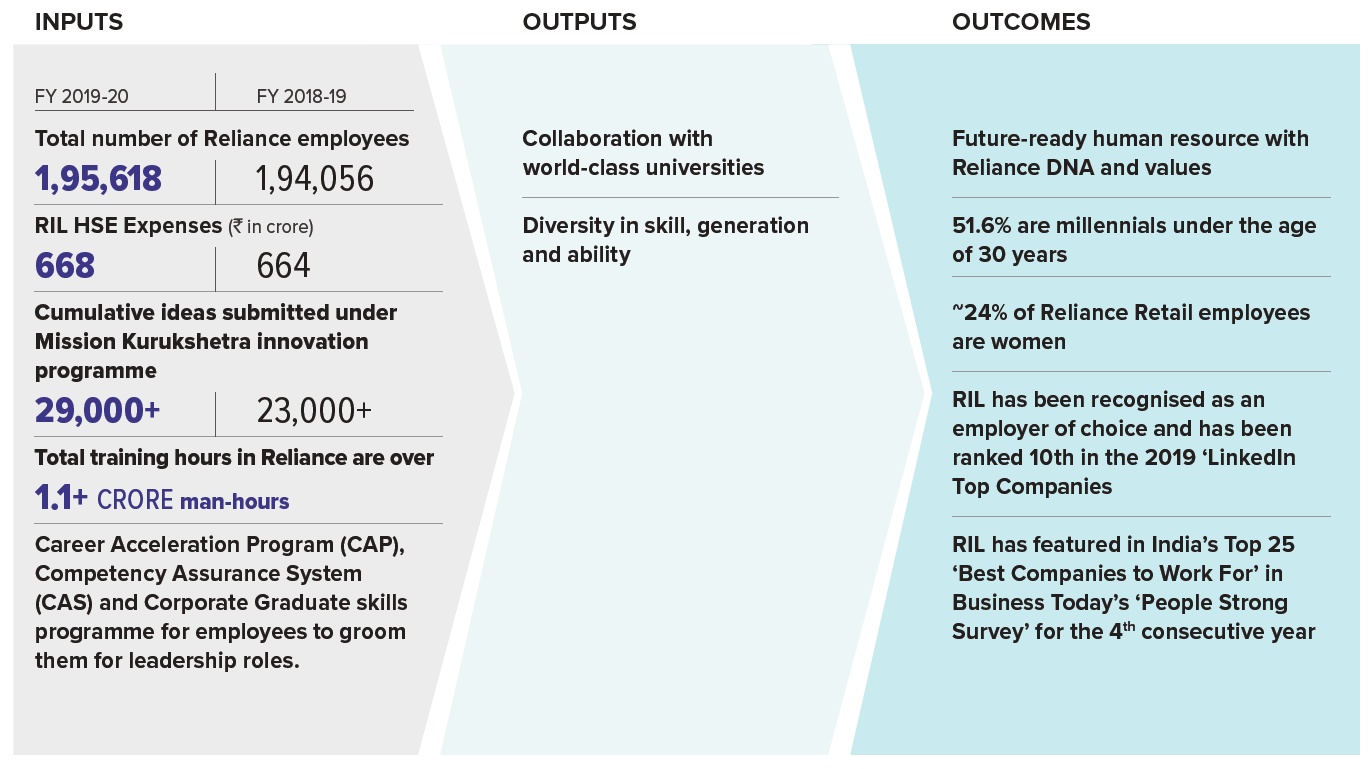

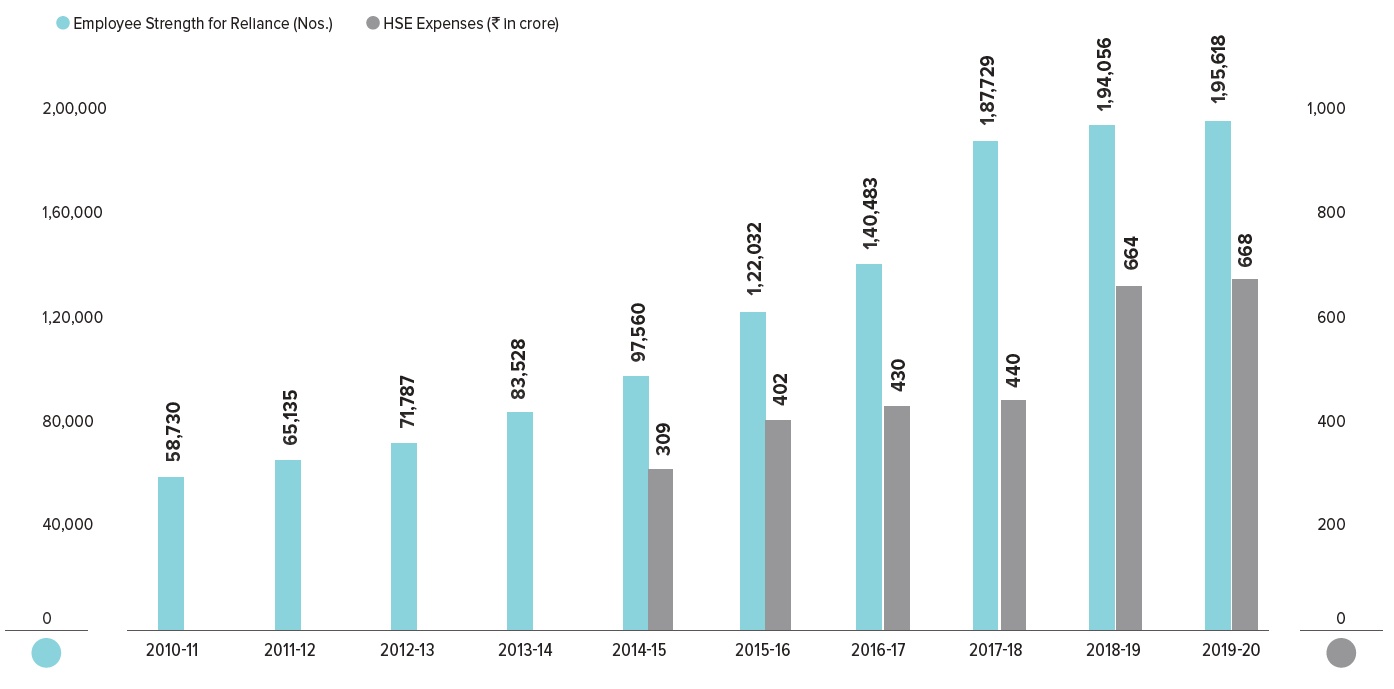

Reliance Retail is home to almost one lakh employees with diverse socio-economic and educational backgrounds. Reliance Retail provides employment and development opportunities to a wide strata of population ranging from unskilled workforce to people with doctoral degrees.

Under the National Apprenticeship Promotion Scheme (NAPS), unskilled workforce work with Reliance Retail as apprentices in a year-long program. Another initiative named Source-Train- Hire, is run in partnership with Reliance Foundation, through which Reliance Retail trains unemployed youth across nation with the aim of imparting their skills to help them move up the social ladder through gainful employment.

Reliance Retail helps the employees with financial assistance schemes for higher education. Through the BBA in Retail program, Reliance Retail helps them become graduates. Reliance Retail also provides the opportunity to earn “Recognition of Prior Learning” RPL Certificate under PMKVY scheme.

Under the “Step-Up” program, store and warehouse people get an opportunity to be trained and grow towards more complex roles.

Reliance Retail also recognises that there is a huge opportunity to provide upwards social mobility to people with disabilities who constitute 2.2% of Indian population. Through the efforts of making Reliance Retail a great and welcoming place to work for people with disabilities, more than 2,000 PWDs are part of Reliance Retail family.

Carrying forward the vision of the Chairman of creating an ease of living for every Indian, Reliance Retail is leaving no stone unturned. Reliance Retail’s commitment to “bettering the lives” has led to the initiative of bringing millions of farmers, small scale producers and merchants to the forefront of the retail revolution by partnering with them for growth.

Reliance Retail is committed to creating one of the world’s most people-friendly, performance-driven, and process-efficient learning organisation, where the best and the brightest work together to create a responsive, respectful and delightful work environment. This has impacted the lives of millions of people by improving their living standards to a great extent.

Unforeseen situations, language barriers and disabilities would never diminish the spark in the eyes of the employees. They are committed to exhibit the core values of Reliance Retail at all times. Be it providing exceptional shopping experience or helping the needy and elderly, Reliance Retail’s employees go an extra mile to create an impact in our customer’s buying decision to a great extent. There have been bounteous instances wherein the customers have appreciated the quality of hard work our employees have put in for the following areas:

The seed of Reliance Retail was sown with a vision of building the most admired & successful organised retail company in India that enhances the quality of life of every Indian.

The journey that started 14 years ago has manifested into a remarkable and robust business that we all are proud of.

Reliance Retail’s operating model is based on customer centricity, while leveraging common centers of excellence in technology, business processes and supply chain. In an endeavor to serve customers across geographies, segments and consumption occasions, Reliance Retail has built and refined multiple store concepts with a focus to serve diverse needs of its customers.

Reliance Retail has consistently endeavoured to provide best store experience, unmatched value proposition and seamless anytime, anywhere shopping experience, through omni-channel initiatives. This strategy has resulted in strong operating performance, broad-based growth and leadership across consumption baskets.

Reliance Retail engages with its value chain partners and bring out disruptive gains for all stakeholders.

In the grocery consumption basket, linkages with the farm have brought about transformational changes in the quality of life of farmers, also enhancing the quality of produce, reducing wastage by shortening the time to move fresh produce and reducing intermediaries in the value chain, thereby benefiting all. Modern grocery retail has evolved in India and so has the consumers. To remain relevant to weekly and monthly shopping missions of a household, Reliance Retails grocery stores have successfully maintained a fine balance of serving local tastes by offering small brands, as well as national and international brands. Similar interventions in fashion & lifestyle and consumer electronics consumption baskets have also brought about lasting gains to all value chain partners and have benefited consumers.

With an undistracted focus and commitment to better the Indian retail landscape, Reliance Retail has emerged as a leader in not only in Indian market context but also global arena. Reliance Retail has featured amongst the fastest growing retailers in the list of “Global Powers of Retailing” published by Deloitte for 3 consecutive years based on FY2016-17, FY2017-18 and FY2018-19 financial numbers. Reliance Retail has currently featured at #1 position amongst the fastest growing retailers in the world, a feat that makes India proud.

To connect everyone and everything, everywhere – always at the highest quality and the most affordable price. Jio’s vision is to transform India with the power of digital revolution

MyJio

Manage your Jio account

Jio Call

VoLTE and rich

communication on all phones

Jio Store

Install and manage your

apps on Jio devices

Jio Motive

Make your car Wi-Fi enabled,

check real-time location and

status, emergency contacts

JioTV

Live and catch-up

TV on the move

JioCinema

Entertainment at

your fingertips

JioSaavn

Music for you.

Anytime, Anywhere

JioGames

Bringing games to

everyone’s life

JioHealthHub

Your digital health vault

JioNews

Complete package for

digital news and magazines

JioTV+

Aggregating video

content across OTT apps

JioAds

Cross-device marketing

technology platform

JioCloud

Store and access your

files from anywhere

JioNet

Gateway to India’s

largest Wi-Fi network

JioBrowser

Fast, safe and

lightweight Indian browser

JioHome and JioSmartLiving

To control IoT devices,

access media

content, customised

home automation

and surveillance

JioChat

Free chat, SMS, voice

and video calls

JioSecurity

Protect your phone,

secure your data

JioSmartSecurity

Security camera application

which lets you connect and

view multiple cameras

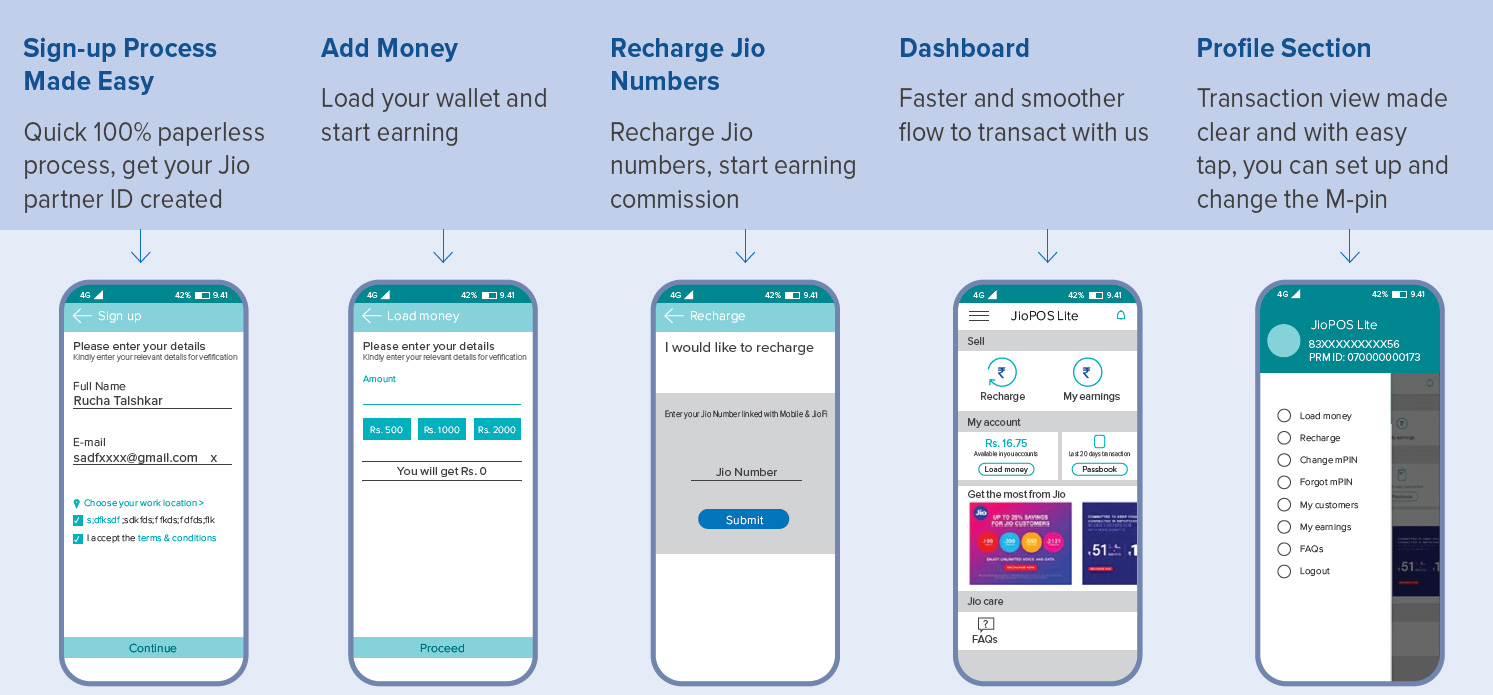

JioPOS Lite

JioPOS Lite

Peer to peer mobile recharging

on a commission basis

Tesseract

Democratising mixed

reality

JioMoney and

Jio Payments Bank

Experience cash-free living

JioSwitch

Secure file

transfer and share

JioGST

GST service provider

JioMart

Online to Offline (O2O)

commerce platform

Embibe

Education platform

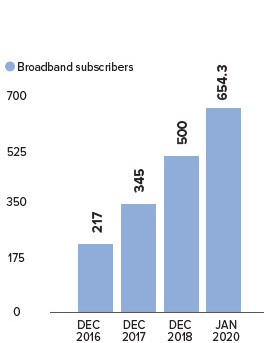

Jio continues to drive the digital revolution in India with 387.5 million subscribers becoming a part of the Jio ecosystem as of March 31, 2020. Jio was built on the core thesis of the transformative power of data with connectivity as an enabler. It has delivered the fastest at scale connectivity user onboarding and is now layering on a robust digital services ecosystem of apps while leveraging its deep technology capabilities.

As a first step towards creating the digital services ecosystem in the country, Reliance Jio has been the key catalyst in creating the broadband data market in India. It is now the #1 ranked mobile telecom operator in the country by both Adjusted Gross Revenue (AGR) and subscribers.

To further facilitate this from the perspective of a business organisation, Jio has consolidated all its technology capabilities, investments and connectivity businesses into a single-holding company called Jio Platforms Limited.

Jio remains committed to creating the world’s premier digital society in India. This will be built on the transformative power of data, where connectivity becomes the enabler for digital platforms, improving lives of every citizen of the country.

Jio remains committed to its vision of connecting everyone and everything, everywhere – always at the highest quality and the most affordable price.

Coverage

Coverage refers to

anytime, anywhere mobile

broadband access. Jio’s

4G coverage at present is

greater than 2G coverage

in India with close to 99%

population coverage. This

coverage is backed by

pan-India 4G spectrum

across three bands and

the best fiber and tower

infrastructure in the

country, providing the best

network experience and

farthest reach.

Data

Average per capita

data consumption on

Jio’s networks is

11+ GB per month

with potential upside

from new use cases

coming up every day.

Quality

Jio offers services on an

all-IP, LTE network with

best-in-class customer

service, easy app-based

customer interaction for

query resolution and

recharges, and AI-based

bots to provide seamless

onboarding and

service experience.

Affordability

Affordable and simple

pricing plans have been

the key to the large-scale

adoption of Jio services.

Jio has been able to

offer these on the back

of superior technologybased

operating

efficiencies, enabling it

to offer services at the

most affordable price.

Agility

Jio’s adoption of an

agile model while

developing its systems

has supported its ability

to scale and adapt in an

orderly manner.

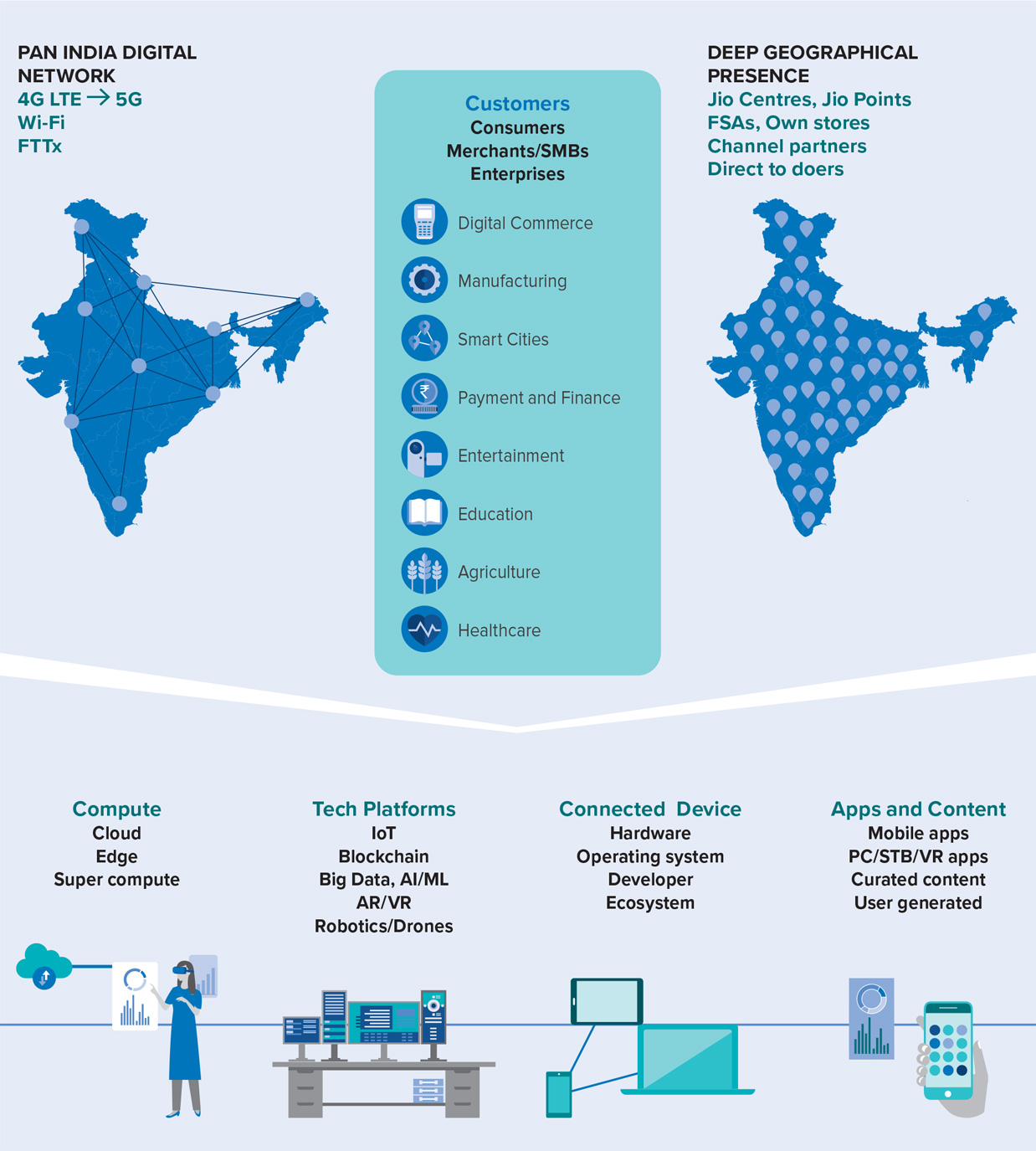

TOTAL SOLUTIONS FOR

ECOSYSTEMS

Jio is creating a massive digital ecosystem

for a billion Indians with domain expertise

across business verticals in the platform

company. The platform company will not

just provide world-class fixed-mobile

converged connectivity, but also digital

solutions across business verticals and

the customer life cycle. Jio has taken the

ecosystem approach to bring together

its pan-India network and distribution

presence with deep technology expertise

to benefit consumers, merchants/Small and

Medium Businesses (SMBs) and enterprises.

Jio’s services span across connectivity and cloud, media, digital commerce, financial services, gaming, education, healthcare, agriculture, Government to Citizen (G2C), smart cities and manufacturing.

DIGITAL PLATFORMS

Jio has created strong internal

capabilities across the following key

digital technologies:

Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Big Data, Augmented Reality/Virtual Reality (AR/VR), Internet of Things (IoT), Blockchain, Artificial Intelligence (AI), Machine Learning (ML), edge computing, speech/natural language, super computing, computer vision, robotics and drones.

These capabilities will power the creation of reimagined solutions for various ecosystems.

ADOPTION OF DIGITAL SERVICES

India now has over 650 million mobile

broadband subscribers driven by

large-scale launch of 4G-LTE network

across the country by Jio and other

mobile operators. Deeper rollout of 4G-LTE networks has also led to a steady

increase in mobile internet penetration

across rural areas to 28%. India has seen

a meaningful transition from 2G/3G to 4G

and existing 350 million feature phone

users are expected to follow suit with

affordable smartphones and seamless

availability of mobile data networks over the

next few years.

EXPONENTIAL GROWTH IN

DATA USAGE

Increasing adoption of broadband services

has led to a 50% y-o-y growth in wireless

data usage across the country over

FY 2018-19. Increasing availability of

devices, improving network penetration,

higher affordability for data services

and emerging new use cases are likely

to sustain this exponential growth

in data demand.

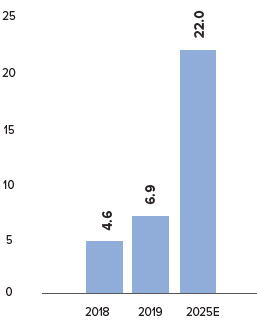

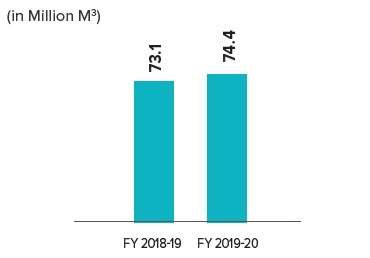

Jio with affordable data plans has been the primary driver of data boom in India over the past three years. Prior to the launch of Jio services, the total mobile data traffic across all networks in India was 0.2 Exabytes per month. At present, Jio network alone carries over 4.5 Exabytes per month, with the industry data traffic of more than 7.5 Exabytes per month (this was 6.9 Exabytes at the end of CY 2019).

As per data in the Ericsson Mobility Report 2019, mobile data in India is expected to grow 3X during CY 2019-25E, with mobile broadband subscriptions expected to double during the same period. The government’s endeavour to roll out nextgeneration data network in the remotest corner of the country for all citizens would accelerate this transition towards a digital society.

(Exabytes)

Source: Ericsson Mobility Report

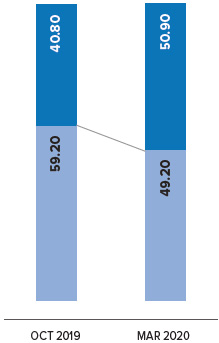

REGULATORY DEVELOPMENTS

Among the key regulatory developments

with respect to the digital services business,

was TRAI’s decision to push back the

transition to Bill and Keep (BAK) regime by

12 months. The Interconnect Usage Charge

(IUC) would now be reduced to zero with

effect from January 1, 2021. Accordingly, Jio

introduced a charge of 6 paise/minute on

all off-net outgoing voice minutes to pass

through the impact of change in regulatory

stance on IUC in October 2019. This has

led to a significant improvement in voice

traffic mix as misusers of free voice services have left the network and Jio is now a net

receiver of IUC.

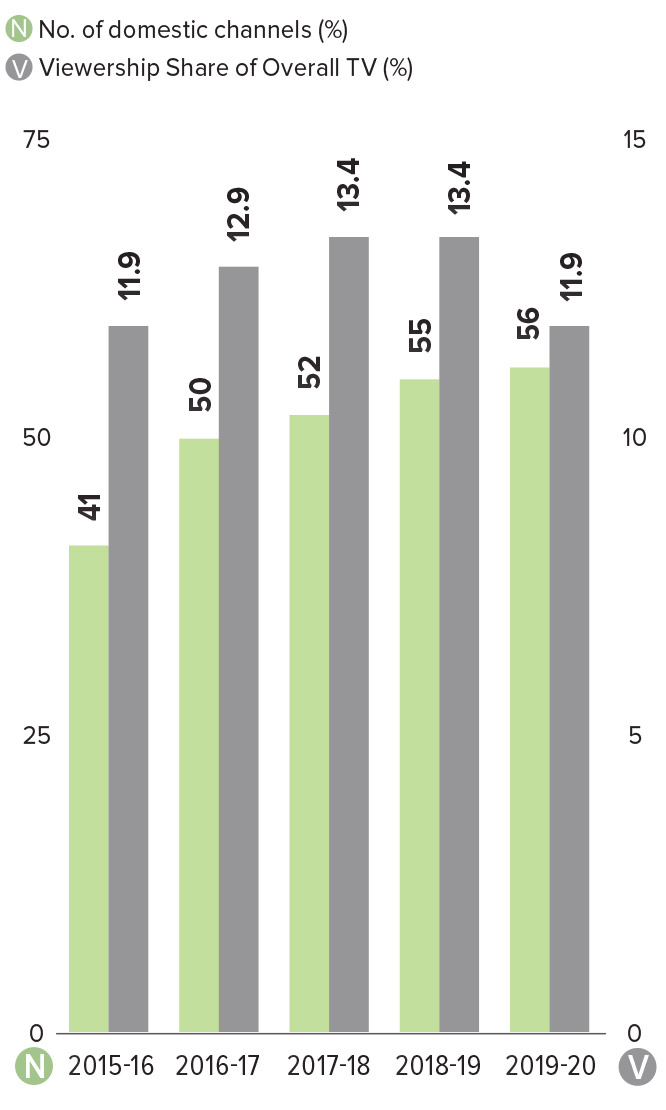

(%)

(Million)

Source: TRAI

Jio continues to believe that transition to the BAK regime will hasten the adoption of more efficient technologies like VoLTE, which has a negligible cost for carrying and servicing essential voice services.

During the year, TRAI has also initiated consultation process on feasibility of establishing a floor price for mobility services in the country. Market dynamics have improved in the recent past, as reflected by tariff hikes effective December, 2019 wherein all the operators revised their tariff plans upwards by up to 40%. As a responsible corporate citizen, Jio would continue to actively engage with the regulator and industry stakeholders to drive growth for all.

In addition, the Honorable Supreme Court of India had, in its verdict related to the pending AGR matter, directed operators to pay the outstanding dues before January 24, 2020. In compliance with this judgement, Jio had self-assessed AGR related levy and deposited `195 crore with the Department of Telecom within the stipulated timeframe.

The government has also expressed its intentions of conducting the next round of spectrum auctions during the fiscal year 2020-21. Jio with its 5G-ready network and extensive fiber assets, would play a key role in the development of the 5G ecosystem in India, based on market dynamics.

WIRELINE NETWORKS

With sub-optimal wireline infrastructure

and a meagre 7% penetration in terms

of households, India has for long, been

a laggard in fixed broadband services.

Fiber penetration in low single digits is

significantly lower than global benchmarks.

Jio is approaching Fiber to the Home

(FTTH) services as a huge greenfield

opportunity to potentially connect 50

million homes and 15 million enterprises

with high-speed fiber across 1,600 cities.

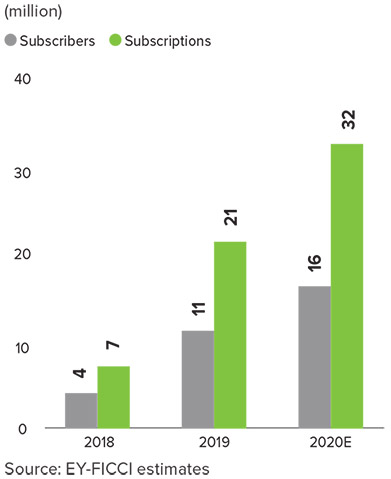

Jio’s extensive intracity fiber network, last-mile execution, seamless customer experience along with attractive bundling of digital content and smart home IoT solutions would be key differentiators. Jio had connected approximately one million homes with JioFiber services until March 2020.

DATA PROTECTION

Jio believes that customers are true owners

of their data and without their consent, no

data should be collected, processed or

used by any corporate entity. Also, Jio has

been an active supporter of local storage of

critical and sensitive customer data in the

interest of national security and protection

of customer privacy. Data localisation is also

expected to drive investment and create

employment in the country.

The regulatory framework through the Personal Data Protection Bill, 2019 is currently being finalised by the Government of India to ensure adequate measures are taken by corporates with respect to data protection. Reliance with more than 500 million customers across consumer businesses and one of the largest data lakes across corporates in India would abide by the law in letter and spirit.

DIGITAL SERVICES FOR ALL

Government of India has undertaken the

project BharatNet which is the world’s

largest rural broadband project to provide

broadband connectivity to all 2,50,000

Gram Panchayats covering 6,25,000

villages. Jio has in its own way tried to

boost the ‘Digital India’ initiative by covering

99% of population with an all-IP 4G-LTE

network. Jio with the widest 4G coverage

is the only provider of mobile data services

to almost 250 million citizens of the

country would play a pivotal role in digital

inclusion in India.

India is the second-largest smartphone market in the world after China, with approximately 450 million unique smartphone users. Notwithstanding, smartphone penetration has been low, constrained by availability of good quality affordable devices for the lowest economic strata.

Over the past two years, JioPhone (marketed by Reliance Retail) has successfully transitioned over 100 million erstwhile feature phone users to 4G network. The 'JioPhone Diwali' offer introduced in October 2019 has been very successful in accelerating data adoption as subscribers have seen enormous value in the affordable bundle of device and digital services. Despite this, rural India remains an underpenetrated market and presents a huge opportunity for digitisation, with rural broadband penetration at 28%.

Jio believes that the availability of digital services at affordable price points would drive adoption of Internet-based services by all and give the right tools in the hands of young Indian entrepreneurs to drive revolutionary growth.

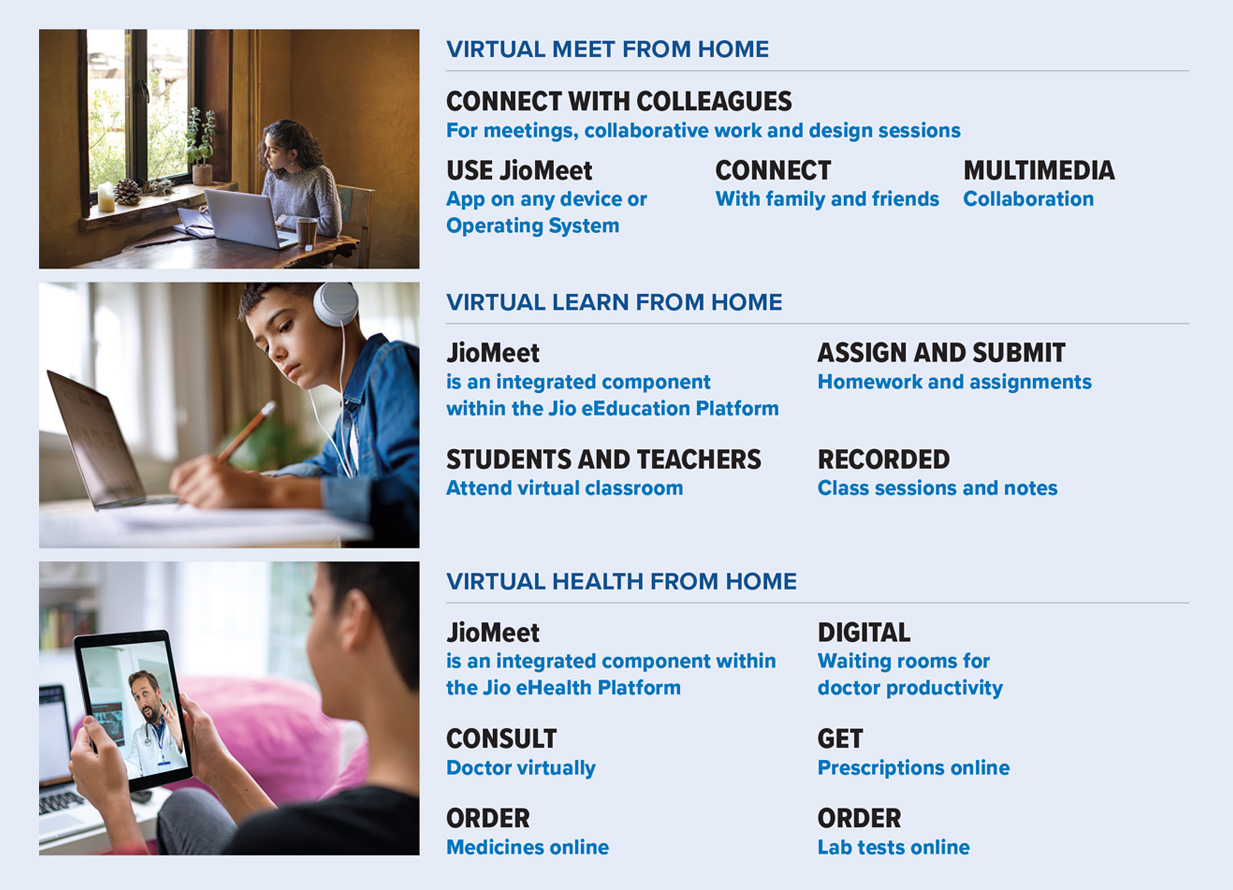

In tandem with RIL’s response to its call-ofduty to be at the service of the nation 24x7 in the collective fight against COVID-19, Jio has remained committed to serve a billion Indians, provide seamless connectivity in this time of distress and help India fight COVID-19 through the use of technology.

Jio has made investments in excess of US$50 billion since inception to create the largest and most advanced digital and connectivity ecosystem in India, with a rich bouquet of successful apps and platforms. New growth areas in Narrow- Band (NB) IoT, IaaS/ PaaS, mixed reality, gaming, education, healthcare, agriculture and manufacturing have been identified. This has created a portfolio of world-class, legacy-free and future-proof digital assets.

As a part of restructuring of the digital businesses that Jio undertook during the year, a single platform company named Jio Platforms Limited has been created. This has been done to bring together digital assets of Reliance spanning across connectivity and technology investments under a single wholly-owned subsidiary. This has created not just an ability to leverage the subscriber base to create the world’s best and most relevant platforms, but also create a debt-free and financially strong holding company that could pursue growth opportunities and be attractive for strategic investments and partnerships.

PARTNERSHIPS WITH GLOBAL

TECHNOLOGY LEADERS

Jio’s success in building technology,

specifically for India and its ability to

proliferate across the country has attracted

global technology leaders – Facebook and

Microsoft—to forge partnerships with it.

Facebook – In April 2020, RIL, Jio Platforms Limited and Facebook Inc. announced the signing of binding agreements for an investment of `43,574 crore by Facebook into Jio Platforms. This investment by Facebook valued Jio Platforms at `4.6 lakh crore pre-money Enterprise Value. Facebook’s investment translated into a 9.99% equity stake in Jio Platforms on a fully diluted basis.

This partnership is aimed at accelerating India’s all-round development, fulfilling the needs of Indians and Indian economy. The joint focus will be India’s 60 million micro, small and medium businesses, 120 million farmers, 30 million small merchants and millions of SMEs in the informal sector, in addition to empowering people seeking various digital services.

Concurrent with the investment, Jio Platforms, Reliance Retail Limited and WhatsApp also entered into a commercial partnership agreement to further accelerate Reliance Retail’s Digital Commerce business on the JioMart platform using WhatsApp and to support small businesses on WhatsApp. The companies will work closely to ensure that consumers are able to access the nearest kiranas who can provide products and services to their homes by transacting seamlessly with JioMart using WhatsApp.

Microsoft – In August 2019, Jio and Microsoft Corp. embarked on a unique, comprehensive, long-term strategic relationship aimed at accelerating the digital transformation of the Indian economy and society. This 10-year commitment combines the world-class capabilities of both companies to offer a detailed set of solutions comprising connectivity, computing, storage solutions, and other technology services and applications essential for Indian businesses. It will span the broad Reliance Industries ecosystem including its existing and new businesses.

The aim of the partnership is to enhance the adoption of leading technologies such as data analytics, AI, cognitive services, Blockchain, IoT, and edge computing among SMEs to make them ready to compete and grow, while helping accelerate technology-led GDP growth in India and driving adoption of next-gen technology solutions at scale.

Specifically, Jio’s connectivity infrastructure will promote the adoption of the Microsoft Azure cloud platform and technology stack to its enterprise customers. In addition, Jio will leverage the Microsoft Azure cloud platform to develop innovative cloud solutions focused on the needs of Indian businesses. Jio will also set up data centres in locations across India, consisting of next-generation compute, storage and networking capabilities, and Microsoft will deploy its Azure platform in these data centres to support Jio’s offerings. The initial two data centres, which can house IT equipment consuming up to 7.5 MW of power, are being set up in the states of Gujarat and Maharashtra. These are targeted to be fully operational in CY 2020.

NETWORK BUILT FOR A BILLION

INDIANS, WITH WORLD-CLASS

NETWORK ARCHITECTURE

Jio’s all-IP data network is built on the

4G-LTE technology. The network built as

a mobile video network carries more than

4 Exabytes of data monthly and is future

ready to transition to 5G and beyond.

Network capacity too is being augmented

by adding incremental sites, Wi-Fi access

points, small cells and expanding fiber

backhaul. To further improve the network

experience, advanced features such as

Software Defined Networking (SDN) and

Network Function Virtualisation (NFV) have

been incorporated, along with significant inhouse

data centre capacity and investments

into Content Distribution Network (CDN).

Even with 387.5 million subscribers having per capita voice usage of 771 minutes per month and data usage of 11.3 GB per month, data speed remains the highest while network latency and call drop rates remain the lowest among all networks across the country. The entire scale-up of Jio has come alongside sustained network performance underlining its quality and capacity.

PROGRESS ON TOWER AND

FIBER INVIT

Jio’s passive infrastructure, which

includes 1,75,000 towers and 1.1 million

route kilometers for fiber in full scope,

has already been transferred through a

Scheme as of March 31, 2019, held through

two separate Infrastructure Investment

Trusts (InvIT). During the year, Reliance

has signed a binding agreement with

Brookfield Infrastructure Partners LP and its institutional partners for investment

in the units to be issued by the Tower

InvIT. Brookfield and affiliates will invest

`25,215 crore in Tower InvIT. Discussions

with potential investors for Fiber InvIT

are in progress.

FIXED MOBILE CONVERGENCE

In the next phase of the connectivity

rollout, Jio will offer state-of-the-art wireline

services across FTTH and Enterprises.

The core and aggregation layers of the

Jio network have been converged and

5G-ready from the time of inception. This

will allow Jio to offer services across the

fixed mobile connectivity layers, leading

to not just enhanced experience but also

efficient pricing.

LIBERALISED SPECTRUM ACROSS

THREE BANDS

The strength of Jio network is in the fact

that the entire 1,108 MHz of pan-India

spectrum holding across the three bands

(800 MHz, 1800 MHz and 2300 MHz) is

deployed towards 4G-LTE. Each of the sites

on the network radiates all three bands. The

average life of the spectrum is 13 years with

all spectrum liberalised, which can be used

to roll out any future technology.

PIONEERING VOICE

TECHNOLOGIES AT SCALE – FROM

VOLTE TO VOWI-FI

Jio is the first network globally to roll out

VoLTE at scale. In fact, Jio is the largest

VoLTE network carrying 9 billion minutes

per day. To further improve customer

experience, Jio also launched nationwide

voice and video over Wi-Fi services. With

this, customers can use any Wi-Fi network

for Jio Wi-Fi calling. The voice and video

calls seamlessly switch over between

VoLTE and Wi-Fi to provide an enhanced

voice/video-calling experience.

UNDERSEA CABLE FOR DIGITAL

CONNECTIVITY

Jio has been actively creating a multi terabit

capacity international fiber network. Jio,

with its partners, is a part of two undersea

cable network consortiums:

DISTRIBUTION ACROSS EVERY NOOK AND CORNER OF THE COUNTRY Reliance Retail works as the Master Distributor for Jio connectivity services Jio has a pan-India distribution channel with over 1 million retailers for customer acquisition and selling recharges ensuring every Indian home is within 20 kms of a Jio Point. In addition to this, services are also sold through the MyJio application, the best-in-class full-service (prepaid and post-paid payments, loyalty coupons, troubleshooting, addition or deletion of services) self-care application. MyJio’s success is evident from a large portion of smartphone and JioFiber customers recharging and selecting their subscription plans through the application.

INNOVATION ACROSS NETWORKS

AND PLATFORMS

Right since its inception, Jio has strived

to lead innovation in India across network

technology, platforms and consumer

services. Till date, Jio has filed 134

patents for the pioneering initiatives it

has undertaken, of which 29 have been

granted. In FY 2019-20 alone, Jio filed for 31

patents and was granted 10. These patents

span across devices, network, cloud, digital

media, branding and customer experience.

Jio’s patents cover areas of cutting-edge

technology, including IoT, 5G, video bots,

Blockchain, NFV and Evolved Multimedia

Broadcast Multicast Services (eMBMS).

SUITE OF DIGITAL APPS

Jio has taken a practical approach to

technology and a platform approach to

bring networks, technology, services and

experience under a single umbrella. This has made the time to market for Jio’s

solutions the lowest across any technology

firms, allowing it to be nimbler and more

responsive to customer and market needs.

Across technologies and customer needs,

Jio endeavours to create scalable and

globally exportable platforms.

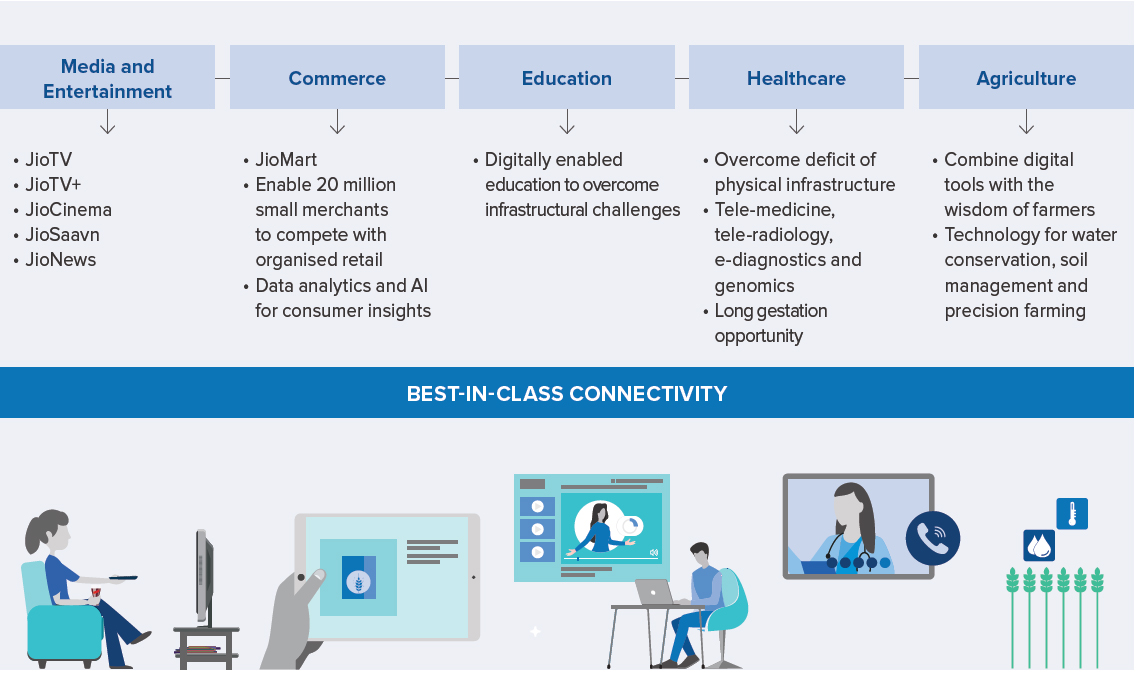

Jio network’s ability to seamlessly carry multimedia content has allowed it to enrich customer experience through a rich suite of applications and tools that encompass entertainment, news, information, commerce and self-service. Jio’s rich suite of digital applications have won multiple accolades and continue to have the bestin- class customer engagement metrics in their respective categories. These include JioTV (680+ channels of live and catch-up TV, across 15 languages and 10 genres), JioCinema (video on demand, 10,000+ movies, 1,20,000+ episodes, 60,000+ music videos), JioMoney, JioNews (190+ live channels, 800+ magazines, 10+ languages, JioSaavn (India #1 OTT music app with 55+ million tracks across 16 languages, unique Artist Originals Programme), JioChat, JioHealthHub, among others. MyJio app with digital self-service and e-care capability is a cornerstone of Jio’s digital proposition for its customers. Jio has done deep integration of JioSaavn, JioCinema and JioCloud, among others, into MyJio to provide a single-window access to all apps. Digital services to the customer would expand from the current media and entertainment to also include education, commerce, healthcare, agriculture and e-governance.

INVESTMENTS IN NEXTGENERATION

TECHNOLOGY

CAPABILITIES

With technology capability in its core DNA,

Jio has invested in technologies ranging

across Big Data, Blockchain, Mixed Reality,

edge compute, IoT, computer vision, secure

identity, AI/ML, super compute, robotics

and IaaS/PaaS. Some of these are already

integrated and find use cases in the

existing offerings, while others would drive

launch of Jio’s next set of digital offerings

to the consumers.

India has a rich and fast-growing ecosystem of entrepreneurs who are using technology to solve customer problems across the strata of population. Reliance is playing an important role in developing this ecosystem through investments and collaboration. Over the course of time, Reliance has invested in companies such as Embibe (AI-based education platform), Karexpert (digital healthcare platform), Tesseract (AR/ VR capabilities), Reverie (AI for speech and language recognition), SankhyaSutra (computing, analytics and simulation tools), Netradyne (AI-based fleet management), Easygov (G2C solutions), Haptik (AI/ML for speech and language recognition), Saavn (online music platform), NewJ (content curator), Radisys (digital initiative for communications and networks) and Asteria (drone technology).

These investments, along with Reliance’s inhouse developed technology capabilities, will be a part of Jio Platforms Limited and have been carefully selected to fit into the Reliance digital ecosystem to enhance and keep its offering across mobility, homes and enterprises future ready.

Digital services reported another year of strong revenue and EBITDA growth driven by continued momentum in wireless subscriber addition. Customer engagement on Jio network also remained healthy across data and voice services, with video accounting for 70% of data usage. Net subscriber addition of 81 million in FY 2019-20 was well ahead of the industry peers. Revenue of `68,462 crore for FY 2019-20 on a year-ending subscriber base of 387.5 million and EBIT margin of 21% underlines the best-in-class execution capability of the digital services team.

Jio continues to transform the Indian telecom industry with key performance indicators as follows:

Jio envisages a significant opportunity in building a digital society for the citizens of the country, which besides catalysing the productivity and overall economic growth would also generate adequate shareholder returns over the next several decades. Key pillars of building this digital society would be; i) best-in-class wireless and wireline data network for all at the most affordable prices, ii) digital platforms for Media & Entertainment (M&E), commerce, education, financial services, health, government services, agriculture and more, iii) next-generation technologies such as Blockchain, AI, IoT and Mixed Reality.

Over the next few years, Jio would focus on creating a robust wireline network across the country, offering high-speed connectivity and a bouquet of digital services to every home and enterprise. Jio is geared up to touch the lives of over a billion Indians through its wireless as well as wireline offerings.

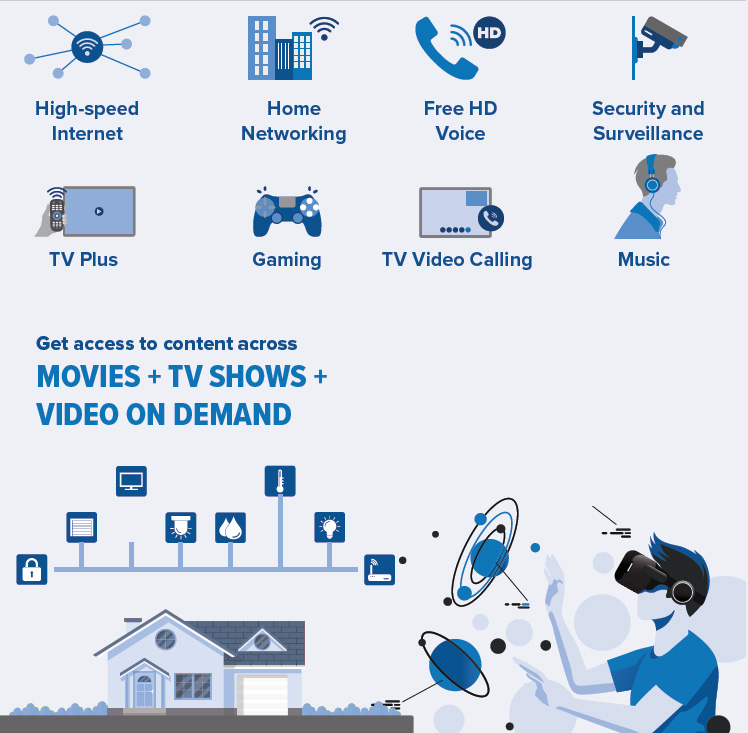

Endless possibilities with JioFiber connectivity

JioPhone is one of a kind product that combines the affordability and ease of use of a feature phone with the functionalities of a smartphone for first-time mobile Internet users.

Over 100 million Internet-deprived feature phone users are brought onto the mobile broadband platform.

An affordable 4G-enabled handset for the large feature phone user base in India, to make the transition towards using Internet and digital media over mobility network. Critical in bridging the digital divide in the country.

Reliance Jio has been at the forefront in supporting its users during the COVID-19 pandemic.

a) Additional calling and

data benefits

Jio offered double data benefits across its data voucher recharges, bundled voice minutes in the data vouchers, additional 100 voice minutes and 100 SMS to JioPhone users, access to incoming services despite expiry of validity of existing packs.

Assured connectivity in times of a national crisis.

Enabling continuity of services for every Jio subscriber.

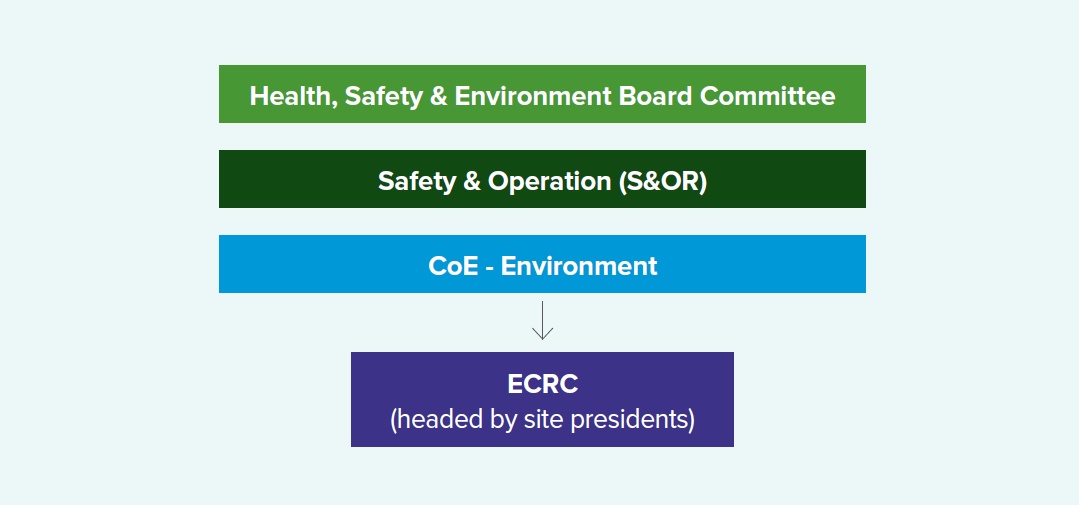

b) Digital recharge awareness campaign/ recharge partner initiative