The Oil to Chemicals (O2C) business portfolio spans across transportation fuels, polymers and elastomers, intermediates and polyesters. The O2C business includes world-class assets comprising refinery, crackers and downstream assets that are deeply and uniquely integrated, supported by best-in-class logistics and supply chain infrastructure.

The RIL O2C business includes plants and manufacturing assets located in India at Jamnagar (Jamnagar DTA, Jamnagar SEZ), Hazira, Dahej, Nagothane, Vadodara, Patalganga, Silvassa, Barabanki and Hoshiarpur as well as in Malaysia at Nilai, Melaca and Kuantan. It also includes a 51% equity interest in a fuel retailing JV with bp-Reliance BP Mobility Limited (RBML, operating under the brand Jio-bp), and a 74.9% equity interest in Reliance Sibur Elastomers Private Limited (RSEPL).

The integrated O2C business structure enables an integrated decision-making approach that helps to maximise and optimise the entire value chain from crude to refining to petrochemicals to the B2B/B2C model.

Continued recovery in global oil demand supported product margins. High operating rates, superior product placement and feedstock flexibility led to strong operating performance for the year.

1.4 MMBPD

Crude refining capacity, the largest single site refinery complex globally

68.2 MMT

Production meant for sale for FY 2021-22

12

Manufacturing facilities in India (9) and Malaysia (3)

21.1

Complexity Index

#1

Largest Petcoke Gasifier globally

3rd

Largest producer of PX globally

7th

Largest producer of PTA globally

Vision and Mission

Accelerate new energy and materials businesses while ensuring sustainability through circular economy and target to become a net carbon zero company by 2035.

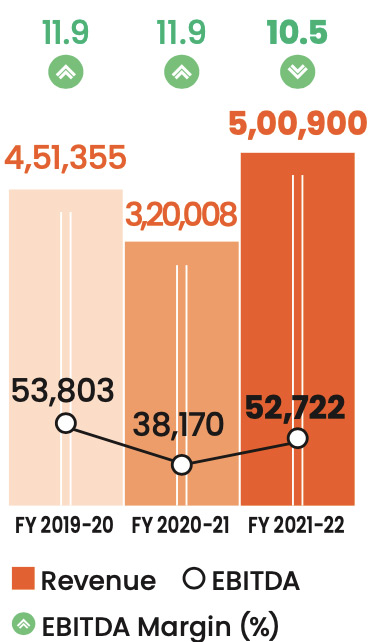

Performance Summary

REVENUE & EBITDA

(` IN CRORE)

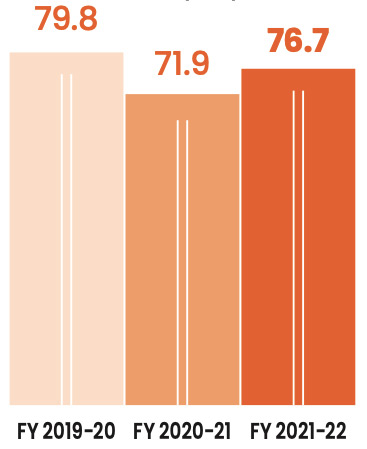

TOTAL THROUGHPUT

(MMT)

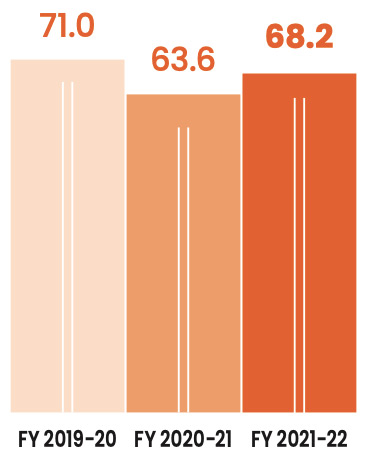

PRODUCTION MEANT FOR SALE

(MMT)

Strategic Advantages and Competitive Strengths

Deep and unique integration across sites

Fully integrated O2C value chain comprising the highly integrated complex at Jamnagar, which is integrated with other manufacturing O2C assets

Flexibility to process a variety of feedstock including crude, condensate, naphtha, refinery off-gases, ethane/propane, vacuum gas oil and straight run fuel oil

Highly optimised operations across the entire value chain from crude selection, product yield management, logistics to product placement, leading to best-in-class profitability

Ability to manage impact of volatility in commodity prices and cash flows

World-class manufacturing facilities

Large global-scale manufacturing sites based on competitive technology and flexible design

Top quartile performance in costs, safety and operational excellence

Robust portfolio catering to growing consumption markets

One of the few companies globally with integration from oil to transportation fuels, polymers and elastomers, intermediates, and polyesters

Unparalleled logistics and supply chain network

Unmatched distribution footprint in India with multi-modal logistics

11,000+ customers for chemicals and materials across India

Retailing transportation fuels at 1,460+ outlets spread across India

Global competitiveness and leadership

World’s 3rd largest producer of paraxylene and among the world’s top ten producers of PP and PTA (Source: IHS Markit)

World’s largest integrated polyester producer and among the top 10 global producers of MEG (Source: PCI)

Strong project management capability

Track record of delivering world-class, large-scale projects

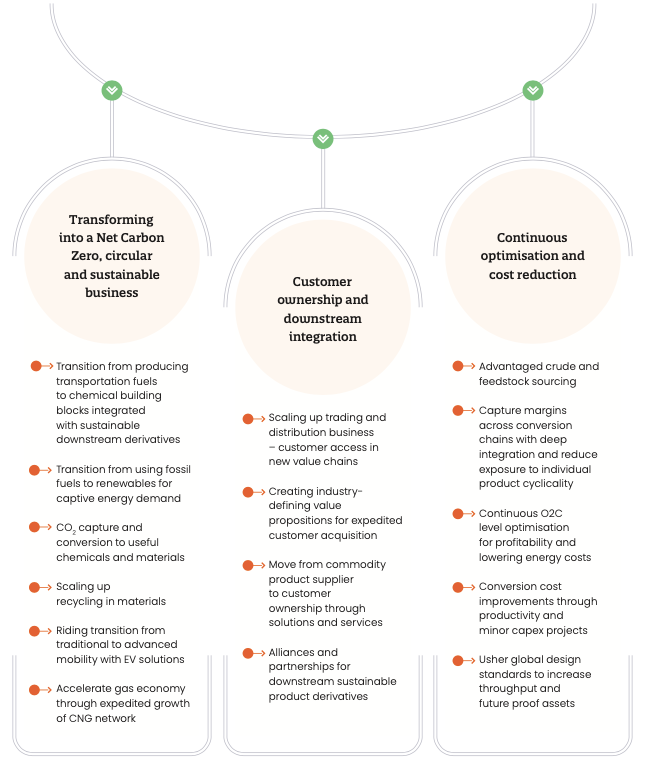

Operating Strategy

The key priorities of the O2C business are as under:

Highlights FY 2021-22

Operational performance

Delivered strong performance on the back of recovery in global demand

Secondary unit processing maximised with improvement in transportation fuel margins

Implemented Petrochemical Naphtha (PCN) quality upgrade to capture premium pricing

Optimised production of naphtha, gasoline and xylenes to capture best margins in changing market conditions

Achieved near full capacity utilization, despite COVID-19 related operational challenges

Processed 10 new crudes, widening feedstock sources including feedstock for Fluid Catalytic Cracking (FCC)

Fuel mix optimisation ensured minimum impact from higher LNG prices

Optimised light-feed cracking on favourable economics vis-a-vis naphtha

Sustainability

LLDPE received ‘Innovator of the Year’ award for RELCAT from Federation of Indian Petroleum Industries

Continue to develop a sustainable petrochemical business model by participating in India’s circular economy

Promoting circular economy & sustainability across the downstream through industry wide initiatives and various re-engineered materials

Focus on innovation to cater to customers’ requirements and national goal

Implementing digital platforms to enrich customer business experience

Transfer of gasification assets to Reliance Syngas to unlock value

In November 2021, the Board approved the transfer of RIL’s gasification assets to Reliance Syngas Limited (RSL) as a going concern on a slump sale basis for a lump sum consideration equal to the carrying value of the gasification assets as on the appointed date of the scheme of arrangement.

The gasification project at Jamnagar was set up with the objective of producing syngas to meet energy requirements and reduce the volitality in energy costs so as to enable cost-efficient production of olefins. Syngas is also used to produce hydrogen for consumption in the Jamnagar refinery.

As the Company progressively transitions to renewables as its primary source of energy, more syngas will become available for upgrading to high value chemicals, including C1 chemicals and hydrogen, thus sharply reducing the carbon footprint of the Jamnagar complex.

Going forward, RIL expects gasification assets such as syngas to be increasingly used as a platform for conversion to high value chemicals as opposed to a source of energy. Therefore, the nature of risk and returns for the gasification streams are likely to become distinct from those of the other businesses of the Company. In addition, the Company is exploring various opportunities to bring in strategic and other investors in RSL.

Industry Overview

FY 2021-22 was characterised by the recovery in global demand as a result of improved consumer sentiment, vaccination drive and the reopening of economies, leading to an increase in crude and petrochemicals prices. Global refinery operating rates also improved in line with the rising demand.

Crude Oil Demand and Supply

Demand in CY 2021 recovered sharply by 5.6 mb/d to 97.5 mb/d. In comparison, demand had fallen by 8.5 mb/d to 91.9 mb/d in CY 2020.

Robust global economic recovery, rising vaccination rates, easing social distancing measures and travel restrictions supported steady demand recovery in FY 2021-22. The demand recovery was further supported by gas to oil switching in the power sector following the energy crisis and high natural gas prices beginning October 2021. In the last week of February 2022, Russian Ukraine conflict began which led to high oil prices and volatility due to uncertainties in global oil supply. Prices rose above $100/bbl levels due to sanctions on Russia and expected disruption to Russian oil & product trade flows.

Global oil supply increased by 1.4 mb/d to 95.5 mb/d in CY 2021. Oil supply growth was mainly controlled by OPEC+ with a mandate to increase 400 kb/d of output each month from August 2021 to March 2022 in response to demand. OPEC supply was lower by 4.2 mb/d in CY 2020 but increased by 0.7 mb/d in CY 2021. Non- OPEC supply which fell by 2.6 mb/d in CY 2020 increased by 0.7 mb/d in CY 2021 mainly led by Russia. However, uncertainties to supply rose in March 2022 due to US, Canada sanctions on Russian oil imports in response to Russia-Ukraine conflict. This, together with self-imposed restrictions by private companies started to impact trade flows and regional supply.

In FY 2021-22, lower oil supply amid higher oil demand growth led to reduction in global crude inventories and oil market tightness.

Global refining operations

Global refinery crude throughput (mb/d)

| CY 2021 | CY 2020 | Change 2021 vs. 2020 | |

|---|---|---|---|

| OECD Americas | 17.8 | 16.6 | 1.2 |

| OECD Europe | 11.0 | 10.7 | 0.3 |

| China | 14.2 | 13.8 | 0.4 |

| Rest of the World | 34.8 | 33.7 | 1.1 |

| World Total | 77.8 | 74.8 | 3.0 |

Source: IEA

Global refinery throughputs increased steadily during FY 2021-22 on higher utilisation and new capacity additions to meet rising transportation and petrochemical demand. In CY 2021, refinery throughputs recovered by 3 mb/d after falling by 7.3 mb/d in CY 2020. Permanent refinery closures amounted to 2.8 mb/d till the end of 2021 mainly in the US, Europe and Asia.

Refining margins recovered strongly in FY 2021-22 as refinery throughputs lagged fuel demand recovery.

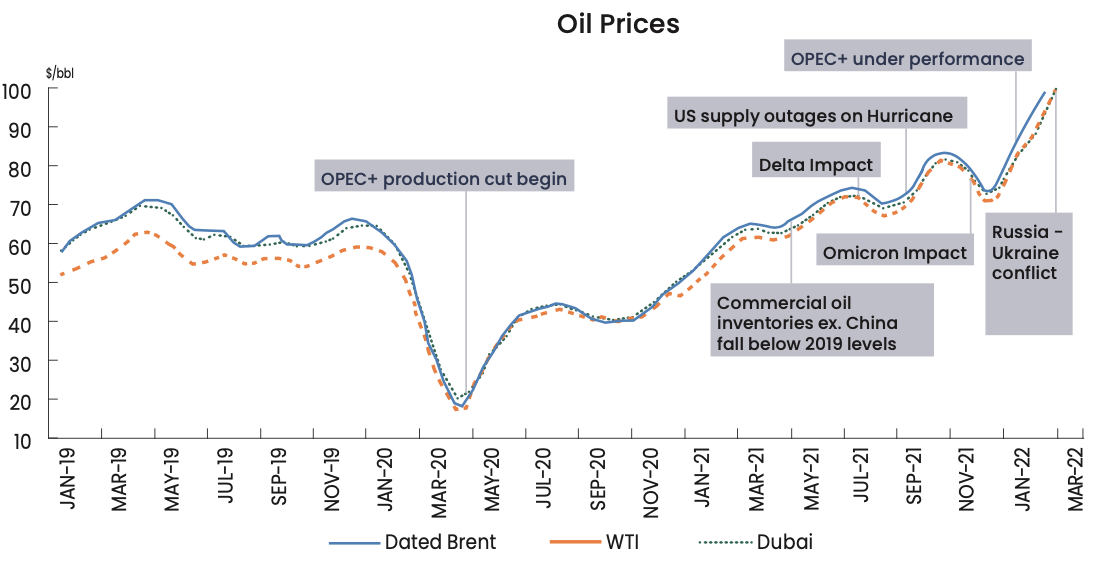

Crude Oil, LNG and Ethane Prices

CRUDE OIL PRICES

Source: Platts

Crude prices rose sharply in FY 2021-22 with Brent price reaching US$ 118.8/bbl in March 22 from US$ 64.7/bbl in April 2021. Oil prices rose in response to steady oil demand growth, continued oil supply management by OPEC+, falling global oil inventories and also geopolitical impacts such as Russia-Ukraine conflict.

In 2H 2021, US supply outages due to Hurricane Ida also supported oil prices despite the demand being impacted by COVID-19 variants like Delta.

The energy crisis, high natural gas prices, the failure of OPEC+ to meet its output targets and rising geopolitical tensions further propelled oil prices. Geopolitical risks with Russia-Ukraine conflict , the blockade in Libya and protests in Kazakhstan also contributed to the rise in oil prices in 2H FY 2021-22 in spite of the tapering of demand following the spread of the Omicron variant and China’s zero tolerance COVID-19 policy.

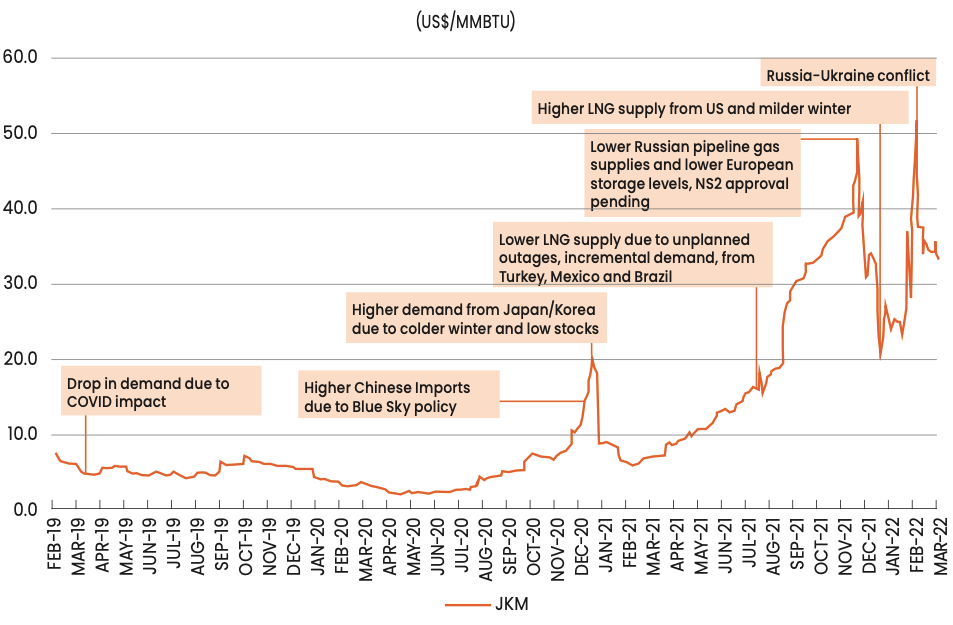

LNG PRICES

During the year, LNG prices were highly volatile, with Asian prices seeing a low of US$5.8/MMBtu in March 2021 and a high of US$51.7/MMBtu in March 2022, averaging at US$23.37/MMBtu in FY 2021-22. The uptick in price was due to demand recovery post-COVID, coupled with unplanned LNG outages, lower Russian pipeline gas flow into Europe and later invasion of Ukraine by Russia in February. The Company used various optimisation initiatives to minimise the impact of high energy prices.

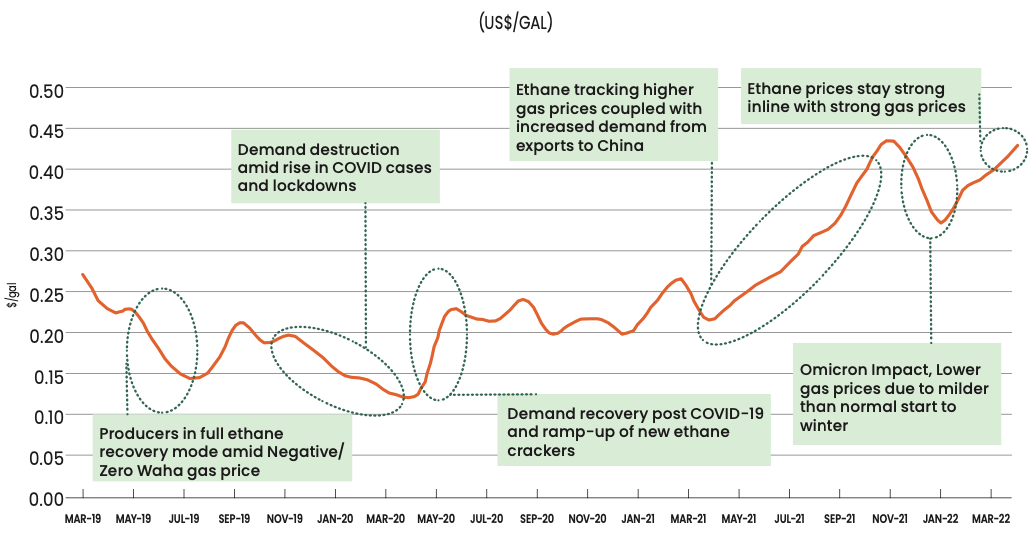

US ETHANE PRICES

During the year, ethane demand-supply growth was accelerated due to the addition of export facilities, delivery of new Very Large Ethane Carrier Ships (VLECS) and demand growth of the newly operational cracker in the US. Ethane prices in FY 2021-22 moved in tandem with that of natural gas for most of the time, and hence traded at highest-ever prices in the last four years at 46.8 US cents per gallon (cpg). This was owing to the surge in natural gas prices as a result of the supply scarcity and colder than expected winter. The average price of ethane for FY 2021-22 was 34.9 cpg. Despite relatively higher prices, ethane continued to be the preferred feedstock.

Tanker Freight

The crude tanker market continued weaker trend due to various factors, ranging from COVID-19, reduction in crude imports to China, OPEC cuts, increasing bunker prices to limited cargoes being quoted, weighed in on market sentiment. This also helped to lower overall crude cost.

Clean Tanker freight rate for shipping products remained at a 5-year low in FY 2021-22 as lockdown restrictions led to uncertainty and dampened sentiments. Ample new-built tanker availability also helped long-haul distillate market movements, keeping a lid on freight prices

Reliance has been proactively taking appropriate actions by taking optimal cover through time charters & COAs’ (Contract of Affreightment) to avoid freight volatilities and incurring additional cost to the refinery.

Transportation Fuels

Global Market Environment

Global gasoline demand recovered steadily in FY 2021-22 as a result of improving mobility and higher preference for personal vehicles. In CY 2021, demand recovered to above 96% of pre-pandemic level (CY 2019 levels) as restrictions on mobility were lifted gradually on rising vaccinations. Diesel demand recovery also continued in FY 2021-22 – on strong economic growth and rising industrial activity with demand reaching 98% of pre-pandemic level in CY 2021.

Jet fuel was the only fuel to remain significantly below pre-pandemic level with demand recovering to only 66% of CY 2019 levels in CY 2021 mainly due to sluggish recovery in business and international travel. However, demand was supported by countries which were opening up and easing international travel restrictions, following rising vaccination coverage and low impact from the Omicron COVID wave.

Domestic market environment

After the lows of FY 2020-21, Indian fuel demand bounced back in FY 2021-22. However, the growth was tempered by the second and third pandemic waves, which led to partial or total lockdown in stretches across the country during 1Q and 4Q respectively.

India Fuel Consumption Trend (exit quarter trend)

| Product (Mn MT) | 4Q FY 2019-20 | 4Q FY 2020-21 | 4Q FY 2021-22 |

|---|---|---|---|

| HSD (Gasoil) | 19.7 | 20.6 | 20.6 |

| MS (Gasoline) | 7.1 | 7.8 | 7.9 |

| ATF (Jet fuel) | 1.9 | 1.4 | 1.4 |

On the back of sustained economic activities, and the absence of a blanket nationwide lockdown, business growth was steady through the course of the year. India’s fuel demand grew by 7.8% and stood at 113 MMT. LPG demand too maintained an upward growth trajectory.

While inter-city highway traffic has maintained steady momentum, growth in intra-city travel has surged, as reflected in the consistently growing Motor Spirit (MS) sale. Despite muted growth in 1Q FY 2021-22 and some set back in 4Q, both gasoil and gasoline demand has grown steadily with the resurgence of road traffic. FY 2021-22, diesel demand increased by 5.5% and gasoline demand increased by 10.4% Y-o-Y. Exit industry volumes are already 4.2% higher than the pre-COVID average in FY 2019-20. The shift away from ride-sharing and limited availability of public transport (driven by lower bus frequency and curtailed rail movement) have increased preference for self-owned vehicles, which has supported this growth.

Reaching the end of their ongoing investment cycle, both state-owned oil marketing companies and private players have continued expanding their network, and taking the total number of retail outlets in India to over 83,000.

FY 2021-22 also emerged as the defining year for Indian Electric Vehicle (EV) industry. On the back of sustained policy push at both the central and state levels, increased options in the market and growing charging infrastructure, EV sales recorded a 218% growth over that in FY 2020-21. Even though the base is low, the industry is looking at convergence of charging infrastructure and retail outlets.

Rebounding from its worst ever year, India’s aviation industry, driven primarily by the domestic sector, grew strongly in the 2H FY 2021-22. Phased allowance from 70-100% capacity utilisation enabled airlines to ramp up steadily. ATF demand in FY 2021-22 grew 35% Y-o-Y.

Margins

Gasoline margins rose sharply to US$ 11.4/bbl in FY 2021-22 from US$ 3/ bbl in FY 2020-21, backed by steady demand recovery and improving mobility. Also, limited exports from China in 2H CY 2021 supported cracks.

Gasoil margins increased to US$ 12.3/bbl in FY 2021-22 from US$ 5.7/bbl in FY 2020-21, following steady demand growth supported by the strong economic recovery and rising industrial activity. However, gasoil margin gains were limited due to sluggish jet fuel demand recovery and persistently higher stocks during most of the year. Cracks were supported by lower gasoil exports from China, due to various policy changes like the imposition of higher taxes on blended fuels such as light cycle oil, tightening supervision on independent refiners, lower crude import and product export quotas in 2H CY 2021. Gasoil cracks rose strongly in March 2022 on disruptions to Russian diesel supply to Europe amid Russia-Ukraine conflict and trade sanctions on Russia.

Jet fuel cracks rose to US$ 9.1/bbl in FY 2021-22 from the unprecedented low of US$ 1.2/bbl in FY 2020-21. Jet fuel demand continued to recover, albeit slowly led by North America in FY 2021-22.

Asian cracks for transportation fuels

| $/bbl | FY 2021-22 | FY 2020-21 |

|---|---|---|

| Gasoline 92R | 11.4 | 3.0 |

| Jet | 9.1 | 1.2 |

| Gasoil 10 ppm | 12.3 | 5.7 |

Source: Platts

Global Cracker Operations

Global demand for ethylene grew 8% Y-o-Y to 179 MMT in CY 2021 from 166 MMT in CY 2020, while operating rates remained unchanged at 86%. New capacity addition for the year was 12 MMTA, in line with the demand growth.

Ethane and Naphtha Prices

Ethane average prices increased by 63% Y-o-Y to 34.9 cpg in FY 2021-22. While naphtha average prices in Asia were up by 82% Y-o-Y led by the rise of crude price, LNG supply crunch and related strength in energy prices.

Polymers and Elastomers

Global Market Environment

Global polymer demand – for polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC) – in CY 2021 was 253 MMT, registering an uptick of 4% on Y-o-Y basis. Global PP, PE and PVC demand grew by 5%, 4% and 4% respectively in CY 2021, led by Asia, especially China and India.

Growth in global demand for Styrene- Butadiene Rubber (E-SBR) was 4% and Polybutadiene Rubber (PBR) 6% in FY 2021-22 on the back of strong automotive sector demand. Global vehicles production recovered by 3% in CY 2021, and global vehicle sales recovery was 4%, despite various setbacks like semiconductor shortage, supply chain issues and low inventories.

Domestic Market Environment

PP domestic market demand grew by 16% on Y-o-Y basis on account of healthy demand from the health & hygiene sector, raffia and Biaxially Oriented Polypropylene (BOPP) packaging. PE demand also registered a growth of 4% on Y-o-Y basis, driven by e-commerce, FMCG and liquid packaging. PVC demand grew by 6% Y-o-Y, majorly driven by growth in construction activities and policy boost for several water and sewage pipeline projects.

Indian E-SBR demand grew by 7% in FY 2021-22 while demand for PBR was up by 5% for the year. The demand growth was supported by revival in passenger vehicle, commercial vehicle and replacement market.

Margin

Polymer prices strengthened during FY 2021-22 amidst global demand boost and regional supply shortages due to lower import availability amid container shortage. Global operating rate for PP and PE averaged 89% and 87% respectively during 2021, at par with pre-pandemic levels. Polymer margins weakened during the year amidst higher feedstock cost. Integrated PP-Naphtha and HDPE-Naphtha margins contracted by 17% . PVC margins weakened by 3% during the year.

Southeast Asia Polymer Margins

| (US$/MT) | FY 2021-22 | FY 2020-21 | % chg y-o-y |

|---|---|---|---|

| HDPE-Naphtha | 426 | 512 | -17 |

| PP-Naphtha | 529 | 637 | -17 |

| PP-Propylene | 235 | 193 | 22 |

| PVC-EDC-Naphtha | 569 | 584 | -3 |

| PBR-BD | 1126 | 727 | 55 |

| SBR-BD-Styrene | 1063 | 718 | 46 |

Source: Platts and ICIS

Intermediates and Polyesters

Global Market Environment

Global demand for Intermediates (MEG/PX/PTA) increased by 5% to 157 MMT in CY 2021 from 149 MMT in CY 2020. PX markets improved in the latter part of the year due to new downstream PTA capacity additions. PTA markets remained healthy and witnessed 7% overall annual growth, the demand went up despite rising inventory in the first half of the year. MEG demand was impacted due to intermittent disruption led by pandemic and energy crisis. Supply disruptions in the US led to tightening of China port inventories.

Polyester overall global demand improved by 7% at 85 MMT. Increase in vaccination rate and relatively lower restrictions across the world have helped improve the global demand for textiles and apparels. Global apparel market which shrunk in CY 2020 by 22% to US $ 1.3 trillion, has recovered by 16% in CY 2021 to US $ 1.5 trillion.

Domestic Market Environment

Domestic Intermediates demand improved by 32% on account of recovery in textile and polyester demand. Removal of restrictions and improvement in retail demand led to the recovery of the polyester downstream industry, which has shown resilience against repeated pandemic waves and volatility in raw material prices. Polyester downstream operating rates varied from stable to strong across the value chain barring an exceptional dip in April-May '21. Lower polyester imports on account of high ocean freights supported demand and margins.

Margins

Global economic recovery resulted in improved petrochemicals demand. In FY 2021-22, PX prices surged 61%, while PX-Naphtha margins firmed by 21% Y-o-Y, but it is well below 5-year average levels. In 3Q, the imposition of dual control policy in China, emergence of Omicron coupled with the start-up of large PX capacities (2x2.5 MMTPA) resulted in supply overhang and weak margins.

PTA markets in China remained oversupplied given the capacity addition of 8.6 MMTA, together with medium to high level market inventories. Global PTA operating rates remained around 79% in FY 2021-22. PTA prices followed crude oil price movements in FY 2021-22, with the margin on PX improving gradually from H1 with the decrease in China inventory. Overall, in FY 2021-22, PTA prices surged 56% while PTA-PX margins firmed up by 43% Y-o-Y.

MEG margins were under pressure due to oversupply and lower operating rates. MEG prices surged 36% and MEG-Naphtha margins softened by 12% Y-o-Y owing to high feedstock prices.

PET markets witnessed an unprecedented trend during the year. Global PET supplies tightened due to plant shutdown in the US and Europe during the pandemic, leading to a surge in PET prices by 43%, however margins firmed up by 11% Y-o-Y constrained by high feedstock prices.

Intermediates and Polyester Margin Trends

| (US$/MT) | FY 2021-22 | FY 2020-21 | % chg y-o-y |

|---|---|---|---|

| PX- Naphtha | 207 | 172 | 21 |

| PTA-PX | 224 | 157 | 43 |

| MEG-Naphtha | 203 | 232 | -12 |

| POY-PTA & MEG | 195 | 203 | -4 |

| PSF-PTA & MEG | 43 | 150 | -71 |

| PET- PTA & MEG | 161 | 146 | 11 |

Source: Platts, ICIS, CCF Group

Business performance

Production Meant for Sale

(in MMT)

| Particulars | Products | FY 2021-22 | FY 2020-21 |

|---|---|---|---|

| Transportation Fuels |

|

|

|

| Polymers and Elastomers |

|

|

|

| Intermediates and Polyesters |

|

|

|

| Others | Fuels, Solids and Others | 10.9 | 9.7 |

| Total | 68.2 | 63.6 |

Overall production meant for sale increased from 63.6 MMT to 68.2 MMT. Most of the increase came from transportation fuels due to increase in global demand. RIL's agile business operations with its ability to optimise feedstock has helped to run downstream plants at full throughput.

Transportation Fuels

In FY 2021-22, RIL remained among the largest producers of transportation fuels, exporting 34.7 MMT of products across the globe.

RIL can also produce a large variety of grades to meet international market requirements of European countries, Africa, East Asia including Australia and the US market which has the most stringent specifications. The Company is well recognised as a trusted supplier of high-quality transportation fuels with zero cases of quality and quantity disputes. RIL has a competitive advantage as it operates through one of the most modern and efficient ports – Jamnagar. The Company marketed 15 MMT of products in the domestic market in FY 2021-22.

RIL continues to leverage its strong highway presence and rapidly growing intra-city footprint to move towards its target of covering over 90% freight load on Indian roads despite having a significantly lower outlet count compared to its competition. It has worked towards establishing gasoil customer ownership by strengthening its industry leading fleet program (Transconnect) to target fleet customers and continuing to augment on-demand fuel delivery to target non-transport/off-road segment. Network push, higher share of fleet volumes, industry defining technology and strong Q&Q (Quality and Quantity) focus have contributed to the significantly higher per outlet throughput for RIL.

HSD B2B Business

In FY 2021-22, bulk diesel industry volumes grew by 10.2% on Y-o-Y basis though it was 13.5% lower than pre-pandemic level. Cementing its presence across geographies, RIL continued to outperform the industry, achieving a growth of 13.2% on Y-o-Y basis and much lower decline of 2.1% of pre-pandemic level with market share of 9.4%. Building on its strong customer connect, RIL’s O2C business has further strengthened its relationship across customer segments. The Company continues to pursue profitable growth opportunities in infrastructure, construction and the mining segment, providing healthy returns.

Petroleum Retail Business

Reliance BP Mobility Limited (RBML), operating under brand Jio-bp, a 51:49 joint venture of RIL and bp, with a network presence of 1,460 outlets and customer trust in its proposition, recovered 100% of its pre-pandemic gasoline and gasoil volumes.

Working on its commitment towards reducing industry pilferage and encouraging safe practices, Jio- bp has further strengthened its leadership position in on-demand fuel delivery, operating under brand Jio-bp fuel4u. With ~1,200 sites, Jio-bp commands leadership in market share, successfully ushering in channel innovation that has redefined the range of a retail outlet. With ~50 mobile dispensing units and ~44,000 packed containers, Jio-bp supported the functioning of mobile towers, agriculture, hospitals and other critical facilities during the peak of the pandemic and floods.

Building on the first phase, Jio-bp outlets and mobile dispensing units delivered over 2.2 million litres of free fuel for 56,500 notified emergency response vehicles during the second wave of the pandemic.

Aviation Turbine Fuel (ATF) Business

With the domestic aviation industry recovering steadily, Jio-bp (operating under air-bpJio) has registered an annualised volume growth of 19% over industry, staying ahead of competition and reinforcing customer trust.

Downstream Chemicals

RIL maintained steady polymer production with reliable operations across sites. It maintained operating rates higher than its peers based on the market scenario by leveraging global supply chain. This was achieved by leveraging high level of integration from feedstock to finished goods, strong global business networks, multi-modal logistics capabilities and enhanced digital capability with all stakeholders in the value chain. RIL maintained its market share in both polymer and polyester market. As RIL continued to explore new products and market segments, the integrated O2C business model helps optimise feedstock to run downstream plants at full capacity.

Moving towards being the ‘Preferred Provider’ for all mobility solutions in India

Operating under the brand Jio- bp, RBML launched its first Jio-bp branded Mobility Station at Navde, Navi Mumbai, Maharashtra. Jio-bp Mobility Stations bring together a range of services, including additivated fuel, multiple fuelling choices and convenience for consumers on the move.

Operating strategy

- Bring in best-in-class global fueling experience to Indian consumers through technology-enabled unique Customer Value Proposition (CVP)

- Take on a leadership role in EV infrastructure by proactively offering upcoming technologies and operating models

- Deploynext-generation technologies for automation- led operational and process efficiency

Towards realising the Net Carbon Zero ambitions of RIL, Jio-bp is working on the twin targets of becoming a leading EV charging infrastructure provider and building a CNG network in the country.

Having built the first on-the-go charging station, first cluster charging station, first fleet charging hub, launch of charging app and many other firsts during the last financial year, Jio- bp now has over 300 charging and swapping points across the country.

Jio-bp has also announced partnerships with some of the key players such as OEMs, last mile delivery players etc. to collaborate on increasing EV penetration and make EV charging and swapping convenient for customers.

It has partnered with several CGD companies during the year for establishing CNG facilities for its customers at RBML Mobility stations. In spite of the pandemic-led constraints, Jio-bp has gone full throttle towards ramping up the pipeline for future growth of under- construction outlets. Both the new outlets and the existing network of over 1,460 fuel pumps will be rebranded as Jio-bp over the next few years. Fuel, convenience (with embedded wild bean cafe) and express oil change offering are gaining strong traction at the fuel forecourt.

5,500 outlets

Proposed network post

expansion

1,460 outlets

In the Jio-bp network

Strategic Priorities and Way Forward

Diversified feedstock sourcing, minimising feedstock cost

Progress in FY 2021-22

- Increased crude oil sourcing from the Americas to capture arbitrage opportunity

- 10 new crude/SRFO grades processed during the year, widening crude sourcing

- Widening of supplemental feedstock sourcing options for FCC and Coker to minimise cost

- Advantageous Ethane feedstock sourcing from USA for optimised cracker operation

Medium-term priorities

- Explore strategic terming of advantage feedstock

- Debottlenecking crude processing constraints in CDU for improved sourcing

- Debottlenecking FCC supplemental feed processing constraints

- Increase production of EDC to reduce import dependence. Maximise Ethane sourcing to optimise feedstock cost

Improved product netbacks with wider market reach and quality upgrade

Progress in FY 2021-22

- Diversified product supply to South America / West Africa on delivered basis improving netbacks

- Implementation of PCN quality upgrade for improved product placement flexibility and premiums

- Oxyfree and Ethanol Blend Motor Spirit (EBMS) gasoline production for domestic market compliance

- Focus on increasing LDPE domestic sales

- Successfully established grades in Caps and Closure segment

- Focus on optimising ethylene derivative value between Ethylene Oxide and Monoethylene Glycol. Increased focus on specialty polyester products

Medium-term priorities

- Production of niche fuel / petrochemical grades for improved product netbacks

- Invest in new materials while maximising product netbacks

- Strengthening further market share of PP grades namely in ICP/RCP/Fibre-Filaments.

- Focus on increasing PP sales to further promote value-added exports of Woven Sacks & FIBCs by RIL downstream customers.

- Complete import substitution of domestic LDPE capacity

- Increase tie-up with global PVC suppliers to further augment domestic sales

- Optimising product mix to maximise Ethylene Oxide over Monoethylene Glycol

- Improving product and end segment mix by targeting the growth in differentiated and specialty polyester products through downstream value chain

Asset sweating and operating cost minimisation

Progress in FY 2021-22

- Near 100% utilisation of O2C assets with improved demand recovery

- Eliminated high-cost spot LNG procurement exploiting in-house fuel flexibility

- In-house catalyst development for LLDPE to minimise cost

Medium-term priorities

- Low-cost debottlenecking of existing assets for petrochemical capacity enhancement

- In-house technology development for O2C transition sustaining market advantage

- Ensure sustainability through circular economy and transition to renewable power and green hydrogen

Digital transformation

Progress in FY 2021-22

- Industrial Internet of Things (IIoT) for Algae to oil R&D initiatives

- Machine Learning (ML) for improved gasifier reliability and efficiency

- Uber4Oil (on-demand door step delivery of diesel through app) for fuel retail business in Jio-bp

- Video analytics for remote service standard and safety management at Jio-bp

- Aligning and digitising the business services against three value streams namely Revenue & Channel, Business Ownership and Product Ownership

Medium-term priorities

- Process digital twins’ development for critical process units for improved process efficiency, safety and reliability

- ML for predicting equipment failures / catalyst performance minimising unplanned downtime

- Leveraging AI/ML for O2C business profitability improvement

- Prioritising the collaborative processes for enhancing the customer experience through further automation

Sustainability and transition to Net Zero

Progress in FY 2021-22

- Bio-mass utilisation in Circulating Fludized Bed Combustion (CFBC) boilers at Hazira and Dahej, minimising carbon footprint

- Transition to low carbon intensity fuel to minimise carbon footprint

- New exclusive toll manufacturing business model to promote entrepreneurship in recycling

- Green polyolefin products - EcoRepol™ (green Polypropylene) and EcoRelene™ (green Polyethylene) trials for various applications

- Commercial Continuous Catalytic Pyrolysis Oil technology trial plant set up. Final product to be taken to refinery/crackers for producing circular polymers through mass balance attribution approach

Medium-term priorities

- Transition to renewable power for O2C assets

- Bio-mass gasification

- CO2 capture for mineralisation or chemicals

- Commissioning of new Toll manufacturing plant at Andhra Pradesh to produce Recycled Polyester Staple Fibre and ramping up recycling capacity to 5 billion bottles per year

- Develop green polyolefin product portfolio and ramping up capacities to deliver application specific green products

- Scale up chemical recycling technology to promote plastic circularity

Continuous domestic transportation fuel sales volume push

Progress in FY 2021-22

- Reinforced fleet management program to consolidate position in highway segment

- Grew network of mobile dispensing units (MDU) and packed fuel containers (PFC)

- Ramped up prospect pipeline & OTP pace for under-construction outlets

Medium-term priorities

- Leverage network growth to garner larger share of fleet customer volume

- Leverage technology and expedite rollout to sustain market leadership in mobile fuelling

- Work aggressively towards proposed network growth to 5,500 outlets

Build and establish Jio-bp brand

Progress in FY 2021-22

- Launched Mobility Station with array of new customer value propositions

- Initiated network-wide rebranding exercise for existing outlets, AFS & tank-trucks

Medium-term priorities

- Country-wide brand launch combined with accelerated re-branding exercise

- Expedited network footprint of all new customer value propositions launched

Foray into advanced mobility (EV charging and CNG)

Progress in FY 2021-22

- Launch of multi-format electric vehicle charging and battery swap units

- Tie-up with leading gas distributors, demand aggregators, technology providers and OEMs

Medium-term priorities

- Ramp-up country wide footprint of EV charging network

- Evolve technologies and operating model to stay abreast with the EV industry

- Build CNG network alongside evaluating co-location with existing RBML outlets

Leadership in Adopting Circular Economy in India

Circular polymers

RIL is developing commercial scale continuous catalytic pyrolysis technology. The process has been successfully demonstrated at pilot scale. This can convert unsegregated mixed waste plastics into Pyrolysis Oil, which will be processed at the refinery. Credits can be attributed to various petrochemicals as per International Sustainability and Carbon Credit (ISCC) plus mass balance certification to create circular products. These products are in demand from multinationals to fulfil statutory requirements and keep their commitment to plastic circularity. We plan to scale up this production to promote plastic circularity.

R|Elan™ Fabric 2.0

Promoting circularity and wellness sustainably

Through the reporting year, R|ElanTM built upon its long-term sustainability commitment and undertook innovative, solution-oriented initiatives. These included Season 3 of its Circular Design Challenge, 3rd edition of #EarthTEE activation, launch of new sustainable products and digital campaigns in collaboration with its downstream customers and partners to promote sustainable, circular fashion.

Circular Design Challenge 3.0 – India’s largest sustainable fashion award

In FY 2021-22, for the third time in a row, R|ElanTM Fashion for Earth presented the Circular Design Challenge in partnership with United Nations Environment Programme at the FDCI X Lakme Fashion Week. This edition brought greater recognition of the R|ElanTM Award for excellence in circularity to one of the finalists, Ashita Singhal of Paiwand, for outstanding innovation in circular fashion.

Showcasing sustainable fabrics via Designer Showcase at Lakme Fashion Week

To promote sustainable fashion and to make circular fashion aspirational, R|ElanTM collaborated with several fashion designers and influencers through the year, including Payal Singhal and the designer duo, Abraham & Thakore. For the Winter Fashion event at Lakme Fashion Week, R|ElanTM presented an exclusive collection titled ‘Assemble, Disassemble & Reassemble’ made with R|ElanTM GreenGold -– a next-gen eco-friendly fabric, made with 100% recycled post-consumer PET bottles.

“I can’t tell you how difficult it is to tear myself away from my infant son. But it is work like this that pulls me. I also know it is work like this that will keep my son’s future safe.”

Dia Mirza,

UNEP Goodwill Ambassador

Making sustainability cool through EarthTEE 3

Launched on World Environment Day 2018, the #EarthTee, a t-shirt designed in collaboration with Anita Dongre from recycled PET bottles, strove to make sustainability fashionable in collaboration with fashion celebrities and influencers.

New innovative fabric launches

R|ElanTM fabric 2.0 launched a range of three fabric collections that combine the goodness of R|ElanTM GreenGold with three other technologies that is ‘Good on you. Good for your soul, and Great for the planet’.

R|ElanTM EcoGold with Ciclo

Within the Sustainability category of R|ElanTM, a new product introduced this year was R|ElanTM Ecogold with Ciclo. One of the most environment- friendly fabrics, it enables sustainable fashion across different applications. This innovative fabric helps to reduce the impact of unrecycled textiles on the environment.

#RestoreWithRElan

RIL highlighed the importance of recycling and circularity through ongoing campaigns on important days like the World Environment Day, Earth Day and others. Beginning on the World Environment Day, RIL ran a number of interactive campaigns to create awareness, stressing on the fact that the fashion we choose, and our ecosystems are inter-linked. Inviting everyone to learn how to #RestoreWithRElan on World Environment Day, RIL urged the audience to share images/videos of their initiatives that can help restore the ecosystem.

Impact

Driven by our B2B2C marketing concept, R|ElanTM GreenGold continuously engaged with end consumers on social media through digital posts, stories, videos and reels that promoted sustainability. During the year, such communications reached millions of users on Instagram and Facebook. There has been a major increase in engagement with the content and our co-brand partners have reported significant uptake in the demand for sustainable products and fashion collections made from Reliance’s Sustainable materials.

Scaling up Digital Platforms to Enrich Customer Experience

RIL implemented several new digital initiatives to ensure seamless execution of business in the virtual working environment.

Ensuring Information Readiness for Resilient Refinery Planning

The digital initiatives across planning and optimisation platform modules allow management of supply and demand volatility and the price risk. The digitisation of all inputs required for rolling plan has ensured faster response for disruption management and sensitivity analysis. Platform has improved risk assessment processes and also enabled auto price forecasting based on forward curve.

Domestic Vessels Replenishment Planning and Scheduling

Coastal replenishment is one of the key modes in Domestic Bulk S&D business for PAN India distribution. Products are needed to be placed across all coastal terminals on the East and West coasts to meet needs of the Retail network, Direct and other manufacturing companies / PSU.

An integrated optimisation module has been implemented enabling the following key benefits to business.

- Product placement at all coastal locations with optimal distribution cost

- Optimisation of operational metrics like tankage hiring cost, lead time, inventory levels and vessel utilisation etc.

- Improved visibility and disruption management by integrating data pertaining to future demand, inventory positions, and voyages

Business Operations Center

Business Operations Center has been set up for close monitoring and control of Trading and Mid office business processes. The centre provides:

- Near real time view of transaction workflow and operating parameters

- Specific actions against role holders on immediate and upcoming schedule basis

- Capability to track and monitor contract specific events and validate system details for contract execution

- Functionality to initiate actions, generate system exceptions and escalations, eliminating manual effort and smooth operations avoiding last minute issues/ decisions

The historical process data will also help in streamlining activities, identifying bottlenecks and performance of activity Service Level Agreements (SLAs) on an ongoing basis, thereby driving process efficiencies.

Port Operations Platform

Port operations platform has been deployed on latest open source based technology with enhanced features. It will facilitate:

- Vessel nomination, acceptance, invoicing of services, at Sikka and GCPL port facilities

- Visibility to the Operations and Scheduling team for better control of activities, minimising potential demurrage

- The historical data from the system will also help in identifying process and capacity bottlenecks for optimisation

Digital Experience for Customers/Agents

- Credit control management platform to improve order execution lead time and risk management

- R-collection platform integrated with RIL systems for instant limit enhancement and utilisation

- Transporter nomination facility for touchless and paperless order execution

- Export document tracking platform for live visibility and timely cargo clearance

- Reinforced on-demand HSD delivery offer to customer’s doorstep by ensuring 100% visibility from order to delivery for retail fuel customers

Analytics for Process Optimisation

- SCM Spend Analytics covering warehousing, shipping, multimodal and chartering

- Business analytical and visualisation platforms to enhance the decision making process

- Trade flow information platform to increase business sustainability

- Marine insurance management platform to optimise export cargo lifecycle management cost

- Rolled out next-gen retina and face scanning system for remote monitoring of attendance, mask compliance and body temperature of outlet staff

- Deploying drone technology and smart CCTV analytics for progress measurement / safety of retail outlets under construction

Supply Chain Management: Saving human lives and delivering sustained value for stakeholders

The second wave of COVID-19 in 1Q FY 2021-22 led to a national crisis over medical oxygen and created a challenging logistics landscape. RIL responded to this national emergency by building new facilities in its plants for medical oxygen and importing oxygen in ISO containers from all over the world through emergency airlift operations with the help of the Indian Air Force. Simultaneously, multimodal logistics solutions were established to deliver medical oxygen to various hospitals across the country in the shortest possible time, thereby saving human lives.

Apart from the crisis in shipping containers, port operations were affected globally , and port congestion hit an all-time high, creating challenges in vessel schedules reliability, labour management and so on. The resulting demand-supply gap led to a multi-fold increase in shipping freight in H1 FY 2021-22.

To ensure optimum supply chain cost, RIL swiftly implemented long-term supply chain cost planning, flexible multimodal transportation solutions and digital monitoring of movement across the entire supply chain. Long- term contracts with shipping line partners and organised extra-loader ships to manage large volumes in global exports. This approach has helped to retain market share and business margins . During this time, the Company supported all stakeholders in the SCM value chain for vaccinations, treatments, and timely financial support.

Bio-Degradable & Compostable Polybutylene Adipate Terephthalate (PBAT) Process & Composites: Niche Applications for Packaging & Agriculture Sectors

RIL has developed and scaled up to pilot a novel process for PBAT. Different grades with varied melt viscosities showed good performance in terms of physical and mechanical properties. The developed grades were also compounded with various fillers for ease of downstream processing and enhancing product properties required for applications in flexible as well as rigid packaging, agriculture mulch films, among others.

Novel bio-compostable net-bags have been developed through a net- extrusion process using PBAT polymer blends / composites. The process optimisation and development have been carried out on conventional downstream machines with high output and minimal loss of material in processing. It offered a cost competitive product for a green packaging solution for the fruit & vegetable (F&V) sector. The developed net-bags are easy and convenient to use and have good weight carrying capacity. These net-bags are ideal for leafy vegetables, as they maintain freshness for longer time. This development is important in view of replacement of single-use plastic by sustainable materials. Further, the R&D team is working on different variants of net-bags for different weight carrying capacity to target applications other than F&V.

Puncture-proof Tire Inner Liner: Sealant Elastomer Development

RIL has developed a new generation of air impermeable functional polymer. By preventing tyre punctures, it will ensure more safety for vehicles on the move. This product will add value to next-gen EV vehicles and contribute to net carbon zero economy.

‘Shop’ with Embedded WBC Offering: Redefining Fuel Forecourt Retailing

To ensure standard, consistent and quality on-the-move food and beverage experience, Jio-bp has launched 'Shop' with embedded WBC offering at its mobility stations.

This has brought international on-the- move brand Wild Bean café (WBC) to India, built over the country-wide supply chain of Reliance Retail for compelling daily need offers and created locally curated delicacies through own chef.

Ensuring 100% Fuel Additivation: A New Normal for Indian Fuel Standards

Using over six unique operating and infrastructure models across its 40+ supply terminals, Jio-bp has built world-class bespoke products developed in globally acclaimed laboratories, invested in state-of the-art technology and built a country-wide additive supply logistics network from scratch.

By additivating every single drop of fuel, Jio-bp is providing international quality fuel to Indian customers at no extra cost.

Jio-bp Pulse Fleet Charging Hub: Leading from the Front in EV Transition

Jio-bp has developed its own Jio-bp pulse charge app and set up couple of India's largest charging hubs (85+ and 120+ charging points) in Delhi NCR with Blusmart as our primary customer. The hub allows ease of self-charging for those taking to EVs. A mix of slow and fast chargers cater to the specific needs of vehicles. The steady state site is already registering over 250 charging sessions per day.

Express Oil Change: Redefining 2W Oil Change Industry

RIL has ensured peace of mind for millions of India’s two-wheeler users through its latest innovation in partnership with leading lubricants major- Castrol. They can now have free vehicle health check-up and free oil-change service as well as the service of professionally trained experts to assess their vehicles. This customer ease can be expected to create a renewed push for lubricant and gasoline sales.

Outlook

Global downstream demand is likely to

improve amidst easing

of COVID-19 restrictions, improvement in mobility, consumer sentiments and large economic stimulus programmes worldwide. The momentum in transportation fuel is also likely to pick up pace as the global economy returns to pre-COVID level. Polymer demand is expected to be strong, driven mainly by the growth in healthcare,

e-commerce, packaging, durables, auto and infrastructure segments. Growth in the downstream polyester chain market

is also expected to

remain steady, making it possible to achieve higher operating rates. Although post-pandemic reopening of global economy is expected to provide further demand growth, however rising inflationary pressures due to ongoing geopolitical events and fears around economic slowdown could impact near-term demand outlook.