The key focus of the E&P business has been the health and safety of its people and assets during the pandemic while ensuring timely project delivery, safe and reliable operations and ramping up the new fields to peak production.

With the commissioning of R Cluster and Satellite Cluster Fields in December 2020 and April 2021 respectively, production has been ramped up to 18 MMSCMD gas.

Following the expected commissioning of MJ Field in

3Q FY 2023, the KG D6 block

will produce

>1 BCFe/day by

FY 2023-24, thereby contributing ~30% of India’s gas production and helping meet ~20% of India’s demand. This will significantly reduce the country’s dependence on imported gas and meet

the growing clean energy requirements of the nation.

The focus of the E&P business has been on safeguarding

health and safety of the people and assets while

simultaneously augmenting gas production.

Despite continuing pandemic challenges, the Satellite Cluster deepwater fields were successfully commissioned in April 2021. It is another significant milestone in India’s energy landscape and showcases Reliance’s continued commitment in the journey towards a greener gas-based economy.

Industry recognition R Cluster field development awarded ‘Best Managed Project of the Year’ and 'Special award for significant increase in gas production' by Federation of Indian Petroleum Industry (FIPI)

Zero LTI

in offshore installation campaign

Production ramped up to 18 MMSCMD, contributing ~ 20% of India’s domestic gas production

Satellite Cluster commissioned in April 2021, two months ahead of plan despite COVID-19 challenges

Vision

To be a major contributor to India’s Gas based economy supplying ~30% of India’s production.

Mission

Our mission is to maximise stakeholders’ value by finding, producing and marketing hydrocarbons and to provide sustainable growth while catering to the needs of customers, partners, employees and the local communities in which we do business. We will conduct our business in a manner that protects the environment as well as the health and safety of our employees, contractors and the local communities in which we do business.

Strategic Advantages and Competitive Strengths

India’s leading deepwater E&P operator with best-in-class safety and reliability track record

Partnership with bp synergising RIL’s project execution and operations with bp’s global E&P knowledge

World-class deepwater hub infrastructure in the East Coast

~3 TCFe resources in Block KG D6

Exploration underway in the proven geological fairways of the contiguous Block KG UDW1

Gas-based portfolio contributing to India’s transition towards clean energy

Performance Summary

REVENUE

(` IN CRORE)

EBITDA

(` IN CRORE)

PRODUCTION (RIL’S SHARE)

(BCFe)

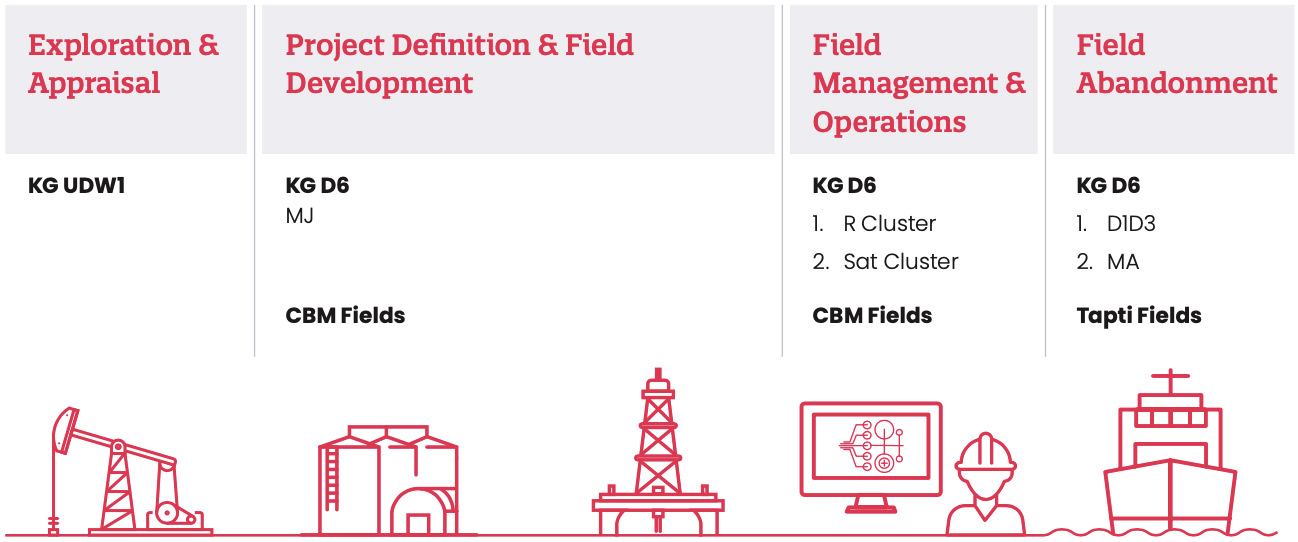

E&P Asset Life Cycle and Portfolio

E&P Portfolio

| Block | Country | Partner | RIL Stake | JV Acreage (acres) |

Status |

|---|---|---|---|---|---|

| Conventional | |||||

| KG-DWN-98/3 | India | bp–33.33% | 66.67% | 2,90,230 | R Cluster Field: Producing from December 2020 Satellite Cluster: Producing from April 2021 MJ Field: Development activities underway |

| NEC-OSN-97/2 | India | bp–33.33% | 66.67% | 2,05,520 | FDP submitted; under review with GoI |

| KG-UDWHP-2018/1 | India | bp–40.00% | 60.00% | 3,74,093 | Exploration activities ongoing |

| Unconventional | |||||

| SP(East)- CBM-2001/1 | India | – | 100.00% | 1,22,317 | Development ongoing |

| SP(West)-CBM-2001/1 | India | – | 100.00% | 1,23,552 | Producing |

Industry Overview

Global oil demand rebounded in CY 2021, as the global economy began to recover from the impact of the COVID-19 pandemic. However, global oil production increased slower than demand, driving up prices. The production shortfall was mainly due to OPEC+ production cuts that started in late 2020. During 4Q CY 2021, global demand increased sharply by 1.1 MMBD to 99 MMBD. This resulted in withdrawals from global petroleum inventories that averaged 1.4 MMBD in 2021, leading to higher crude oil prices.

Average annual price of Brent crude oil climbed to US$ 70.7/bbl in 2021, ~US$ 30 more than the CY 2020 annual average and highest in the past three years. West Texas Intermediate (WTI) crude oil averaged US$ 3/bbl below Brent in 2021. With an outbreak of conflict in Europe, Brent prices rose sharply to above $110/ bbl levels, reaching as high as $130/ bbl in March'22.

Global gas consumption increased by 4.6% in 2021 to ~3.8 TCM, more than double the decline seen in 2020, driven by the economic recovery and successive extreme weather events. Insufficient supply coupled with unexpected outages led to tight markets and steep price increases. The year closed with record high spot prices in Europe and Asia, as natural gas supply remained very tight. Henry Hub prices almost doubled from their 2020 levels to average US$ 3.9/MMBtu, the highest since 2014. Asian LNG spot prices rose more than four-fold to US$ 18/MMBtu with a 4Q average of over US$ 35/ MMBtu. Record high prices led to dampening of demand growth in the second half of 2021.

Emerging Trends and Business Response

Clean energy

Concerns over greenhouse gas (GHG) emissions have heightened global focus on green energy to mitigate the industry’s environmental impact

How RIL E&P is geared up?

At RIL, the focus is on building a gas-based portfolio. Being a cleaner fuel, gas is seen as a transition fuel to green energy

Brownfield developments

In these challenging times, when prices for oil and gas are volatile, companies are focusing on brownfield developments to improve commerciality

The Company is leveraging its existing infrastructure in the KG Basin to develop three projects in Block KG D6 and is undertaking exploration in contiguous areas. Two of the fields, R Cluster and Satellite Cluster, have been commissioned and production is being ramped up

Digital technologies

Accelerated adoption of new technologies as a result of the COVID-19 pandemic, which has reinforced the importance for improved efficiencies

Always at the forefront in the adoption of the latest technologies, RIL is further enhancing its capabilities through Digital Twin, Autonomous Fields, Virtual Command Centres and other cutting-edge technologies

Business Performance

Production

| JV production | Unit of Measurement | FY 2021-22 | FY 2020-21 |

|---|---|---|---|

| KG D6 | |||

| Gas | BCF | 224.3 | 24.0 |

| Oil | MMBL | 0.2 | - |

| CBM | |||

| Gas | BCF | 10.2 | 11.8 |

KG D6

With ramp up of gas production from R Cluster and Satellite Cluster Fields, E&P's operating performance improved due to incremental production and higher gas price realisation across the producing assets, leading to higher Revenue and EBITDA.

The D1-D3 and MA fields in the KG D6 Block produced ~3 TCFe of gas, oil and condensate, which have set global benchmarks in operational performance and excellence during their operations over the years. These existing facilities have been made future ready for the next 20 years through necessary upgradations made before production start-up from R Cluster and Satellite Cluster fields. The three integrated projects – R Cluster, Satellite Cluster and MJ – are leveraging the hub infrastructure in place by utilising existing production facilities and thus reducing costs. At the onshore terminal, RIL is undertaking augmentation of Monoethylene Glycol (MEG) regeneration and reclamation, and associated facilities.

KG D6 Deepwater Production Update

R Cluster Field was commissioned successfully in December 2020 and achieved peak production of 12.9 MMSCMD with six wells. Satellite Cluster Field was commissioned in April 2021, two months ahead of schedule. All five wells have been opened, tested and ramped up, achieving a peak production of 6.1 MMSCMD. Together, the fields are currently producing ~18 MMSCMD, and contributing substantially to domestic production.

KG D6 MJ Deepwater Development Update

Phase 1 drilling and installation of Xmas Trees for all 8 wells have been completed. Phase-2 drilling and completion activity has commenced in July 2022. The second and final installation campaign has commenced in December 2021. All subsea structures (Manifolds), 24” rigid pipeline and Turret Mooring System (TMS) buoy, along with mooring lines, have been installed.

For the Floating Production Storage & Offloading (FPSO) vessel , hull construction has been completed. All topside modules have been fabricated and erected on the hull.

Geostationary and Swivel modules have been installed. Pre-commissioning and commissioning activities have commenced. Reliance expects to commission MJ Field in 3Q FY 2023.

Abandonment

The D1D3 Field ceased production in February 2020, following which the Oil Industry Safety Directorate (OISD) and Management Committee (MC) have approved the permanent Plug & Abandonment (P&A) of wells and in-situ abandonment of the associated equipment.

Following cessation of production in MA Field, freeing flexible flowlines of hydrocarbons and the flushing of umbilicals were completed, and the floating production storage and offloading (FPSO) unit was demobilised. The flexible flowlines, dynamic flexibles, dynamic umbilicals, subsea structures, mooring lines and the Submerged Turret Production (STP) buoy were decommissioned in accordance with the Field Decommissioning Plan, which was approved by the OISD and the MC. Well P&A has been completed for all MA wells.

Exploration strategy

RIL and its partner bp acquired Block KGUDWHP-2018/ (KG-UDW1) under the OALP II licensing round. The Petroleum Exploration License (PEL) was issued in August 2019, with 341 days’ extension of the Initial Exploration Phase granted in 2021. Despite the pandemic and related challenges and constraints, the 3D Seismic Acquisition campaign was completed in the Block. Currently, Data Processing and Interpretation work is ongoing for prospect maturation, with a plan to drill the first exploration well in 2023.

Business Performance

Coal Bed Methane (CBM)

RIL is currently producing Coal Bed Methane (CBM) from Block SP (West)– CBM–2001/1. More than 300 wells are in production, with an average output of 0.73 MMSCMD gas during the year. To sustain plateau production, CBM development is being undertaken in Blocks SP (West)–CBM–2001/1 and SP (East)–CBM–2001/1.

Reliance Gas Pipeline Limited, a subsidiary of RIL, operates the 302 km Shahdol-Phulpur Pipeline from Shahdol (MP) to Phulpur (UP), connecting the CBM gas fields with the Indian gas grid, thus providing access to consumers across the country.

US Shale

During the year, Reliance Eagleford Upstream Holding, LP (REUHLP) a wholly owned step-down subsidiary of RIL, signed an agreement with Ensign Operating III, LLC to divest its interest in certain upstream assets in the Eagleford shale play of Texas, USA. With this transaction, RIL has divested all its shale gas assets and exited from the shale gas business in the US.

Update on Arbitrations And Other Legal Issues

Due to the continuing COVID-19 related circumstances, there has not been any material progress in the following matters: KG D6 Cost Recovery Arbitration, Public Interest Litigations (PILs) relating to the KG D6 Block pending before the Hon’ble Supreme Court of India, suit filed by NTPC Limited against RIL before the Hon’ble Bombay High Court, Government of India’s proceedings seeking setting aside the arbitration award relating to the alleged migration of gas from KG D6 Block before the Hon’ble Delhi High Court, and the Writ Petition filed by RIL before Hon’ble Delhi High Court relating to the jurisdiction of the Delhi Anti- Corruption Bureau.

PMT Arbitration

The Arbitration Tribunal unanimously decided certain issues in favour of BG Exploration and Production India Limited and RIL (together the ‘Claimants’) in its final partial award dated January 29, 2021. Government of India filed a challenge and an appeal before the English High Court against the January 29, 2021 final partial award, which has been decided in Claimants' favour on 9 June 2022 (subject to a limited further right of appeal). In addition, the Tribunal commenced hearing the Claimants’ application for increase in PSC Cost Recovery Limits at the end of 2021 and will continue hearing the said application in various hearing tranches in 2022 and 2023.

Further, arguments have been ongoing in the execution petition filed by the Government of India before the Hon’ble Delhi High Court, seeking enforcement and execution of the Tribunal’s 2016 Final Partial Award.

New Technologies: Bio-CBM

RIL is engaged in R&D efforts to increase recovery from CBM fields. The current focus of this research is Bio-CBM. In CBM, methane gas is produced that is adsorbed and trapped naturally in coal seams. The Bio-CBM technology uses microbe injection to produce in-situ methane in places where either the coals are devoid of methane or conventional CBM extraction is uneconomical.

Lab tests have shown encouraging results on the potential of methane production. Research is underway to verify if this technology can be scaled up to commercial level. RIL is leveraging its infrastructure (advance laboratories), diverse inter-disciplinary technical skills, CBM production expertise, CBM fields and knowledge of regulatory requirements to boost the Bio-CBM research.

COVID-19 response

For workforce

- Weekly RTPCR tests for employees

- Tie-up with hospital for treatment of COVID-19 positive cases among employees and their dependents

- Oxygen generation plant installed and made operational at OHC, onshore terminal; 12 beds equipped with oxygen supply. Also, 10 oxygen concentrators kept ready to meet any emergency requirement

- Strict implementation of all COVID-19 protocols and guidelines, including social distancing, masking and sanitisation (or SMS) at both the workplace and in vehicles

- Creation of Bio Bubble for safety of workforce

- Bio Bubble created for 450 employees, with food, medical and transportation facilities, for the commissioning of new fields and steady state operations

- Quarantine facility created for personnel going offshore

- 4,680 vaccination doses administered to employees and family members and 1,190 doses administered to the community

For community

- Organised awareness camps on COVID-19 in villages in the vicinity

- Organised disinfection of all surrounding villages continuously

- Extended support to the district administration during the pandemic by providing cots to the Government Hospital

- Installed 10 KL oxygen plant at the District Government Hospital, Kakinada; plant can supply oxygen to about 200 patients for 48 hours continuously

- Developed green belt at Rajahmundry Airport

- Provided 40 tricycles to differently abled persons in Kakinada

- Conducted free medical camps in Gadimoga where 1,100+ patients utilised the services

- Reliance Foundation CBM CSR team continued to complement government efforts to mitigate effects of the pandemic on the community and other key stakeholders. As part of Mission COVID-19 Suraksha, 50,000+ masks and 5,000 hand sanitisers distributed to frontline workers, community and police officials in Shahdol and Kotma

- During Madhya Pradesh Chief Minister’s visit to Shahdol, 18 oxygen concentrators handed over to Shahdol district administration, a gesture acknowledged and appreciated by the CM

- Financial support worth `51 lakh provided to Shahdol district administration towards the purchase of an emergency ambulance for the police and for other COVID-19 related relief work in the district

- Support worth `3.60 lakh extended by the Reliance Foundation CBM CSR team to 15 children who had lost one or both parents to COVID-19

CSR activities

Health

- CBM CSR Shahdol continued to provide MMU services to 150 project villages in Shahdol, Kotma and Shahdol-Phulpur Gas Pipeline (SHPPL) locations under CBM project; 1 lakh + consultations provided

- Undertaken ‘Adopt an Anganwadi’ initiative; Reliance Foundation (RF) supported 53 Anganwadis for beautification and renovation till date; 6 anganwadis were renovated in FY 2021-22. Initiative featured in State Government website, leading to greater program visibility

Livelihood

- Supported farming households with various provisions, including input support, improved farming technology transfer and intercultural management practices resulting in sustained income enhancement of additional 6,000+ households

- Enhancing income through agroforestry and improving green cover; 20,000+ saplings planted on private and common lands, 109 orchards established in farms of progressive farmers as models for long-term income sustainability

- Reliance Foundation (RF) supported establishment of 5,100+ Rural Nutrition Gardens (RNGs) towards improving the availability of fresh vegetables for marginal households

- Promoted fishery for 670 households in 70 villages of Shahdol and Kotma, providing 1,700+ kg fish fingerlings and feed for fish in 264 ponds

- Enhanced non-farm income of 1,300+ households in 50 villages of Shahdol and Kotma, supporting with 20,000+ poultry chicks as part of a scheme run with the Veterinary Department

- RF efforts recognised with awards; 3 farmers from RF project villages received awards under various categories from the Shahdol district administration; one awarded `25,000 for best practices in livestock management at the district level and two farmers awarded `10,000 each for agriculture and horticulture at the block level

Water

- To boost CBM produce water and rainwater harvesting, 8 new farm ponds were dug and old water harvesting structures (WHS) were renovated to create a capacity of 2.69 lakh cubic metres harvesting capacity, benefiting over 651 acres farm area of 328 households

- To promote community ownership of development, RF facilitated 81 low-cost community water harvesting structures. Bori Bandhan created for communities in Shahdol and Kotma; 6+ lakh CuM water harvesting capacity created to benefit 600+ households by ensuring irrigation water for 500+ acres of farm area

- Potable water ensured for 2,200 new households round the year by installing or repairing 153 hand pumps/submersible pumps in project villages of Shahdol and Kotma

- RF supported efficient irrigation and institutionalised water use through farmer groups, setting up 30 sprinkler sets for 30 farmer groups comprising 136 farmers from 17 villages of Shahdol that will ensure irrigation for 287 acres of farm area

- Improved public amenities for village residents, particularly women, by constructing 27 bathrooms near hand pumps in 20 villages of Shahdol and Kotma

Education

- Felicitated 111 meritorious students from schools in project villages of Shahdol to motivate and assist them in education

- Continued competitive coaching in offline and online mode to prepare youth for government employment in the police or armed forces; 100+ students availed benefits of the coaching. Also organised physical training jointly with RF for youth aspiring for jobs in the police and armed forces

- Resumed bus service to facilitate conveyance for girl students after opening of educational institutions; two buses operationalised for 370+ girl students from 21 villages of Shahdol

Outlook

Gas is expected to play a key role as a transition fuel and share of gas in energy mix is expected to increase from 6% to 15% by CY 2030.

Globally, gas markets are becoming tighter and gas prices have seen spikes across Europe, Asia and also India. With the resurgence in economic activities, receding COVID-19 cases , ongoing geopolitical conflict in Europe and gas supplies trailing demand, gas prices are expected to remain high in the medium term.

With all three fields in production, the KG D6 Block will produce >1 BCFe/day by FY 2023-24, thereby contributing ~30% to India’s gas production and helping meet ~20% of India’s demand. This will help reduce the country’s import dependence and meet the growing clean energy requirements of the nation.