Network18 Media & Investments (Network18) is India’s only Media & Entertainment conglomerate with presence across the full spectrum of content genres – news, entertainment, sports, movies and live entertainment.

With its young and diverse bouquet of properties, it has been delivering authentic news and wholesome entertainment that resonate with audiences across demographics and socio-economic segments, building a unique connect through the use of native languages. As a platform which is pipe and screen-agnostic, Network18's endeavour is to continually expand its reach to connect with consumers wherever they are present. It continues to make investments for creating quality content, enhancing reach of the network and striking partnerships in the media eco-system to capture the growth opportunities presented by India’s rapidly evolving media landscape, with a keen eye on improving profitability.

The year gone by will stand out for coming of age of our new initiatives as they turned around on the profitability front driven by their increasing consumer salience. With content consumption taking up an increasingly higher share of consumer time, the group, given its truly diversified presence across media genres, languages and platforms, is well-poised to leverage these strong tailwinds.

DIGITAL REACH

200* mn+

(for NW18 digital news portfolio)

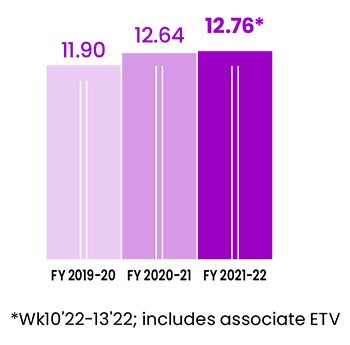

TV VIEWERSHIP SHARE

12.8 # %

Portfolio at a glance

*Source: comScore, March 2022

#Source: BARC, All India 2+, Wk10-13'22; includes associate ETV

Vision and Mission

Network18 aims to be a channel-agnostic provider of top-drawer content across genres, regions and languages. We seek to be India’s top media house with unparalleled reach, and touch the lives of Indians across geographies and demographics.

Strategic advantages and competitive strengths

Reach and engagement

1 in every 2 Indians watches Network18 television channels that reach >95% of TV homes in India annually

1 in nearly every 2 internet users in India accesses Network18 websites or apps every month, making it the #2 reach digital news/information publisher in India, and amongst the top 10 globally

India’s largest TV News portfolio, with an 8.8%* share of news viewership; Entertainment channels enjoy 11.1%# viewership share

MoneyControl is India’s leading Finance app and Voot is the #2 OTT broadcaster in terms of daily time spent per user

*Source: BARC | TG: 15+ | Market: All India | Period: Wk10'22-13'22

#Source: BARC | Mkt: All India | TG: 2+ | Wk 14'21 to 13'22; share in non-news viewership

Diverse network with genre defining brands

The only M&E company with presence across all content genres – news, entertainment, sports, movies, live entertainment

20 domestic TV news channels in 15 languages; digital news in 13 languages

Full-portfolio entertainment offering includes 10 regional language TV channels, a film studio renowned for standout cinema, and a leading OTT platform

Brands like CNBC TV18, News18, Colors, MoneyControl, Nickelodeon have high brand equity and are synonymous with the genres they operate in

Strong partnerships across the board

Partnerships with leading global and Indian players to strengthen content creation and distribution capabilities

Paramount Global, NBCU (CNBC), CNN, and A+E Networks, Forbes are among Network18’s global partners

Leading content distribution platforms like Jio, Den, Hathway are part of the parent company, enabling Network18 to have extensive reach

Around 3,000 advertisers use TV and digital platforms of Network18 to reach their consumers across the country

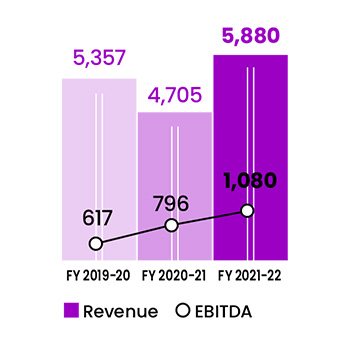

Performance Summary

OPERATING REVENUE & EBITDA

(` IN CRORE)

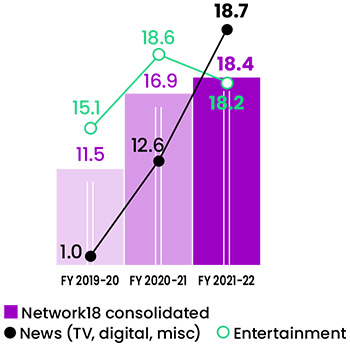

OPERATING MARGINS

(%)

TV VIEWERSHIP SHARE

(%)

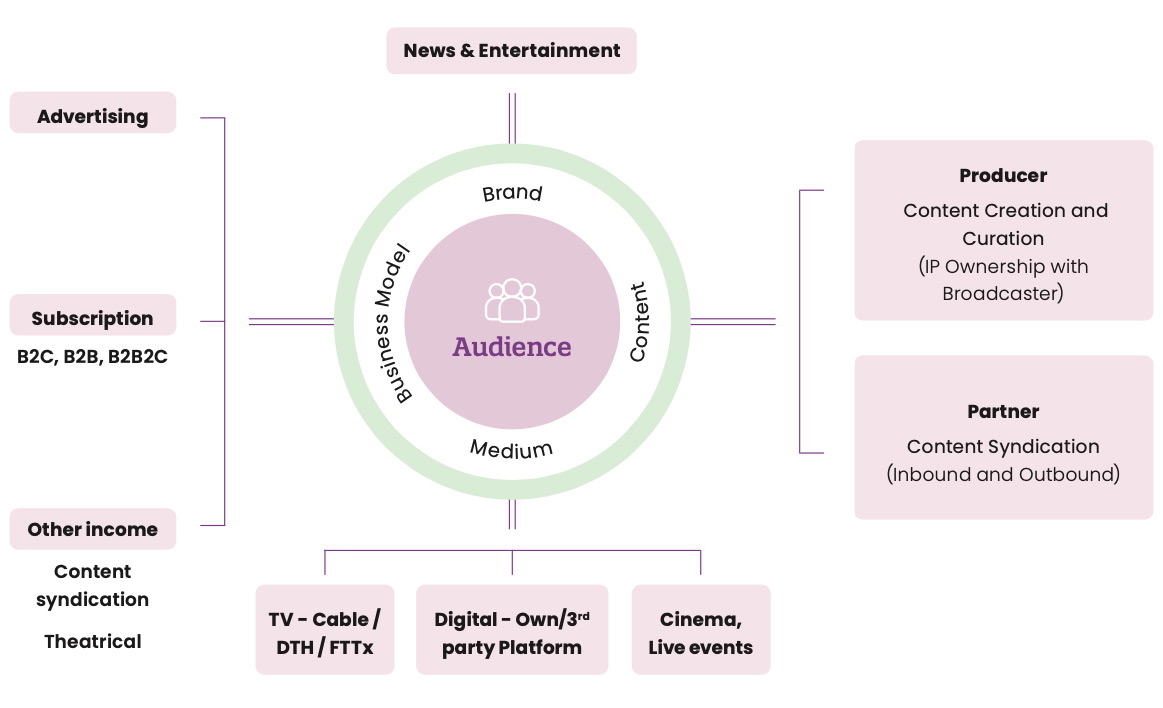

Operating Framework

Network18’s operating model places the audience at its centre and contextualises business models to genres. In the process, it has established a strong connect with viewers through multiple mediums, diverse brands and cutting-edge content.

Network18 has a track record of building successful strategic alliances with international media companies such as Paramount Global in entertainment, WarnerMedia (CNN) in English general news, NBCU (CNBC) in business news, A+E Networks in factual entertainment and Forbes in business magazines.

Value Chain

Network18 is spread across content creation and distribution, thereby delivering the best of Indian and global content and brands to discerning audiences across India’s vast demographic diversity.

Highlights FY 2021-22

Strong Financial Performance

Highest ever consolidated operating margin of 18.4%, ~150bps Y-o-Y improvement

TV News business continued to improve profitability and delivered highest ever operating margins of ~21% (~16% in FY 2020-21)

Digital News saw an inflection in profitability and delivered operating margin of 13% (0% in FY 2020-21), in line with consolidated group margins

Entertainment business delivered highest ever operating profit and strong margins despite a significant scale-up in investments

TV Network grew stronger

TV18 was the #2@ reach news network in India and had the widest language footprint

TV18 Entertainment network was #3 in India, with an all-India entertainment viewership share of 13.4%*; flagship GEC Colors was #2 prime-time channel driven by strong fiction and reality shows

@Source: BARC | TG: 15+ | Market: All India | Wk10'22-13'22

*Source: BARC | TG: 2+ | Market: All India Non-News | Period: Wk14'21-Wk13'22; includes associate ETV

Digital platforms saw a significant uptick

Voot, MoneyControl, News18.com continued to scale up reach and engagement, and leveraged digital advertising tailwinds to deliver sharp revenue growth

Digital subscription platforms (Voot Select and MoneyControl Pro) saw a sharp jump in paid subscriber base

Content – expansion and innovation

The group forayed into sports genre and acquired rights of marquee properties like FIFA World Cup, NBA, La Liga, Serie A, Ligue1, World Boxing Championship, WTA and a host of other properties; it also launched 3 dedicated sports channels in April 2022

Building on ‘Digital First, TV Always’ proposition

Bigg Boss: Over-the-Top, OTT exclusive version of India’s most popular reality show, drove eyeballs, engagement and subscriptions on Voot

The Big Picture, a new concept quiz show, also had a real-time, watch and play quiz game on Voot app to increase engagement

News business pivoted to a digital-first approach based on the solid foundation provided by broadcast operations

Industry Overview

Having bounced back from the shocks of the pandemic in the second half of last fiscal, FY 2021-22 was a year of continued resilience and implementing learnings from the first wave of the pandemic. The beginning of the year saw a sharp rise in COVID-19 cases, which would have impacted content production again but for the implementation of contingency plans and new SOPs that helped business continue in a normal fashion. Demand for content continued to grow across platforms, with both TV and Digital seeing growth in viewership. However, the movie exhibition industry remained affected as cinema halls were either shut or opened with lower capacity through the year, leading to either a delayed release in halls or OTT release.

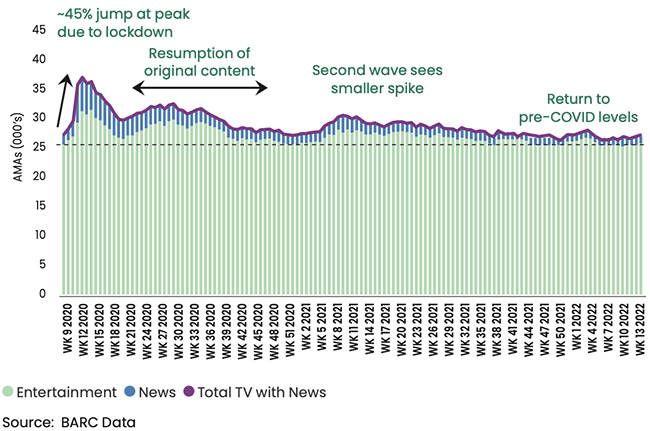

TV viewership reverted to pre-pandemic levels

During the second wave of the pandemic (April-June 2021), TV viewership saw a much smaller spike than last year as lockdowns were localised and movement of people was not as restricted. TV viewership normalised through the year and returned to pre-COVID levels at the beginning of CY 2022 and the genre shares also reverted back. Broadcast networks rolled out their full content catalogue and OTT platforms scaled up release of original shows. Regional viewership continued to be strong across languages, with most markets seeing intense competition for share. Movie channels continued to be impacted during the year due to the postponement of movie releases. Sports viewership was boosted by events like T20 World Cup, Tokyo Olympics and IPL.

TV VIEWERSHIP

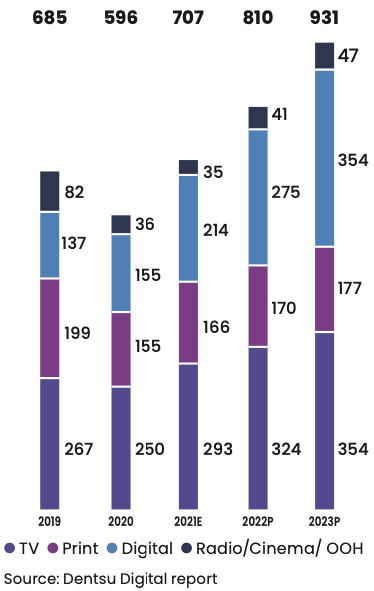

Strong growth in advertising revenues

Though FY 2021-22 started on a weak footing, local and short duration lockdowns, accompanied by a strong consumer demand and advertiser appetite, caused only a minor blip in the strong growth momentum that had begun to build up in the second half of FY 2020-21. Industry ad revenues surpassed 2019 levels, with TV ad volumes reaching a multi-year high and digital continuing its strong growth momentum. However, high input price inflation for the FMCG sector, the biggest advertiser, tempered the growth towards the end of the year. While TV continues to be the primary platform for brands looking to reach audiences at scale and brand building with high frequency advertising, digital has an inherent advantage in targeting, driving personalisation and offering options for advertisers with constrained budgets.

18.6%

Increase in ad spend in 2021

INDIA AD INDUSTRY

TV subscription continued to be resilient

India’s TV penetration of ~67% and Average Revenue Per Unit (ARPU) of ~US$ 3 remain well below that for most developed as well as developing economies, highlighting the headroom for growth. After the introduction of the New Tariff Order (NTO) regulation in FY 2019-20, the industry had seen a jump in subscription revenue. However, the growth has plateaued since then due to the continued legal battle over the implementation of the amended regulation, pending which a status quo had been imposed by the courts on channel pricing. The revenue was also marginally impacted by the pandemic as some of the pay-TV households migrated to the free DTH platform, DD FreeDish.

TV subscriptions in India

| million | FY 2020-21 | FY 2021-22 |

|---|---|---|

| Cable | 73 | 67 |

| DTH | 56 | 55 |

| HITS | 2 | 3 |

| Free TV | 40 | 43 |

| Total | 171 | 168 |

Source: EY-FICCI M&E Report

Digital continued to see strong traction

OTT platforms offer an alternative to TV with on-demand, differentiated content and, more importantly, a dedicated screen, unlike TV which is shared by 4-5 household members. Digital content consumption has seen a sharp growth over the last couple of years driven by increasing broadband and smartphone penetration and increasing volume of exclusive content for digital. With more than 30 OTT platforms, Indian consumers have plenty of options to choose from – regional to global platforms, from production houses’ apps to teleco-aggregation platforms. The propensity to pay for digital subscriptions has grown as consumers have begun to see value in OTT content offering.

Given the competitive pay TV ARPUs, OTTs are still experimenting with the pricing for their subscription-based video on demand (SVOD) platforms.. The year saw several major platforms change their subscription plans. Most Indian platforms continue to operate a hybrid monetisation model, offering free content supported by ads and premium content behind the paywall. As per the BCG CII Report, the Indian OTT industry is expected to grow at a 22-25% CAGR over the next decade, driven by both subscription and advertising.

SIZE OF THE INDIAN OTT INDUSTRY

Emerging Trends and Business Response

Content consumption on digital platforms is growing

With over 300 million people watching content on digital platforms, digital has now become a second screen, and in some cases the first.

Our response

As part of RIL group, which ushered in the broadband revolution in the country, Network18 has been focused on creating digital platforms which become the gateway for content consumption. With a ‘Digital First, TV Always’ approach, the group is investing in technology and content creation for platforms like News18.com, Moneycontrol.com, Voot, to provide consumers a seamless experience on the medium of their choice

New content forms emerging

From user generated short videos to metaverse, content is seeing a wave of disruption

Network18 has been at the vanguard of content evolution in the country, continuously experimenting and innovating new concepts. Its teams keep abreast of changing consumer preferences and continuously adapt. From bringing Bigg Boss to OTT screens, to launching NFTs to engage with loyal fans, to creating news campaigns that drive change at the ground level, the group content repertoire has been evolving, both in breadth and depth.

Strategic priorities and progress

Continue to strengthen ‘Digital First, TV Always’ proposition

Progress in FY 2021-22

- News pivoted to digital first approach, with newsroom integration, revamped workflow, organisational redesign and scaling up of tech capabilities

- Bigg Boss, one of the most popular reality shows was made in a digital exclusive format

Medium-term priorities

- Provide a seamless experience to the user, irrespective of the platform

- Complement the ‘mass’ nature of TV viewing with the ‘personalisation’ experience of digital

Strengthen position in regional markets

Progress in FY 2021-22

- Bengali and Tamil entertainment channels scaled up original programming; Kannada and Marathi channels strengthened viewership shares

- Regional news portfolio delivered first quarter of break-even performance; significant headroom for growth

Medium-term priorities

- Become a true pan-India player with strong positions in markets across the country

- Establish strong vernacular presence on digital platforms

- Use learnings from one market to replicate success in others

Build sustainable and scalable business model for digital products

Progress in FY 2021-22

- Voot AVOD is already profitable and scaled new heights; Voot paid subscriber base saw strong growth

- MC Pro became the leading subscription based financial news platform in India

Medium-term priorities

- Leverage both AVOD and SVOD opportunities to drive growth

- Evaluate opportunities to create new monetisation streams

- Digital contribution to revenue to grow to 50%

Continue innovation and expansion into new content genres

Progress in FY 2021-22

- Forayed into the sports genre with acquisition of marquee properties

- Launched new concept shows like The Big Picture, Bigg Boss OTT, Hunarbaaz

Medium-term priorities

- Be the go-to destination for diverse demographic and socio-economic audience segments for content across genres

Business Performance

Television business

News

Business News

Business News channels, CNBC TV18, CNBC Awaaz, and CNBC Bajar, offered extensive coverage of the important events in business and financial markets, introduced new content offerings, and rolled out consumer-centric campaigns.

General News

CNN-News18 and News18 India ensured in-depth coverage of all major news events - elections, political news or global events. The channels also undertook extensive programming and multiple Public Service Announcement campaigns. The regional news channels reported exhaustively on state/region specific events.

Entertainment

Hindi General Entertainment

Colors was the #2 prime-time channel in the genre driven by a strong programming mix of fiction shows like Udaariyan and Naagin and popular reality shows like The Bigg Boss and Khatron Ke Khiladi. Colors Rishtey, FTA channel, also improved its share during the year. Pay movie channel, Colors Cineplex, maintained its share during the year while Colors Cineplex Bollywood, an FTA movie channel launched at the beginning of the fiscal, helped the network improve its viewership share and monetisation in the genre.

#1

Khatron Ke Khiladi, highest rated Hindi reality show

Music and Youth

MTV Beats continued to be the #1 contemporary music channel in India. MTV, with popular shows IPs and sports content ‘La Liga Santander 21- 22’ and ‘NBA 21-22’, continued to be a strong brand in the Youth category.

English Entertainment

Viacom18 continued to be the undisputed leader in the premium English genre with a combined viewership share of ~95%.

Kids Entertainment

Viacom18 Kids portfolio, with strong brands like Nick, Sonic, has the undisputed leadership in the genre with 30%+ market share.

#1

portfolio in Kids category since August 2014

Regional Entertainment

The regional entertainment bouquet comprises a mix of GEC and movie channels in Kannada, Marathi, Bengali, Gujarati, Tamil and Oriya markets. The network has been scaling up its original programming across markets and has strong positions in Kannada, Marathi and Gujarati markets.

Infotainment channel, History TV18, ranks among the top 2 in the genre in urban markets.

Digital Business

Digital Content

Network18 has a strong suite of digital platforms across categories - MoneyControl (leader in the finance category), VOOT (#2 broadcaster- OTT in terms of time spent per day), and News18 portfolio #2 digital news/ information network). Pay-product Voot Select saw a strong growth in its D2C subscriber base driven by its premium content library of digital-only shows and shoulder content around TV reality shows. With cutting-edge tools, research and exclusive content for investors, MoneyControl Pro also saw a sharp growth in pay subscriber base, strengthening its credentials as leader in the segment.

E-Ticketing and Live business, Bookmyshow, was impacted by the delayed movie releases and restriction on live events dueto the pandemic.

Film Business

Film Business includes Viacom18 Studios and Jio Studios.

Viacom18 Studios

As the COVID-19 pandemic continued to affect the opening of cinema halls, there were no major theatrical releases during the year by Viacom18 Studios. However, some of the movies and web series were released on OTT platforms during the year.

Jio Studios

Jio Studios is a leading content studio that produces movies and web originals in multiple languages. It monetises such content across theatres, broadcast television and digital OTT, while also powering the video content in Jio’s mobility and home triple play offering of voice, video and data.

In a year disrupted by COVID-19, the studio had three successful releases – Mimi, a powerful entertainer on the topic of surrogacy, Ranjish Hi Sahi, an intriguing web original series, and Hey Sinamika, a musical love story in Tamil.

Jio Studios has an exciting line up of Hindi movies with leading talent such as Shah Rukh Khan, Raju Hirani, Akshay Kumar, Varun Dhawan, Shahid Kapoor, Ayushmann Khurrana and others, as well as marquee projects in other languages. Straddling story telling through traditional media to Metaverse, Jio Studios aspires to be at the forefront of the rapidly expanding $25 billion Indian Media & Entertainment industry.

$25 billion

Size of Indian Media & Entertainment industry

Print/Publication Business

Publication Business comprises of a portfolio of Forbes, Better Photography and Overdrive, each one of them a leader in their own category, and continuously striving to achieve new heights.

CSR Initiatives

At Network18, Corporate Social Responsibility (CSR) is embedded in its long-term business strategy. Network18’s community initiatives help elevate the quality of life of millions, especially the disadvantaged sections of society.

- Mission Paani, an initiative in partnership with Harpic, strives to change attitude and behaviour for saving water for future generations, and endeavors to reach over 20 million Indians to drive this change. The latest season of the campaign was endorsed by Vice President M Venkaiah Naidu, Minister of Jal Shakti, Gajendra Singh Shekhawat, Lok Sabha Speaker Om Birla, and Actor Akshay Kumar, the Campaign Ambassador. Mission Paani was recognised as ‘The Best Media Initiative’ at the 3rd National Water Awards by the Honorable President of India.

- Sanjeevani - A Shot of Life, a CSR initiative in partnership with Federal Bank, aimed towards creating awareness for COVID-19 vaccinations and mobilising efforts to ensure that every Indian is vaccinated. The campaign collaborated with NGOs, government agencies and influencers to spread information and bust myths surrounding the vaccine, while enlisting donors to gift vaccines to the most deprived and worst affected Indians.

- Netra Suraksha - India Against Diabetes was launched in November 2021 in association with Novartis, to increase awareness about eye disorders caused by diabetes. With an aim to build effective and efficient partnerships, the initiative organised round table discussions involving medical experts, think tanks and policymakers.

Outlook

The Indian M&E industry has a long runway for growth, given the secular trend of increasing demand for quality content and higher time spent across demographies on content consumption. As per industry reports, India is expected to be the fastest growing ad market with digital leading the way. The digital subscription market has been seeing rapid adoption as the ecosystem matures and the end of pricing stalemate for TV subcription would help drive growth in broadcasting revenues. We will continue to make adequate investments across our businesses which will help us further strengthen our position and simultaneously prepare us for leveraging future growth opportunities.