Dear and Esteemed Fellow Shareowners,

At the outset, it is my pleasant duty to inform you that recently, your Company has successfully completed the Rights Issue of `53,124 crore. It was oversubscribed 1.59 times, cumulating to an overall commitment of over `84,000 crore. With feelings of pride and humility, I would like to let you know that this was the largest Rights Issue in the last 10 years globally by a non-financial institution, and the largest ever in India. Your Company thus created a new landmark in the history of India’s capital market.

One of its significant features was that the public portion was also subscribed 1.22 times, reflecting their widespread and unwavering confidence in RIL’s vision of the future. The Rights Entitlement (RE) was actively traded with the prices always being higher than the intrinsic value and these healthy premia were a reflection of the broad-based interest in the Rights Issue.

I convey my profuse and profound thanks to all of you, both domestic and foreign public shareholders, for your overwhelming response to the Rights Issue.

The success of RIL’s Rights Issue becomes all the more significant when seen in the context of the prolonged nationwide lockdown necessitated by the COVID-19 pandemic. It is a vote of confidence, by both domestic and foreign investors, in the intrinsic strength of the Indian economy. I have no doubt that the Indian economy will bounce back to follow a high-growth trajectory in the times to come.

I dedicate the success of the Rights Issue to our Founder and timeless source of inspiration and guidance, Shri Dhirubhai H. Ambani, who pioneered people-oriented investment culture in India. He taught us to remember, always, that you are Reliance’s biggest source of strength and that we must treasure your trust as our greatest asset. I am therefore both delighted and humbled by your extraordinary show of confidence in the future of Reliance.

We have recently raised over `1,68,818

crore through investments by global tech

investors into Jio Platforms of `1,15,694

crore and the Rights Issue of

`53,124

crore. The combined capital raised has no

precedence globally in such a short time.

Both of these are also unprecedented

in Indian corporate history and have

set new benchmarks. This is even more

remarkable that this was achieved

amidst a global lockdown caused by the

COVID-19 pandemic.

Along with the stake sale to BP in the petro-retail JV, the total fund raise is in excess of `1,75,000 crore. Our net debt was `1,61,035 crore, as on 31st March 2020. With these investments, RIL has now become net debt-free.

Dear Shareowners,

During these extraordinary times of

the COVID-19 pandemic, our Company

has been contributing positively to the

social and financial well-being of all our

stakeholders, above all, to the common

people of India. Value of human life is of

utmost importance, and this fundamental

principle continues to guide our business

and philanthropic activities. We have

come together as an organisation, with the

combined strengths of Reliance Industries,

Reliance Retail, Reliance Jio, Reliance Life

Sciences, Reliance Foundation and all the

members of the Reliance family, to deploy

a sustainable and resilient response to

this global pandemic. Our multifarious

activities, and our widely publicised motto, #CoronaHaaregaIndiaJeetega, have won

much appreciation from the people, the

media, and the authorities at the central,

state and local levels.

Even as we help the nation battle this crisis, we remain committed to growing our traditional and new businesses, which are guided by our long-term vision of a prosperous Digital India.

During FY 2019-20, Reliance executed on the next phase of its growth journey, forging transformative partnerships across businesses. Recognising the pivotal role of Reliance Jio in India’s digital transformation, global technology giants Microsoft and Facebook have partnered with us. With Facebook, the strategic focus of the partnership is India’s Micro, Small and Medium Enterprises (MSMEs), farmers, small merchants and Small and Medium Enterprises (SMEs) in the informal sector. Additionally, the partnerships will empower people and enterprises seeking state-of-the-art digital services. Marquee technology-focused investors have also endorsed our strategic direction with significant equity investments into Jio Platforms Ltd.

In the Energy businesses, Reliance is working to complete the contours of a strategic partnership with Saudi Aramco. The partnership gives our refineries access to a wide portfolio of value-accretive crude grades and enhanced feedstock security for a higher oil-to-chemicals conversion. In the fuel retail business, Reliance and BP formed a new JV to grow the retail service station network and aviation fuels business across India.

Our Consumer businesses continue to establish new milestones every year, with Reliance Retail and Jio collectively having grown by 49.3% y-o-y of the consolidated EBITDA. We delivered a robust performance in our Oil-to-Chemicals (O2C) business despite the weak global economic environment and volatility in energy markets. Our consolidated EBITDA crossed the `1,00,000 crore mark, a first by an Indian company.

The global economy grew at 2.4% in CY 2019, slowing from 3.0% in CY 2018 amid global trade war, tariff-related uncertainties and Brexit. The COVID-19 crisis has further impacted the slowdown.

The Indian economy grew by 3.8% in FY 2019-20, remaining one of the fastest growing major economies in the world. Industrial activities remained healthy in the beginning of the year, but saw some weakness later. Auto sales suffered due to weak credit conditions, demand softness, and change in regulatory norms. However, services credit averaged at a healthy 10% y-o-y growth even as credit growth deteriorated.

In a volatile environment, Reliance recorded consolidated net profit of `44,324 crore (US$5.9 billion) during the year, registering a growth of 11.3% y-o-y (before exceptional items on account of COVID-19). Our consumer businesses further strengthened their leadership positions and recorded robust growth on all operating and financial parameters during the year. Both Reliance Retail and Reliance Jio continue to work towards providing superior products and services to Indian consumers. Our O2C business delivered sustained earnings due to its integrated portfolio, cost competitiveness, feedstock flexibility and product placement capabilities.

The strong financial performance also reflected the increasing contribution of consumer businesses in Reliance’s earnings. Consumer businesses now account for 35% of our consolidated segment EBITDA.

Retail business continues to scale new heights, achieving important milestones during the year – achieving a turnover of `1,62,936 crore and a store count of 11,784. We are witnessing incredible growth and strong traction across consumption baskets, on the back of unmatched service and value proposition.

It is heartening to see India embrace the new possibilities of digital life. Reliance Jio continues to add subscribers at a rate unprecedented in the telecom world. With 387.5 million mobile data subscribers (as of March 31, 2020), Reliance Jio has truly become the digital lifeline of Indians.

Reliance Retail continues to grow in scale, driven by new store expansions across the geography, improving store throughput and favourable product mix. Operating leverage is resulting in the release of strong operating cash flows to continue making requisite investments to secure future readiness and delivering profitable growth. Roll-out of the Digital Commerce initiative will open up further growth opportunities for the organised retail business, leveraging the best of our consumer and digital platforms. Reliance Retail and WhatsApp have entered into a commercial partnership agreement to further accelerate Reliance Retail’s Digital Commerce business on the JioMart platform using WhatsApp and to support small businesses on WhatsApp.

Reliance Retail has the largest customer franchise for over 125 million registered customers who cherish all its unique store concepts. Every week, Reliance Retail serves millions of customers who patronise our stores.

Reliance Jio has been the key catalyst in creating the broadband data market in India. It is now the #1 ranked mobile telecom operator in the country by both Adjusted Gross Revenue (AGR) and subscribers. Building on this success, Reliance Jio is rolling out its state-of-the-art wireline services across homes and enterprises. All this will help lay a strong foundation for offering platform-based digital services.

India is the second-largest smartphone market in the world after China, with approximately 450 million unique smartphone users. Over the past two years, JioPhone has successfully transitioned approximately 100 million erstwhile feature phone (2G) users to the 4G network. However, there are still millions of 2G phone users in India, who cannot use the Internet and are hence excluded from enjoying the fruits of digital life. This highlights the urgent need for India to transition fully from the 2G era into the 4G era and beyond, and the opportunity Jio has in this transformation.

Jio’s success in building technology specifically for India and its ability to proliferate across the country has attracted global technology leaders - Facebook and Microsoft-to forge partnerships with it.

RIL, Jio Platforms and Facebook Inc. signed binding agreements for an investment of `43,574 crore by Facebook into Jio Platforms. This partnership is aimed at accelerating India’s all-round development, fulfilling the needs of Indian people and the Indian economy. The joint focus will be to digitally enable and empower India’s 60 million MSMEs, 120 million farmers, 30 million small merchants and millions of SMEs in the informal sector, in addition to empowering people seeking various digital services. Last year, we announced our partnership with Microsoft. The aim of these partnerships is to enhance the adoption of leading technologies such as data analytics, Artificial Intelligence (AI), cognitive services, Blockchain, Internet of Things (IoT), and edge computing among SMEs to make them ready to compete and grow, while helping accelerate technology-led GDP growth in India and driving adoption of next-gen technology solutions at scale.

Global economic uncertainty and trade tensions impacted oil demand, which reached its lowest level since 2011, even while the global oil supply grew. Despite the global downturn, RIL continued to outperform Singapore complex margins with a premium of US$5.7/bbl, significantly above its 5-year average. Our Petro-retail segment outperformed the industry with y-o-y growth of 9.8% in retail diesel and 14.7% in retail gasoline volume.

FY 2019-20 revenue from the Refining and Marketing (R&M) segment declined by 1.6% y-o-y to `3,87,522 crore and segment EBITDA decreased by 6.1% y-o-y to `24,461 crore. The R&M segment performance was impacted due to lower price realisations due to fall in crude prices and weaker product margins, particularly for transportation fuels.

The Petrochemicals segment continues to harness the power of chemistry to bring smiles to our customers and end consumers. FY 2019-20 witnessed volatile energy price environment, which echoed in petrochemical feedstock and product prices. Global macro factors such as trade barriers, excess capacities, geo-political uncertainties and regulatory pressure, among others, weighed on demand and price, resulting in decline in petrochemicals margins.

FY 2019-20 revenue from the Petrochemicals segment decreased by 15.6% to `1,45,264 crore due to lower price realisations with weaker demand in well-supplied markets. Petrochemicals segment EBITDA was at `30,933 crore, down due to lower margins in key products - Paraxylene (PX), Monoethylene Glycol (MEG), Polyethylene Terephthalate (PET), Polypropylene (PP) and Polyethylene (PE).

Development of R-Cluster, Satellite Cluster and MJ fields - three projects in KG-D6 are on track to monetise discoveries. These projects will utilise the existing gas production infrastructure of KG D6 block. Further, this infrastructure can act as a hub for development of any discovery from contiguous areas in future. Combined production from these three projects is expected to significantly reduce India’s import dependence and enhance India’s energy security. The peak production from these three fields is expected to reach 1 BCFe per day in 2023, about 15% of India’s projected demand that year. We also progressed on the second phase of development activities at our domestic Coal Bed Methane (CBM) blocks to enhance production from these fields.

During the year, Reliance generated a record EBITDA of `1,02,280 crore, up 10.4% y-o-y, and its net profit of `44,324 crore, up 11.3% y-o-y. (before exceptional items on account of COVID-19).

Reliance continues to tie up new financing as well as refinance its existing loans as part of its ongoing liability management exercise. Reliance was awarded Best Issuer (Corporate) – South Asia by The Asset, Asia’s leading financial publication for issuers and investors.

During the year, RIL issued €405 million Schuldschein. RIL’s inaugural Schuldschein was tied up as a combination of fixed and floating rate notes and a combined average tenor of over five years. RIL is the first non-European domiciled borrower and the first Asian corporate to enter this traditionally German-centric debt market utilising a broad marketing strategy. This transaction was the largest syndicated Schuldschein issuance by a non-European company and the largest in the Oil & Gas sector globally.

RIL also tied up two Export Credit Agency (ECA) supported financing - US$200 million and JPY5.30 billion Korea Trade Insurance Corporation (KSure) supported financing - along with €341 million direct facility from Export-Import Bank of Korea (KEXIM) and US$365 million facility guaranteed by KEXIM.

Our diversified earnings streams and conservative Balance Sheet place Reliance at an advantageous position to face the ongoing macro challenges. We are fully committed on our investment plans in our consumer businesses and new initiatives. We are at the doorsteps of a huge opportunity and our Rights Issue and all other equity transactions will strengthen Reliance and position us to create substantial value for all our stakeholders in the years to come.

We are committed to making continuous improvements across the Triple Bottom Line (People, Planet and Profit) and enabling positive change in our society. Our ability to manage, utilise and transform the six capitals – natural capital, human capital, manufactured capital, intellectual capital, financial capital, and social and relationship capital – is the key to creating value for our multiple stakeholders. In our relentless pursuit of excellence, noteworthy capital investments were undertaken, which led to the resource optimisation and enhancement of operational efficiency. We are committed to becoming a leader in circular economy and are one of the largest recyclers of plastics in India. Integral to growing revenue is the ongoing improvement of our social and relationship capital.

Reliance Foundation is committed to bring about a positive change in the lives of our stakeholders. Our business objectives are aligned with the global Sustainable Development Goals, which is reflected through our work in the areas of rural transformation, health, education, sports for development, disaster response, arts, culture and heritage, and urban renewal. In these testing times of COVID-19, Reliance Foundation is running the world’s largest food-distribution programme to serve the ones worst hit by the pandemic.

We have been tirelessly working on a multi-pronged prevention, mitigation, adaptation and ongoing support strategy with the government and civil society to beat this pandemic. From hospitals and equipment to catering to everyday needs such as hunger and safety, we have mustered all our resources to serve our people and our country.

As soon as the COVID-19 crisis surfaced in our country, Reliance Foundation set up India’s first dedicated 100-bed COVID-19 hospital in Mumbai in just two weeks, and is expanding the capacity to 250 beds. India’s frontline warriors needed Personal Protective Equipment (PPE) in this battle against COVID-19. So, we swiftly established a unit in Silvassa to mass produce high-quality PPEs. We produce 1 lakh PPEs per day and are the largest producer of high-quality PPEs in India.

To further extend our services to those in need, we launched Mission Anna Seva to provide meals and support marginalised communities and frontline warriors across the nation. So far, RF has provided over 5 crore nutritious meals through ration kits, food coupons and cooked meals across 17 states and a Union Territory of India. This is the single largest meal distribution programme ever undertaken in the world by a corporate foundation.

During the crisis, Reliance Retail is working to provide essential supplies every day to millions of Indians through our stores and home deliveries across over 200 cities. Reliance Jio continues to provide seamless connectivity in this time of distress and help India fight COVID-19 through the use of technology: enabling work-from-home, learn-from-home, and health-at-home for Indians; enabling continuity of service for lower-end users of JioPhone; Government of India’s Corona Helpline and Reliance Foundation’s COVID India tool.

To ensure the health and well-being of our employees and their families, we have set up several initiatives such as the nationwide emergency response infrastructure that is available 24x7. We have also created JioHealthHub app for free virtual video consultation with all of our doctors and developed resources for mental health, emotional well-being, yoga, wellness, nutrition and psychological guidance.

We are in a rapidly changing world where digital connectivity, abundance of data and intelligent harnessing of data are reshaping value creation models across verticals. Despite the volatility, in the economic environment, we continue to improve and evolve consistently, fostering an entrepreneurial mindset across the organisation. Overall, we have delivered yet another year of robust performance, achieving remarkable success across our businesses.

At Reliance, our purpose has been to solve the big problems before India and the world. We started with the purpose of clothing millions of Indians, ensuring that every Indian gets a decent quality of life, and then solving the problem of energy. As we grew, we addressed India’s bigger problems. With no prior experience, we entered organised retail. Despite the odds, we had the tenacity to stay and to be persistent. With Jio, we brought India into the Digital Age by connecting billions of Indians with world-class and affordable digital services. If we trace our history, we have always embraced the future with boldness, and have both inspired and empowered future generations to succeed by becoming entrepreneurial, setting ambitious goals, taking more risks and innovating constantly in their enterprises. As we usher in the next decade, we accept the responsibility as custodians of the future.

Our vision is to build a New Reliance for a New India. Our mission is to GROW INDIA, AND GROW WITH INDIA. Your tremendous vote of confidence in the Rights Issue has yet again convinced us that you fully endorse this vision and mission. Reliance’s foundational trust-based relationship with you has consistently spurred us to achieve more. I assure you that Reliance will achieve more in its ongoing Golden Decade than it did in the previous four decades. As we begin our journey in a new financial year, we rededicate ourselves to the task of contributing our utmost to India’s inclusive and accelerated growth, propelled by the adoption of digital technologies. This will improve the lives of 1.3 billion Indians and make India a leading DIGITAL NATION in the world.

I would like to thank the entire team at Reliance for their untiring efforts and unflinching commitment to achieve the lofty goals we have set for our Golden Decade. I would like to convey my sincere appreciation to the Board of Directors for their guidance. I would also like to express my heartiest gratitude to all our stakeholders for their enduring faith in Reliance.

With best wishes,

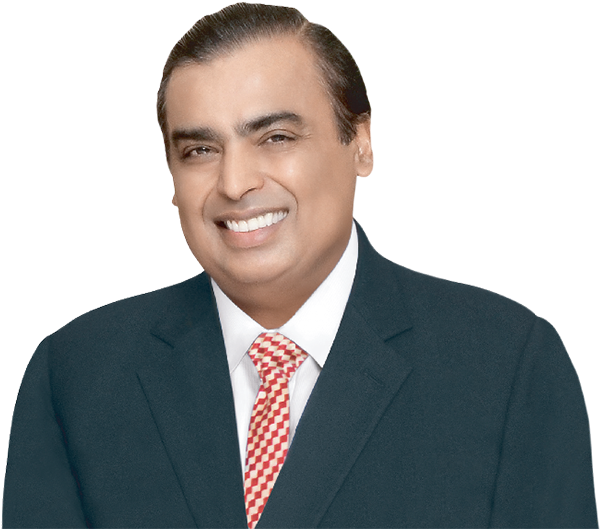

Sincerely,

Mukesh D. Ambani

Chairman and Managing Director

June 20, 2020